This is an excellent example of one of our more popular client webinars where we detail what is happening in the market, what makes us so successful and different from other advisors, and how it effects our clients' portfolios.

Market Commentary – January 14, 2019

People love rules of thumb.

Sometimes, mental shortcuts are helpful. Other times they are not. When it comes to investing, seasonal shortcuts are not uncommon. In fact, January boasts two:

The January Effect explains why U.S. smaller company stocks tend to outperform the market in January. The original theory held that tax-loss harvesting pushed stock prices lower in December, making shares more attractive to investors in January. An article published in International Journal of Financial Research explained the effect could also owe something to the optimism that accompanies a new year, as well as year-end cash windfalls.

In his book, A Random Walk Down Wall Street, Burton Malkiel described the January Effect this way, “…the effect is not dependable in each year. In other words, the January ‘loose change’ costs too much to pick up, and in some years it turns out to be a mirage.”

The January Barometer suggests the performance of stocks during the first month of the year offers insight to the direction of stocks for the year as a whole.

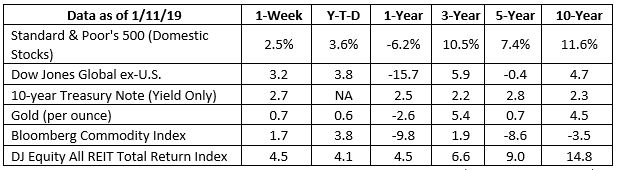

Last week, the Standard & Poor’s 500 Index (S&P 500) was up 2.5 percent. If the Index finishes this month higher, then the January Barometer suggests it should finish the year in positive territory.

Of course, you need look no further than 2018 to see the January Barometer is not completely accurate. In January 2018, the S&P 500 gained 5.6 percent, and it finished the year in negative territory.

According to Fidelity, the theory is flawed because, while stocks move higher for the year a significant percentage of the time after gaining value in January, they also move higher for the year a significant percentage of the time after losing value in January.

This is why mental shortcuts are often poor investment guides.

There is one rule of thumb investors may want to consider adopting: A well-allocated and diversified portfolio that aligns with long-term financial aspirations to help meet goals along with periodic reviews with their financial professional.

Oh, What A Year! Every year brings unexpected events. Here are a few remarkable stories you may have missed in 2018:

Abuzz in NYC

“…a menacing horde of honeybees descended on a hot dog vendor’s umbrella, bringing Times Square to a standstill and drawing swarms of gawking tourists. After a brief flurry of excitement, the buzzing interlopers were apprehended by a police officer armed with a vacuum cleaner-like device that sucked them up. The bees were then whisked away to safety.”

–Reuters, December 17, 2018

Mostly indivisible

“There’s a new behemoth in the ongoing search for ever-larger prime numbers – and it’s nearly 25 million digits long. A prime is a number that can be divided only by two whole numbers: itself and 1… We would write the number out for you, but it would fill up thousands of pages, give or take…”

–NPR, December 21, 2018

Hoop dreams

“Basketball is apparently being embraced by North Korea as a fundamental part of its ideology…‘Promoting basketball is not only a sports-related matter, but an important project that upholds the objectives of the [Workers] Party,’ the North Korean paper reportedly stated. ‘We must rush to elevate the sport to global levels.’”

–NPR, December 21, 2018

None for you

“A California court ruled…in a case involving a Celebes crested macaque who took a selfie using a nature photographer’s camera…the court rejected a lawsuit filed on the monkey’s behalf by People for the Ethical Treatment of Animals, which argued the primate was the legal owner of all photos he took. In a decision that likely left the plaintiffs crestfallen, the court ruled that monkeys cannot sue for copyright protection.”

–Reuters, December 17, 2018

We hope 2019 brings you good health, good humor, and great happiness.

Weekly Focus – Think About It

“As we navigate our lives, we normally allow ourselves to be guided by impressions and feelings, and the confidence we have in our intuitive beliefs and preferences is usually justified. But not always. We are often confident even when we are wrong, and an objective observer is more likely to detect our errors than we are.”

–Daniel Kahneman, psychologist and author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

How to Manage Your Money and Your Risk Exposure

Forgotten 401Ks

ZombiesThey’ll eat you alive!Failure to Rebalance - Zombie Sign #1When was the last time you rebalanced your 401(k) or other retirement account? When you set it up, you took a fairly conservative approach and bought 60% stock mutual funds and 40% bond...

Navigating Bear Market 17 & Covid19 Webinar

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio > This Webinar zeroes in on Technical Analysis and Active Management—two strategies that protect your assets in times of trouble. Our equity...

Six Steps To Financial Independence For Women

Financial independence: Whether you enjoy it or dream about it, it’s a common term that you’ve probably seen in magazine ads, TV commercials and billboards. But what really does financial independence mean, exactly?Read more>>

Active Portfolio Management – How We Do It!

Research Financial Strategies specializes in providing financial advice using a proprietary investment methodology that leverages technical analysis to identify and protect our clients against stock market risk. Research Financial Strategies provides our...

Don’t Be Deceived By Mutual Funds

Best Mutual Funds? Since the bull market run started 10 years ago, how many mutual funds would you guess outperformed the stock market? If you are thinking 500, 200 or even 20, you are very wrong. In fact, not one single mutual fund has beaten the market...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of the The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.researchgate.net/publication/321495311_Does_the_January_Effect_Still_Exists Page 51

Burton Malkiel, ‘A Random Walk Down Wall Street,’ W.W. Norton & Company, Page 271, January 1, 2019

https://www.investopedia.com/terms/j/januarybarometer.asp

https://www.fidelity.com/viewpoints/active-investor/january-barometer

https://www.cnbc.com/2018/12/31/stock-market-wall-street-stocks-eye-us-china-trade-talks.html

https://www.fidelity.co.uk/markets-insights/daily-insight/what-the-january-effect-really-tells-us

https://www.reuters.com/article/us-usa-oddly/bees-brothels-and-monkey-selfies-oh-my-2018-abuzz-with-odd-u-s-stories-idUSKBN1OG213

https://www.npr.org/2018/12/21/679207604/the-world-has-a-new-largest-known-prime-number

https://www.npr.org/2018/12/21/679291823/north-korea-promotes-basketball-as-an-important-project

Daniel Kahneman, ‘Thinking, Fast and Slow,’ Farrar, Straus and Giroux, Page 4, April 2, 2013