Market Commentary – October 1, 2018

It wasn’t headline news…

But, if newsprint was still popular, last week’s key economic news would have appeared below the fold. The Federal Reserve raised rates for the third time in 2018, as expected. In addition, the Federal Open Market Committee projects economic growth will continue for three more years, although its median numbers show growth slowing from 3.1 percent in 2018 to 1.8 percent in 2021. (Remember, forecasts, no matter how venerable the source, are best guesses and not bedrock.)

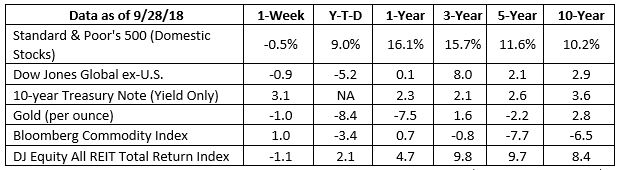

Investors weren’t enthusiastic about the Fed’s actions or its expectations, and the onset of United States-China tariffs didn’t lift their spirits. Ben Levisohn of Barron’s explained: “The Dow Jones Industrial Average dropped 285.19 points, or 1.1 percent, to 26,458.31 on the week, while the S&P 500 fell 0.5 percent to 2913.98. Neither could be considered life threatening, and the S&P 500 still rose for a sixth consecutive month. So, while we need something to blame, we needn’t get too worried. Last Monday kicked off with the implementation of tariffs by the United States and China and continued with a Federal Reserve rate hike. Neither was a surprise, though the Fed might have caught a few napping when it removed the word ‘accommodative’ from its statement.”

What does it mean when the Federal Reserve removes the word ‘accommodative?’ The Fed pursues ‘accommodative’ or ‘easy’ monetary policy when it is encouraging economic growth. Accommodative policy may include lowering interest rates or, in unusual circumstances, quantitative easing.

By removing the word, the Fed may be signaling that policy will be ‘tightening’ in an effort to prevent the economy from overheating, reported Sam Fleming of Financial Times. There is debate about whether rates are at a neutral level; one that won’t cause the economy to run too hot or too cold.

Let’s hope for a Goldilocks economy.

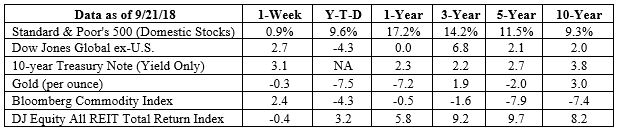

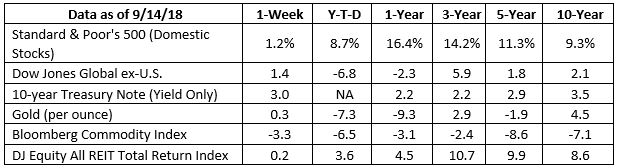

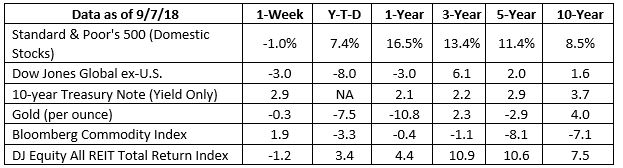

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

When do you behave the most like yourself? Don’t worry. This isn’t about soul-searching and trying to find answers to existential questions like, ‘Who am I?’ or ‘What is my purpose?’ or ‘How should I live my life?’

Nope. This is about a science experiment! Ian Krajbich of Ohio State University and Fadong Chen of Zhejiang University in China wanted to better understand how people made social decisions, according to a paper they published in Nature Communications. They began with the premise that “Social decisions typically involve conflicts between selfishness and pro-sociality.”

Then, they asked 200 students in the United States and Germany to play “mini-dictator games in which subjects make binary decisions about how to allocate money between themselves and another participant.” Science Daily explained, “In some cases, participants had to decide within two seconds how they would share their money as opposed to other cases, when they were forced to wait at least 10 seconds before deciding. And, in additional scenarios, they were free to choose at their own pace, which was usually more than two seconds but less than 10.”

The upshot was people who were pro-social became more pro-social, and people with more selfish instincts became more selfish, under severe time constraints. Given more time, “pro-social subjects became marginally less pro-social under time delay…while selfish subjects became less selfish under time delay…though these effects are less pronounced.”

Maybe you behave most like you when you’re pressed for time.

Weekly Focus – Think About It

“Selfishness is not living as one wishes to live, it is asking others to live as one wishes to live.”

–Oscar Wilde, Irish poet and playwright

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.ft.com/content/635daa64-c1ac-11e8-95b1-d36dfef1b89a

https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20180926.htm (Table: Change in real GDP)

https://www.barrons.com/articles/dow-drops-1-1-on-week-as-tariffs-fed-take-their-toll-1538182108

https://www.investopedia.com/terms/a/accomodativemonetarypolicy.asp

https://www.nature.com/articles/s41467-018-05994-9

https://www.sciencedaily.com/releases/2018/09/180904140530.htm

https://www.brainyquote.com/quotes/oscar_wilde_106085?src=t_selfishness