The world is adapting to a changing reality.

As the war in Ukraine intensified last week, financial markets grappled with uncertainty.

“After watching financial markets gyrate from hour to hour as Russia attacked Ukraine, I was getting dizzy myself,” reported Jeff Sommer of The New York Times. “People in Ukraine were dying. The Russian president, Vladimir V. Putin, put his nuclear forces on alert, and Western sanctions were beginning to bite. One moment stocks were up, the next they were falling. Then they were up again.”

Sanctions have economists revising expectations for global growth and inflation, reported Randall Forsyth of Barron’s. The chief economist at a leading financial institution anticipates that rising commodity prices (oil, gas, grains and palladium) are likely to push inflation higher than it might have been otherwise in 2022, and slow global economic growth. The Russian economy is expected to sink deep into recession, contracting by 35 percent in the second quarter of 2022, reported Karin Strohecker of Reuters.

War in Europe wasn’t the only concern for investors last week, though.

China’s deflating property bubble also created uneasiness. The property sector accounts for about 25 percent of China’s economy. Since last July, when Beijing limited Chinese property developers’ access to credit, a dozen developers have defaulted on bonds, reported The Economist. A bond default occurs when the bond issuer fails to make an interest or principal payment.

“The implications go far beyond the offshore bond market. Construction has stalled in places. Some developers are now selling assets to patch up their cash flows. Many have stopped buying land, causing the value of parcels sold by local governments to crater by 72% in January year on year. Home prices are falling in many cities…”

In the United States, economic data confirmed the resilience of the American economy as it recovers from the pandemic. February’s employment report, which was released last Friday, showed jobs growth accelerated as the number of new COVID-19 cases slowed. Unemployment fell to 3.8 percent with 678,000 new jobs created. It was notable that about two-thirds of the jobs created were in service sectors (leisure and hospitality, retail, and professional and business services).

Major U.S. stock indices finished the week lower, reported Ben Levisohn of Barron’s. Bond yields bounced around a bit last week as investors tried to make sense of war, sanctions and pending Federal Reserve rate hikes. The Treasury yield curve ended the week flatter, reported Karen Brettell of Reuters.

What gives life meaning? Last spring, Pew Research asked people in several countries: What aspects of your life do you currently find meaningful, fulfilling or satisfying?

The No. 1 answer (out of the 17 options) in most countries was “family and children.” The exceptions were Spain (health), South Korea (material well-being), and Taiwan (society).

- In the United States friends ranked second in the hierarchy of things that give life meaning, followed by material well-being.

- In the United Kingdom, friends ranked second, followed by hobbies.

- In Australia, New Zealand and Sweden occupation ranked second, followed by friends.

- In Greece, France and Germany occupation ranked second, followed by health.

- In Italy, Netherlands and Japan, material well-being ranked second, followed by health.

- In Canada, occupation ranked second, followed by material well-being.

- In Belgium and Spain, material well-being ranked second, followed by occupation.

- In Singapore, occupation ranked second, followed by society.

- In Taiwan, material well-being ranked second, followed by family and children.

- In South Korea, health ranked second, followed by family and children.

It’s interesting to note that freedom appears to be widely taken for granted. It was most highly valued in Netherlands where it was mentioned by 20 percent of survey participants. Belgium and New Zealand also ranked it more highly than other nations (15 percent each). Freedom was mentioned least often in the U.K. (5 percent), Singapore (5 percent), and Japan (6 percent).

In the United States, just 9 percent of Americans – fewer than one in 10 – said freedom gives their lives meaning.

Weekly Focus – Think About It`

“Even with all of the things that are so awful, if you walk into your yard and stay there looking at almost anything for five minutes, you will be stunned by how marvelous life is and how incredibly lucky we are to have it.”

—Alice Walker, novelist and poet

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

Most Popular Financial Stories

Veterans Day 2019

In 1945, there were sixteen million of them. Today, there are less than 500,000 left. They endured the hardships of the Depression. They watched firsthand as...

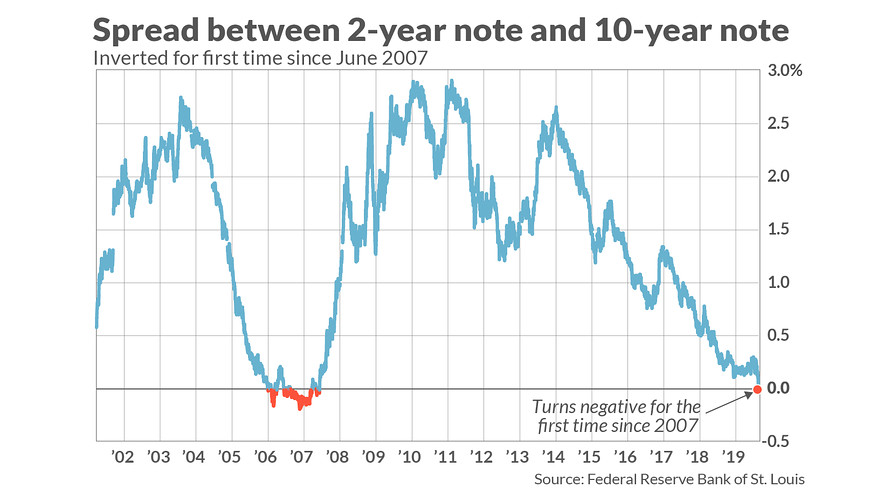

Inverted Yield Curve – Should You Worry About A Recession?

If you ask an economist what makes them toss and turn at night, chances are they’ll tell you, “Fear of missing the warning signs of a recession.” After all, for...

Recession 101

“Markets are flashing deep red as investors worry about the health of the economy” - CNN Business “S&P and Dow Slide as Evidence of Global Slowdown Mounts” - The New...

Hope in Humanity Story #2: Kids Today

When you turn on the evening news, every broadcast seems to bring more stories of tragedy, fighting, and petty politics. But if we take the time to look a little...

The Secret Life of Data

What data about you is most important?The data that identity thieves are after – social security, credit card, and bank account numbers – is important, as well...

Unused Vacation Days Can Be Costly

Would you give up a share of $62 billion?If your answer is no, then you may be a member of the relatively small group of Americans (36 percent) that takes all of...

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

Sources:

https://www.nytimes.com/2022/03/03/business/ukraine-putin-markets.html (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/03-07-22_New%20York%20Times_Talking%20War%20and%20Market%20Volatility%20With%20a%20Giant%20of%20Economics_1.pdf)

https://www.barrons.com/articles/putin-russia-ukraine-global-economy-51646443355?refsec=up-and-down-wall-street (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/03-07-22_Barrons_Putins%20War%20Puts%20Russias%20Economy%20in%20Its%20Crosshairs_2.pdf)

https://www.reuters.com/world/europe/jpmorgan-shock-russian-gdp-will-be-akin-1998-crisis-2022-03-03/

https://www.economist.com/finance-and-economics/china-scrambles-to-prevent-property-pandemonium/21807940 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/03-07-22_The%20Economist_China%20Scrambles%20to%20Prevent%20Property%20Pandemonium_4.pdf)

https://www.investopedia.com/terms/d/default2.asp

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.bls.gov/news.release/empsit.b.htm

https://www.barrons.com/articles/stock-market-dow-nasdaq-sp-500-russia-ukraine-51646438347?refsec=the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/03-07-22_Barrons_The%20Worst%20is%20Yet%20to%20Come%20for%20the%20Stock%20Market_8.pdf)

https://www.reuters.com/article/usa-bonds-idUSL2N2V62K5

https://www.pewresearch.org/global/wp-content/uploads/sites/2/2021/11/PG_11.18.21_meaning-of-life_Topline.pdf

https://www.pewresearch.org/global/interactives/meaning-in-life/data/family_children

https://www.pewresearch.org/global/interactives/meaning-in-life/data/freedom

https://www.brainyquote.com/authors/alice-walker-quotes