Central banks take a turn.

At its first policy meeting of 2019, the U.S. Federal Reserve changed direction. After four rate increases in 2018, Chair Jerome Powell announced interest rates were on hold. Last week, banks in the United Kingdom, Australia, and India followed suit by either reducing rates or cautioning rate reductions were likely, reported Sam Fleming and Jamie Smyth of Financial Times.

The dovish tone of central banks owes much to slowing global growth. January’s International Monetary Fund World Economic Outlook lowered global growth estimates for 2019 and 2020. Changing expectations were fueled both by factors that slowed momentum in the second half of 2018 and by issues that pose a potential risk to continued economic growth. These included:

- The negative effects of higher tariffs

- New auto emission standards in Germany

- A slowdown in domestic demand in Italy

- Economic contraction in Turkey

- High levels of public and private debt

- Escalating trade tensions

- A no-deal British exit from the European Union

- A severe slowdown in China

These issues have had limited effect on the U.S. economy; however, global risks are affecting the performance of some U.S. companies. Financial Times explained:

“The U.S. domestic economy has continued to put in a robust performance, with the number of new jobs in January coming in well ahead of Wall Street expectations and wage growth running comfortably above inflation. But corporate giants in the S&P 500 index, which generate over a third of their earnings overseas, are sounding the alarm about faltering overseas demand in markets including China, where the government has been battling against a slowdown. Smaller U.S. firms are feeling the global chill as well.”

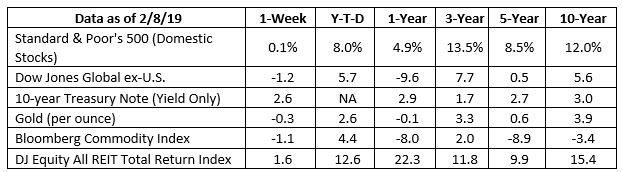

Randall Forsyth at Barron’s reported major U.S. benchmarks finished last week higher, while the yield on 10-year U.S. Treasuries hit a 13-month low. Outside the United States, some global stock markets moved lower.

AT THE INTERSECTION OF ECONOMICS AND VALENTINE’S DAY…Author and illustrator Liz Fosslien has thought a lot about economics and Valentine’s Day. In ‘14 Ways an Economist Says I Love You,’ she offers this advice: “Give your loved one a nerdy Valentine and they’ll be yours forever! Why? Because if you give them diamonds/cufflinks this year, anything you get them next year will fall short. Give them [a nerdy Valentine] and anything they receive next year will be a step up. It’s called expectation management and is the key to a long and happy relationship.”

Fosslien suggests a variety of approaches to saying, ‘I love you,’ in economic terms. (Each is accompanied by an illustrative chart or graph at Fosslien.com/heart.) If you’re looking for a way to express the magnitude or enduring nature of your feelings, you could try:

- I don’t think your great, / I think you’re fantastic, / For what you’re supplying, / My demand’s inelastic.

- The monopoly you have on my heart is all natural.

- Our risk of default is zero.

- The S&P was in the red, / But I wasn’t blue, / Because I shorted the market, / And went long on you.

- The marginal returns of spending time with you will never diminish.

- Irrational, asymmetric, / Love is so foolish. / But I could not care less, / If you’re the stock then I’m bullish.

If the dismal science of economics doesn’t deliver the level of romance your relationship requires, you can always go for the cufflinks or the diamonds.

Weekly Focus – Think About It

“Taking in the good, whenever and wherever we find it, gives us new eyes for seeing and living.”

–Krista Tippett, American journalist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year. It’s a normal, healthy part of the investing cycle. Is it unsettling? Very! But when prices turn...

Sunny Side Down: Egg Prices Fall

Forget the Fed frenzy and take a timeout from tariff talk. Let's focus on what's really scrambling the markets right now: egg prices. After reaching an all-time high of $8.17 a dozen in early March, prices have trended lower and may drop below $3 in the coming weeks....

Hot Dog Inflation at the Ballpark

When you hear “hot dog” and “inflation” in the same sentence, you might think of those supermarket franks that plump up when cooked. In this case, we’re talking about the original dogs of the ballpark, a cultural touchstone of America’s pastime. The average price of a...

Special content from Jack, very short read!

Uh oh! Signs of a potential financial market correction may be on the horizon: The S&P 500 is down 4% from its all-time high. Investors are showing increased interest in gold, silver, copper, and other commodities, which are often seen as safe havens during...

Special Edition from Research Financial Strategies

Dear Friends and Clients, This week, a good friend and client brought something significant to my attention. Despite our initial struggles to uncover the full story, my resourceful son-in-law managed to locate it. It comprises three parts and runs approximately 45...

The Fed’s Drive To 2% Inflation

February isn't over yet, but the Cleveland Fed has released its projections for a few key economic markers. Why are these markers important? The Fed likes to look at the Consumer Personal Expenditures (CPE) to gauge whether or not their plan to curb inflation is...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.ft.com/content/24508f0e-2b91-11e9-88a4-c32129756dd8

https://www.imf.org/en/Publications/WEO/Issues/2019/01/11/weo-update-january-2019

https://www.barrons.com/articles/the-global-slowdown-could-soon-hit-the-u-s-51549676496

https://finance.yahoo.com/news/global-markets-asia-stocks-slip-renewed-anxiety-over-005019341–finance.html

http://fosslien.com/heart/

https://www.goodreads.com/author/quotes/225253.Krista_Tippett