Open any newspaper or tune in to your favorite news channel and you will find much talk about how China is taking over the world’s economy. They have made incredible strides in building infrastructure, manufacturing and their military during the past few decades. In fact, there’s so much talk today about their incredible growth rate and the power of their economy; we may forget just how good we are doing in the United States.

The magnitude of what they have accomplished in such a short period of time is amazing. They’ve literally flooded millions of people from their rural hometowns with the Three Gorges project and forced them to move to the cities. They are relocating 250 million people, according to a NY Times report, from the countryside to the city, from farms to factories.

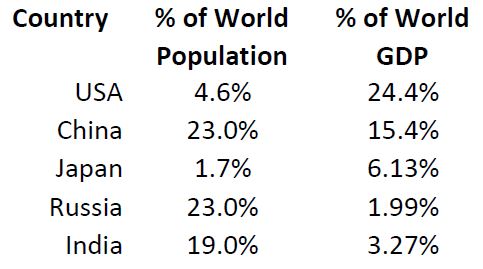

Whether it’s a national news channel or an every day American, many believe that our country’s best days are behind us. One easy way to understand if the economic growth of the USA is healthy is to examine our GDP vs. world GDP. GDP = Gross Domestic Product. It’s the total of all the goods and services each country provides to the world economy. The table below with data from World Bank has some statistics for comparison:

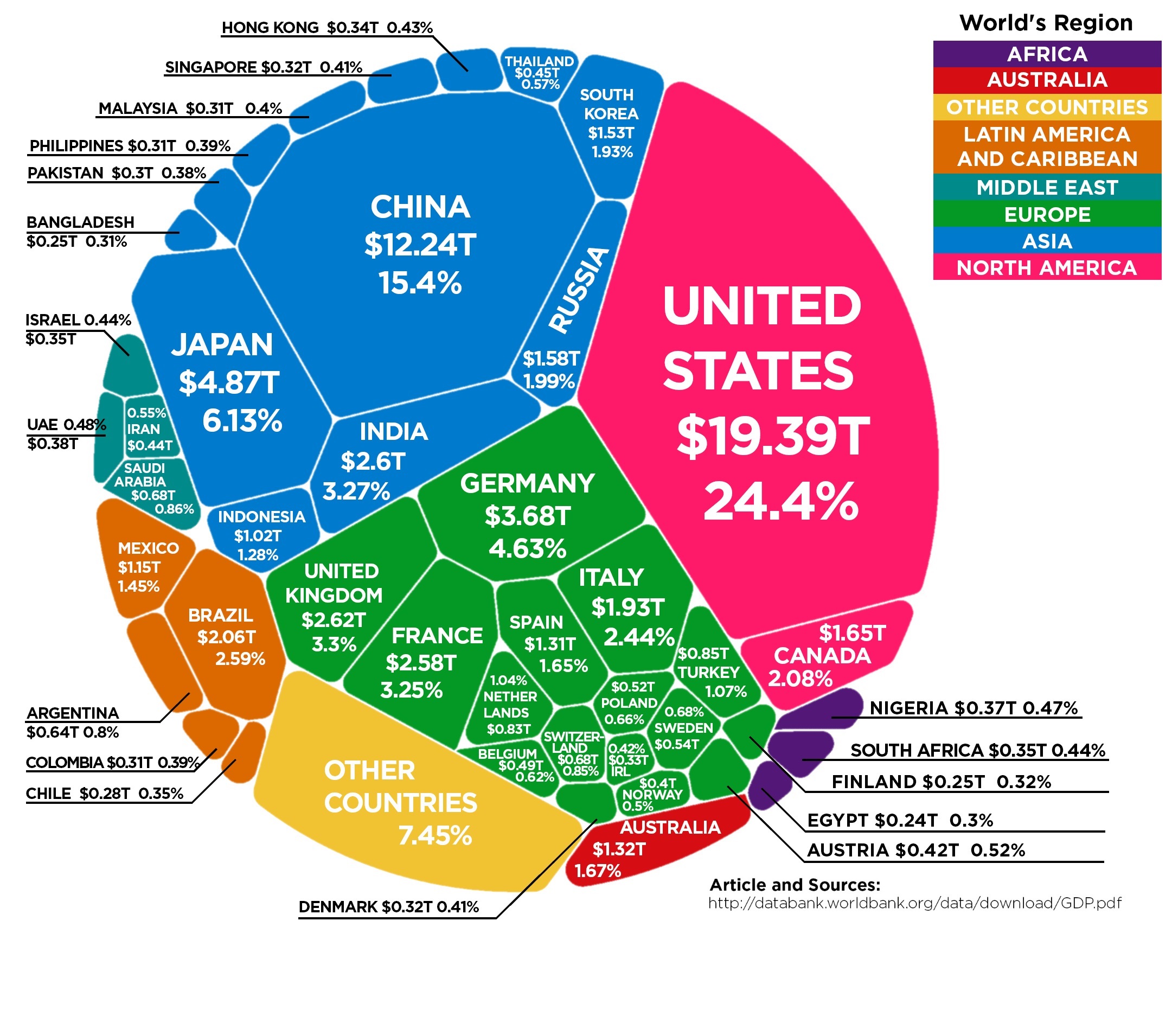

When we examine the graphic, the USA is in the top spot generating 24.4% of world GDP with 4.6% of the world population. China is number 2 producing 15.4% of world GDP with 23% of the world’s population. Those numbers are worth reading again!

The USA is still way ahead of other countries! We are 80% smaller than China, yet we are almost double their GDP.

A strong economy brings great wealth. The rule of law and personal property rights are two of the most basic principles of a capitalistic economy. The USA maintains both.. Not so much in China. Hence, the emerging problem in China. The Chinese can create excessive amounts of wealth and then what? Many leave China and they take their wealth with them. That is because at the end of their life someone in the Chinese government is just going to take it. But in the USA, it is different. Your cars, investments, homes and possessions. You get to determine the final distribution of your possessions. That’s personal property rights and the rule of law protecting you. Two totally different philosophies!

Examining the table further, Japan is the third largest economy. Remember what everyone said about Japan in the late 80’s? Japan was faster and more nimble than the USA. Well, their economy peaked in 1989 at 13.9% of the world’s GDP. Currently, Japan produces 6.13% of the world’s GDP.

India and Russia both have a large population and are nuclear powers. Combines they have 42% of world population. Yet, combined at 5.26% GDP, they do not even exceed Japan!

Recently, India’s economy is growing enormously. They also have personal property rights similar to the USA. They maintain the rule of law and are the world’s largest democracy. India has been working industriously to grow their economy. If there’s one country on this list who has the potential sometime in the future to better the US in GDP, it’s most likely India.

The Russians have always been on everybody’s radar. A significant amount of their GDP involves energy production but their growth has all but stagnated.

This is a lot of information to consider. The USA is the most productive country on Earth. No other country is even close. China has had a 1000 year head start on us. (How come we don’t hear about this on the news every night!)

The constant talk of a trade war and tariff’s is overblown. Many people believe it won’t affect the USA much in the long run. We have had tariffs for years. Our trading partners had tariffs against us which were usually higher. For example, we held a 2.5% tariff on German cars being imported into the US but paid 10% on US vehicle entering into Germany. Very lopsided and ignored by our politicians for a long time. We’ve had trade wars before. We survived because we are very resilient and the rest of the world relies on our productivity. A trade war and tariff’s will hurt the Chinese economy much greater and my guess is they will eventually come to the table and negotiate a fair deal for everyone.

We are in a very strong negotiating position in the USA. Our people have always been driven by independence, innovation, and the pursuit to do better. We attract some of the greatest talent of the world to increase our productivity and lead the way in industry after industry.

Final thought: The United States of America isn’t going to relinquish our top GDP title anytime soon. Someday it may happen- maybe it will be India- but it will be a long time from today.

Recent News from our Financial Advisors

Market Commentary – February 11, 2019

Central banks take a turn. At its first policy meeting of 2019, the U.S. Federal Reserve changed direction. After four rate increases in 2018, Chair Jerome Powell announced interest rates were on hold. Last week, banks in the United Kingdom, Australia, and...

Market Commentary – February 4, 2019

And, U.S. stock markets celebrated. Last week, the Federal Reserve put itself on hold. The Federal Open Market Committee met on Wednesday, January 30, 2019, to discuss the state of the economy and determine policy. After the meeting, Fed Chair Jerome...

Make Sure Your Smart Home is Safe from Cyber Attack

Whether you own a house or rent an apartment, building a smart home is easier than it has ever been. Homeowners and renters can purchase kits that integrate specific smart items or they can select smart home products, such as light bulbs, crockpots, coffee...

Market Commentary – January 28, 2019

Like competitors who’ve completed a difficult section in an endurance race, U.S. stock investors took a breather last week. The Standard & Poor’s 500 Index, which has gotten off to its best start since 1987, ended the week with a slight loss, while the...

Market Commentary – January 22, 2019

We’re off to a good start. Investors who remained steady during December’s wild ride are probably pleased with their decision as stocks have gotten off to a strong start in 2019. Unfortunately, those who reduced their exposure to the asset class may be...

Investment Risk Management

Risk Management There are more financial advisors than ever before in the US. The most important difference is whether they have an independent and unaffiliated custodian. We do. The investment advisor initiates transactions as part of its portfolio...

Most Popular Financial Stories

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Everything we do starts with learning what is important to you. Understanding your unique story is vital in the development of a plan with your best interests in mind. Connect with us to learn more.

Today is a Good Day to Start Your Financial Plan

1. We Listen

Our focus is on your life and priorities. Not just your portfolio. That’s why we start by listening and learning about you. Each individual client has different needs and concerns that need to be addressed. And because we carefully listening to those concerns, we will gain important information that will help us to best serve our clients and help protect their financial futures.

2. Plan

Together we will work to implement the plan that was developed for you. We will keep you constantly updated on what is happening and evolve our plan as your life happens.

Above all, our advisors want to help you meet your goals, even if that means helping you find out what your goals are.

3. We Take Care Of The Rest

We are here for you whenever you need us. Call your Research Financial Strategies Financial Advisor at any time, for any reason. You will always have access to the guidance you need whether it is high tech, high touch or a combination of the two. Your personal Financial Advisor will help you figure out how to pay for life’s great adventures!