Weekly Market Commentary – September 4, 2018

Where is our country’s biggest export market?

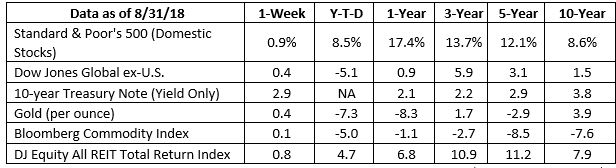

Markets were fired up last week after the United States and Mexico agreed on new trade rules. The Standard & Poor’s 500 (S&P 500) Index reached an all-time high and finished the month of August up about 3 percent, reported Michael Sheetz, Thomas Franck, and Alexandra Gibbs of CNBC.

During the latter half of last week, though, the S&P 500 gave back some gains. A hitch in the giddy-up of trade talks between the United States and Canada caused the index to stumble. Damian Paletta, Jeff Stein, and Heather Long of The Washington Post explained: “High-stakes trade negotiations between the White House and Canadian leaders unraveled Friday, a major setback in President Trump’s effort to redraw the North American Free Trade Agreement…the United States and Canada have interwoven economies, with integrated supply chains and vast amounts of trade. The value of goods and services sold between the two countries last year reached $673.1 billion, making Canada the United States’ largest export market for goods.”

The United States exported about $341 billion of goods and services to Canada in 2017, according to The Office of the U.S. Trade Representative website. Our top exports to Canada during 2017 included:

- Services ($58 billion)

- Vehicles ($52 billion)

- Machinery ($43 billion)

- Electrical machinery ($25 billion)

- Agricultural products ($24 billion)

- Mineral fuels ($20 billion)

- Plastics ($13 billion)

Trade talks are expected to resume next week.

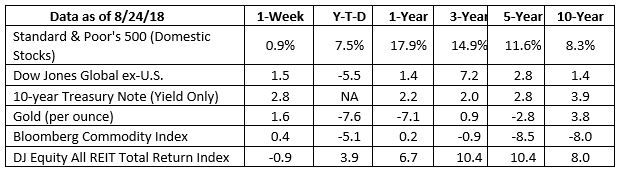

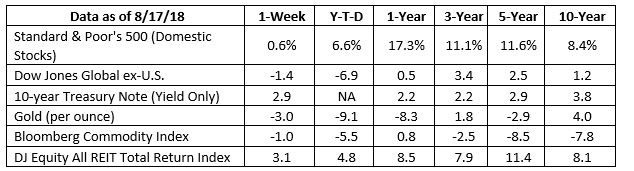

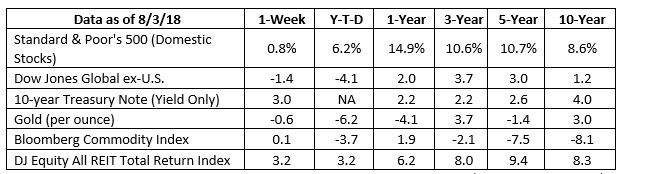

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Prepare for a shake up! From Reuters to Marketplace, economic and financial news shows like to ‘do the numbers.’ They often review economic indicators, Federal Reserve rate changes, or benchmark index performance.

In general, these statistics are intended to help people gauge how economies and markets are performing. For instance, when Gross Domestic Product (GDP) – the value of all goods and services produced by a nation during a certain period of time – moves higher, it means the economy grew during the period. When GDP moves lower, the economy contracted during the period.

Asset managers and investors rely on benchmark indices, like the S&P 500 Index, to measure the relative performance of investment portfolios. The S&P 500 is a benchmark for large U.S. company stocks. It includes companies from diverse sectors including:

- Information technology

- Healthcare

- Financials

- Consumer discretionary

- Industrials

- Consumer staples

- Energy

- Utilities

- Real estate

- Materials

- Telecommunications services

But, wait, change is coming! Soon, benchmark indices will have a new sector. At the end of September 2018, Telecommunications Services will become Communication Services. The name is changing and so are the companies that will be included in the sector. Ben Levisohn at Barron’s reported:

“The biggest changes will be around some prominent companies that will migrate out of the information-technology and consumer-discretionary sectors and into a new communication-services sector…[The changes] certainly don’t herald any fundamental changes for the companies involved. But they do have the potential to create short-term noise…”

If you’d like to learn about the ways sector changes may affect benchmark indices, give us a call.

Weekly Focus – Think About It

“Progress is impossible without change, and those who cannot change their minds cannot change anything.”

–George Bernard Shaw, Irish playwright

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in

the subject.

Sources:

https://www.cnbc.com/2018/08/31/us-markets-global-trade-tensions-ramp-up.html

https://ustr.gov/countries-regions/americas/canada

https://www.reuters.com/finance/markets

https://www.marketplace.org/shows/marketplace/07092018

https://www.investopedia.com/terms/c/contraction.asp

https://us.spindices.com/indices/equity/sp-500

https://www.barrons.com/articles/tech-stocks-could-be-winners-in-big-sector-shift-1535759312

https://www.brainyquote.com/quotes/george_bernard_shaw_386923?src=t_change