Open any newspaper or tune in to your favorite news channel and you will find much talk about how China is taking over the world’s economy. They have made incredible strides in building infrastructure, manufacturing and their military during the past few decades. In fact, there’s so much talk today about their incredible growth rate and the power of their economy; we may forget just how good we are doing in the United States.

The magnitude of what they have accomplished in such a short period of time is amazing. They’ve literally flooded millions of people from their rural hometowns with the Three Gorges project and forced them to move to the cities. They are relocating 250 million people, according to a NY Times report, from the countryside to the city, from farms to factories.

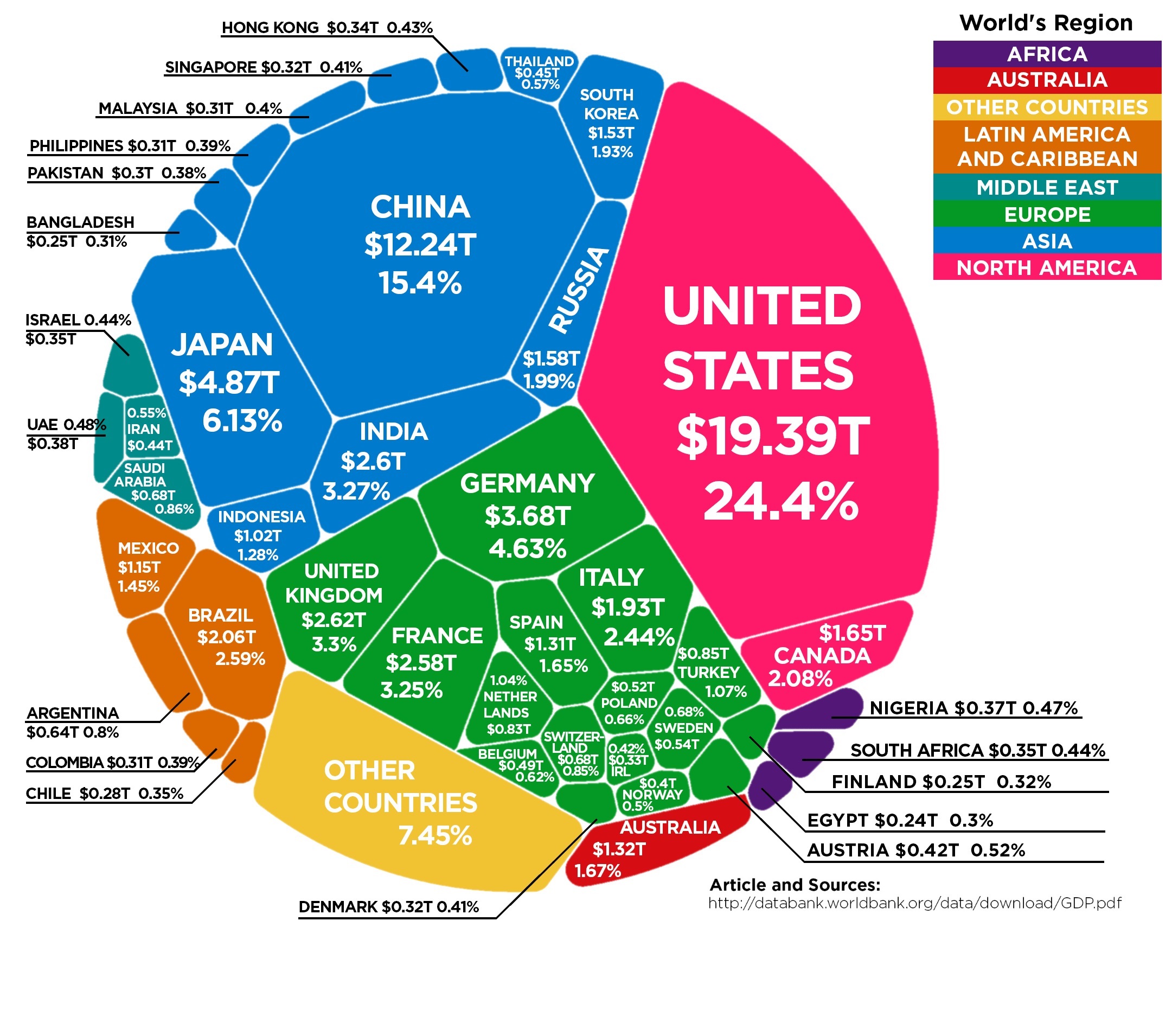

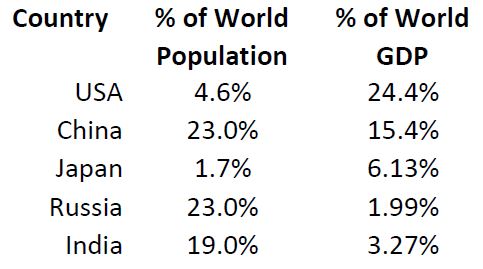

Whether it’s a national news channel or an every day American, many believe that our country’s best days are behind us. One easy way to understand if the economic growth of the USA is healthy is to examine our GDP vs. world GDP. GDP = Gross Domestic Product. It’s the total of all the goods and services each country provides to the world economy. The table below with data from World Bank has some statistics for comparison:

When we examine the graphic, the USA is in the top spot generating 24.4% of world GDP with 4.6% of the world population. China is number 2 producing 15.4% of world GDP with 23% of the world’s population. Those numbers are worth reading again!

The USA is still way ahead of other countries! We are 80% smaller than China, yet we are almost double their GDP.

A strong economy brings great wealth. The rule of law and personal property rights are two of the most basic principles of a capitalistic economy. The USA maintains both.. Not so much in China. Hence, the emerging problem in China. The Chinese can create excessive amounts of wealth and then what? Many leave China and they take their wealth with them. That is because at the end of their life someone in the Chinese government is just going to take it. But in the USA, it is different. Your cars, investments, homes and possessions. You get to determine the final distribution of your possessions. That’s personal property rights and the rule of law protecting you. Two totally different philosophies!

Examining the table further, Japan is the third largest economy. Remember what everyone said about Japan in the late 80’s? Japan was faster and more nimble than the USA. Well, their economy peaked in 1989 at 13.9% of the world’s GDP. Currently, Japan produces 6.13% of the world’s GDP.

India and Russia both have a large population and are nuclear powers. Combines they have 42% of world population. Yet, combined at 5.26% GDP, they do not even exceed Japan!

Recently, India’s economy is growing enormously. They also have personal property rights similar to the USA. They maintain the rule of law and are the world’s largest democracy. India has been working industriously to grow their economy. If there’s one country on this list who has the potential sometime in the future to better the US in GDP, it’s most likely India.

The Russians have always been on everybody’s radar. A significant amount of their GDP involves energy production but their growth has all but stagnated.

This is a lot of information to consider. The USA is the most productive country on Earth. No other country is even close. China has had a 1000 year head start on us. (How come we don’t hear about this on the news every night!)

The constant talk of a trade war and tariff’s is overblown. Many people believe it won’t affect the USA much in the long run. We have had tariffs for years. Our trading partners had tariffs against us which were usually higher. For example, we held a 2.5% tariff on German cars being imported into the US but paid 10% on US vehicle entering into Germany. Very lopsided and ignored by our politicians for a long time. We’ve had trade wars before. We survived because we are very resilient and the rest of the world relies on our productivity. A trade war and tariff’s will hurt the Chinese economy much greater and my guess is they will eventually come to the table and negotiate a fair deal for everyone.

We are in a very strong negotiating position in the USA. Our people have always been driven by independence, innovation, and the pursuit to do better. We attract some of the greatest talent of the world to increase our productivity and lead the way in industry after industry.

Final thought: The United States of America isn’t going to relinquish our top GDP title anytime soon. Someday it may happen- maybe it will be India- but it will be a long time from today.

Recent News from our Financial Advisors

Weekly Market Insights | Investors React to Tariff News

Stocks moved lower last week as investors swung from exuberance to disappointment on news over tariffs and inflation. The Standard & Poor’s 500 Index fell 1.53 percent, while the Nasdaq Composite Index retreated 2.59 percent. The Dow Jones Industrial Average slid...

Weekly Market Insights | Fed Happy Talk Breaks Bad News Streak

Stocks notched a solid gain last week as upbeat comments from the Fed helped stocks snap their four-week losing streak. The Standard & Poor’s 500 Index rose 0.51 percent, while the Nasdaq Composite Index picked up 0.17 percent. The Dow Jones Industrial Average...

Weekly Market Insights | Rough Week for Stocks, with Slight Friday Rally

Investors endured another volatile, whipsaw week as ongoing trade talks and White House comments about the economy unsettled investors. The Standard & Poor’s 500 Index declined 2.27 percent, while the Nasdaq Composite Index dropped 2.43 percent. The Dow Jones...

Weekly Market Insights | Tariffs Take Markets for a Wild Ride

Under the Hood The Institute for Supply Management (ISM) published fresh manufacturing data on Monday. Although headline numbers were decent, a closer look revealed that new orders dropped in January from a years-long high into correction territory while deliveries...

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over? Many of us believe that the party may be over. Last Friday, SPY rose. Well, it climbed back to...

Weekly Market Insights | Tariff Talk Returns, Volatility Close Behind

Stocks were mixed last week as investor concerns over inflation and trade policy combined to produce another volatile trading week. The Dow Jones Industrial Average rose 0.95 percent, while the Standard & Poor’s 500 Index lost 0.98 percent. Meanwhile, the...

Most Popular Financial Stories

Sunny Side Down: Egg Prices Fall

Forget the Fed frenzy and take a timeout from tariff talk. Let's focus on what's really scrambling the markets right now: egg prices. After reaching an all-time high of $8.17 a dozen in early March, prices have trended lower and may drop below $3 in the coming weeks....

Hot Dog Inflation at the Ballpark

When you hear “hot dog” and “inflation” in the same sentence, you might think of those supermarket franks that plump up when cooked. In this case, we’re talking about the original dogs of the ballpark, a cultural touchstone of America’s pastime. The average price of a...

Special content from Jack, very short read!

Uh oh! Signs of a potential financial market correction may be on the horizon: The S&P 500 is down 4% from its all-time high. Investors are showing increased interest in gold, silver, copper, and other commodities, which are often seen as safe havens during...

Special Edition from Research Financial Strategies

Dear Friends and Clients, This week, a good friend and client brought something significant to my attention. Despite our initial struggles to uncover the full story, my resourceful son-in-law managed to locate it. It comprises three parts and runs approximately 45...

The Fed’s Drive To 2% Inflation

February isn't over yet, but the Cleveland Fed has released its projections for a few key economic markers. Why are these markers important? The Fed likes to look at the Consumer Personal Expenditures (CPE) to gauge whether or not their plan to curb inflation is...

Consumers Expect Better Days Ahead

Many consider the University of Michigan the gold standard for reporting on consumer sentiment and trends. Among its 50 monthly reports, the most well-known is the "UMich Consumer Sentiment" survey, which measures consumer confidence. I also follow the University of...

Everything we do starts with learning what is important to you. Understanding your unique story is vital in the development of a plan with your best interests in mind. Connect with us to learn more.

Today is a Good Day to Start Your Financial Plan

1. We Listen

Our focus is on your life and priorities. Not just your portfolio. That’s why we start by listening and learning about you. Each individual client has different needs and concerns that need to be addressed. And because we carefully listening to those concerns, we will gain important information that will help us to best serve our clients and help protect their financial futures.

2. Plan

Together we will work to implement the plan that was developed for you. We will keep you constantly updated on what is happening and evolve our plan as your life happens.

Above all, our advisors want to help you meet your goals, even if that means helping you find out what your goals are.

3. We Take Care Of The Rest

We are here for you whenever you need us. Call your Research Financial Strategies Financial Advisor at any time, for any reason. You will always have access to the guidance you need whether it is high tech, high touch or a combination of the two. Your personal Financial Advisor will help you figure out how to pay for life’s great adventures!