EVs―The Next Big ThingAn Interesting EmailWe recently received an interesting email from a reader of our RFS website. Katie Griffin is a Senior Communications Specialist at EcoWatch.org, a group devoted to disseminating information on the environment to help reduce...

Market Commentary – March 4, 2019

Is it a soft landing?

Economists use aviation metaphors to describe the results of central banks’ efforts to manage rapidly growing economies. If the Federal Reserve lifts rates enough to prevent the economy from overheating without jolting it into recession, then it has engineered a soft landing, according to Investopedia. (Rate increases that drop a country into recession are hard landings.)

Ben Levisohn of Barron’s thinks recent Fed actions may have produced the second soft landing in the history of the United States:

“…the Federal Reserve might have engineered a soft landing for the U.S. economy…When Chairman Jerome Powell abruptly decided that he would hold off on further rate hikes, the market responded as if a recession was no longer in the offing. And it probably isn’t…There are also signs that the Fed, simply by taking a breather, has eased monetary conditions. The evidence: The yield curve is steepening. The difference between 30-year and two-year Treasury yields – the spread most correlated to money supply – has risen to about 0.6 percentage point, the highest since June…”

Not everyone agrees. Last week, Economist Robert Shiller told Bloomberg, “The economy has been growing pretty smoothly…There are some signs there might be things amiss. The housing market is soaring and the stock market is high. It’s been a long time that we’ve been in this recovery period and it wouldn’t surprise me at all if there was a recession.”

The Standard & Poor’s 500 Index and Nasdaq Composite delivered slight gains last week, while the Dow Jones Industrial Average was flat.

here’s a blast from the past. Depending on your age, the 1980s may be a nostalgic chapter in your life or the wellspring of amusing photos of your Miami-Vice clad, lace-gloved parents. The 80s are known for more than MTV, yuppies, sci-fi movies, and cell phones the size of shoeboxes, though. The decade marked the start of a new era in geopolitics as the Cold War ended and the Berlin Wall was dismantled.

The 1980s also brought a wealth of innovative new products that disrupted markets and changed the way people perform everyday tasks. Entrepreneur Magazine recently identified some of the decade’s notable inventions, including:

- The First Artificial Human Heart. Dr. Robert Jarvik’s invention was used as a temporary solution for many people who were waiting for a human heart to become available for transplant.

- Compact Disc (CD) Players. The first compact disc ever pressed was ABBA’s ‘The Visitors’ reported Time Magazine. Not many people listened to CDs early on because of the cost. However, CDs eventually disrupted the market for vinyl records.

- DNA Fingerprinting. This discovery enabled a person to be identified from just a few hair, skin, or blood cells which revolutionized forensic investigation.

- Personal Computers and Software. At the start of the decade, technology visionaries Bill Gates and Steve Jobs – still in their twenties – were figuring out how to make computing accessible. Personal computers became more prevalent, along with floppy disks and CD-ROMs.

While the fashions have become obsolete, along with camcorders and CD players, many of the decade’s inventions have proven more durable – and some have completely changed the way people interact with the world.

Which of this decade’s inventions do you think could have a similar impact?

Weekly Focus – Think About It

“Don’t let anyone rob you of your imagination, your creativity, or your curiosity. It’s your place in the world; it’s your life. Go on and do all you can with it, and make it the life you want to live.”

–-Mae Jemison, American engineer, physician, and NASA astronaut

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

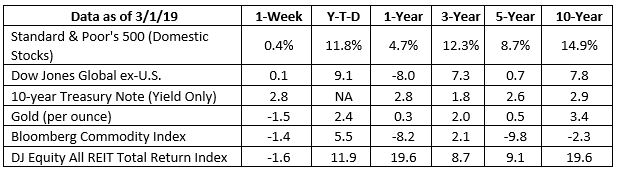

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

EVs―The Next Big Thing

Bitcoin – There’s No There There

The Big Guys Move InOn September 13, 2022, the biggest of the big guys on Wall Street came out with a rather earth-shaking announcement. None other than Fidelity, Citadel Securities, and Charles Schwab have launched a new cryptocurrency exchange. In the words of the...

Special Message

Look! Have You Noticed? Listen to any politician or any news commentator these days, and they always begin a discussion or answer a question like this: Look, when I served in the Senate …. Look, as I wrote in my last column …. Look, if the Republicans won’t …. Look,...

Special Market Update

Inflation is proving to be far more tenacious than financial markets had hoped.The idea that inflation peaked in March was put to rest last week when the Consumer Price Index (CPI) showed that inflation accelerated in May. Overall, prices were up 8.6...

Special Update

All,You undoubtedly have heard reports that the world’s supply of wheat and corn are in jeopardy due to Ukraine and Russia both missing this season’s planting window for obvious reasons (click the link above to read more details). Did you know that Russia...

Significant Shrinkage

Significant Shrinkage Buffeted by Inflation Is it time to double check your household budget? Chances are the budgeted expenditures of the vast majority of Americans are about to get buffeted. Or so says the Oracle of Omaha. In the latest shareholder...

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.investopedia.com/terms/s/softlanding.asp

https://www.investopedia.com/terms/h/hardlanding.asp

https://www.barrons.com/articles/the-dow-just-had-its-best-two-months-in-years-and-there-could-be-more-to-come-51551493199?refsec=the-trader

https://www.bloomberg.com/news/videos/2019-02-26/yale-s-shiller-says-u-s-due-for-recession-sees-housing-market-slowing-video (Time stamp 0:21 seconds)

https://money.cnn.com/data/markets/sandp/

https://money.cnn.com/data/markets/nasdaq/

https://money.cnn.com/data/markets/dow/

https://www.history.com/topics/1980s/1980s

https://www.retrowaste.com/1980s/

https://www.thoughtco.com/michael-jackson-videos-3245489

https://www.entrepreneur.com/slideshow/294171#2

https://www.entrepreneur.com/slideshow/294171#3

http://time.com/3971914/cd-history-music/

https://www.entrepreneur.com/slideshow/294171#5

https://www.entrepreneur.com/slideshow/294171#6

https://www.entrepreneur.com/slideshow/294171#7

https://www.computerhistory.org/timeline/ (See 1980, 1981, and 1984)

https://interestingengineering.com/25-quotes-from-powerful-women-in-stem-who-will-inspire-you