And, U.S. stock markets celebrated.

Last week, the Federal Reserve put itself on hold. The Federal Open Market Committee met on Wednesday, January 30, 2019, to discuss the state of the economy and determine policy. After the meeting, Fed Chair Jerome Powell offered a positive assessment of U.S. economic strength that was leavened with a few concerns.

“We continue to expect that the American economy will grow at a solid pace in 2019, although likely slower than the very strong pace of 2018…Despite this positive outlook…Growth has slowed in some major foreign economies, particularly China and Europe. There is elevated uncertainty around several unresolved government policy issues, including Brexit, ongoing trade negotiations, and the effects from the partial government shutdown in the United States…We are now facing a somewhat contradictory picture of generally strong U.S. macroeconomic performance, alongside growing evidence of cross-currents. At such times, common sense risk management suggests patiently awaiting greater clarity…”

The Standard & Poor’s 500 Index (S&P 500) welcomed the news and delivered its best January performance since 1987, reported Reuters.

Earnings may have helped. Through the end of last week, almost one-half of companies in the S&P 500 had shared fourth quarter 2018 earnings. FactSet reported the blended year-over-year earnings growth – which includes earnings for companies that have reported and earnings estimates for companies that have not yet reported – was 12.4 percent. That’s lower than the 20-plus percent growth companies have delivered since late 2017, and it’s the fifth straight quarter of double-digit earnings growth.

There was good news to close the week, too. The Bureau of Labor Statistics reported far more jobs were created in January than analysts had anticipated, although unemployment ticked higher for the month because of the government shutdown, reported Bloomberg.

here they are: Some of The best inventions of 2018. Time Magazine asked its editors and correspondents to nominate inventions that are making the world smarter and more fun. The magazine whittled down the suggestions to 50 inventions it considers to be the very best. They include:

- Off-the-rack bespoke clothing. If you have ever found yourself between two sizes or have had difficulty figuring out women’s swimsuit sizing, you’ll appreciate an innovation offered by a Japanese retailer. All you have to do is put on one of the company’s “…stretchy black bodysuits…covered in white dots, which enables consumers to make a ‘3-D scan’ of their bodies in the comfort of their own home, via a companion mobile app.” Once you’ve completed the scan, you can order custom-fit clothing. Next up: custom shoes.

- Blankets that ease anxiety. Science suggests there is a connection between insomnia and anxiety – and we all know how important sleep is. Weighted blankets offer gentle pressure that may help soothe the nervous system and improve sleep, according to Time. Retailers suggest consumers opt for blankets with a weigh equal to 10 percent of body weight. Be forewarned. The blankets come with a hefty price tag.

- A gravity-defying toolbox. If you’re looking for the perfect Valentine’s gift for a friend or family member who uses tools in tough environments, this might be a good choice. A former F-16 aircraft mechanic designed a flexible toolbox that stays on curved surfaces without slipping.

- A compass that points to friends and family. If you stress over the possibility of a child or pet getting lost at a crowded event or in an unfamiliar place, you may appreciate these paired compasses. They use GPS technology, in tandem with long-wave radio frequencies, to help people keep track of each other.

Just for fun, check out the other inventions at Time.com.

Weekly Focus – Think About It

“The fact is that my brain goes out to play. That’s what creativity is – intelligence having fun.”

–Joey Reiman, American businessman

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

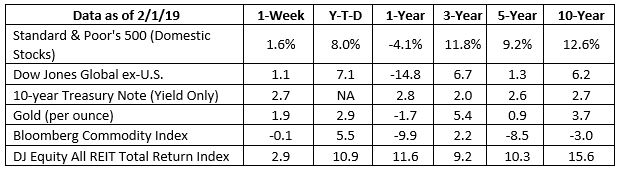

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year. It’s a normal, healthy part of the investing cycle. Is it unsettling? Very! But when prices turn...

Sunny Side Down: Egg Prices Fall

Forget the Fed frenzy and take a timeout from tariff talk. Let's focus on what's really scrambling the markets right now: egg prices. After reaching an all-time high of $8.17 a dozen in early March, prices have trended lower and may drop below $3 in the coming weeks....

Hot Dog Inflation at the Ballpark

When you hear “hot dog” and “inflation” in the same sentence, you might think of those supermarket franks that plump up when cooked. In this case, we’re talking about the original dogs of the ballpark, a cultural touchstone of America’s pastime. The average price of a...

Special content from Jack, very short read!

Uh oh! Signs of a potential financial market correction may be on the horizon: The S&P 500 is down 4% from its all-time high. Investors are showing increased interest in gold, silver, copper, and other commodities, which are often seen as safe havens during...

Special Edition from Research Financial Strategies

Dear Friends and Clients, This week, a good friend and client brought something significant to my attention. Despite our initial struggles to uncover the full story, my resourceful son-in-law managed to locate it. It comprises three parts and runs approximately 45...

The Fed’s Drive To 2% Inflation

February isn't over yet, but the Cleveland Fed has released its projections for a few key economic markers. Why are these markers important? The Fed likes to look at the Consumer Personal Expenditures (CPE) to gauge whether or not their plan to curb inflation is...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20190130.pdf?mod=article_inline

https://www.reuters.com/article/us-usa-stocks-weekahead/fed-pause-validates-market-fears-about-u-s-growth-idUSKCN1PQ4MW

https://insight.factset.com/earnings-season-update-february-1-2019

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.bloomberg.com/news/articles/2019-02-01/u-s-payrolls-rise-304-000-while-wage-gains-cool-amid-shutdown

http://time.com/5453189/how-we-chose-50-best-inventions-2018/

http://time.com/collection/best-inventions-2018/5454324/zozosuit/

http://time.com/collection/best-inventions-2018/5454469/gravity-blanket/

https://www.researchgate.net/publication/243970419_A_Systematic_Review_Assessing_Bidirectionality_between_Sleep_Disturbances_Anxiety_and_Depression

https://www.healthline.com/health/mental-health/weighted-blanket-for-anxiety-review#5

http://time.com/collection/best-inventions-2018/5454282/grypmat/

http://time.com/collection/best-inventions-2018/5454439/lynq/

https://quoteinvestigator.com/2017/03/02/fun/#note-15588-5