No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Risk Management

There are more financial advisors than ever before in the US. The most important difference is whether they have an independent and unaffiliated custodian. We do. The investment advisor initiates transactions as part of its portfolio management responsibility. The custodian then clears transactions as part of its safekeeping responsibility. The custodian has no investment authority (unless assigned for overnight excess cash balance sweep management). They serve to provide an audit trail of all the activity within a client’s investment account. We partner with Schwab as our custodian. They manage over $3.5 trillion in assets, have online account access and reporting and some of the strongest credit ratings in the industry.

Over the last several years and even decades, there have been periods of time when all asset classes are under negative pressure and cash is your best investment choice. Although the financial implications of bear markets can vary, typically, bear markets are marked by a 20% downturn or more in stock prices over at least a two-month time frame. Some bear markets have suffered a 40-60% decline in stock prices and have taken many years after to recover losses. In those instances where downside risks significantly outweigh upside potential, we have often chosen to sell investment positions and move to safer cash equivalents.

Using ETFs (Exchange Traded Funds) with very low trading costs has made that defensive play cost-effective for families seeking to preserve wealth. Plus, ETFs can be sold at any time during the trading day, whereas mutual funds can only be sold at the end of the day.

The oldest law of economics is supply and demand. At Research Financial Strategies, we place a premium on when to make an investment decision based on price movements using technical analysis. Technical analysis is an emotionless investment decision making process. It does not allow for getting caught up in the company or industry story. Investments are made through a series of technical factors.

The most notable factor is one called relative strength. When a security price shows a recognizable pattern of higher highs and higher lows, it demonstrates that there is higher demand than supply for that security. Given that reality, we continually evaluate the current market environment to take advantage of opportunistic investments being presented. Research Financial Strategies has the unique capability to create unlimited customized asset allocation blends for our diverse client base.

Our ability to minimize portfolio risk for our clients is a result of having a Sell-Side Discipline. Prior to investing in a security, we establish an exit point based on the % of loss or price our investment advisors determine is acceptable. If the security price is violated, then it is sold. This ensures that profits are protected for our clients. Or worst case, risk to principal is minimized. Only through having an investment approach that has a pre-determined exit strategy for each investment position, can you mitigate portfolio risk during market corrections.

For many clients, allocating a portion of their assets to a strategy that has limited the downside risk is critical to achieving their investment objectives. However, there is no free lunch in investing or in life. There are numerous financial institutions pitching an array of products that are often not suitable to the client’s needs. Some are just loaded with fees. As independent advisors, we help our clients sift through the noise to find the right solution that works within their larger financial plan.

We invest in ETFs ( Exchange Traded Funds) and bonds funds that provide daily liquidity. Our firm is built on the belief that clients should have access to their money when they want it! And these investments allow us to quickly make decisions to help protect your assets should the stock market start to rapidly decline.

Our focus is on your life and priorities. Not just your portfolio. That’s why we start by listening and learning about you. Each individual client has different needs and concerns that need to be addressed. We carefully listen to those concerns and we will gain important information that will help us to best serve our clients and help protect their financial futures.

People love rules of thumb.

Sometimes, mental shortcuts are helpful. Other times they are not. When it comes to investing, seasonal shortcuts are not uncommon. In fact, January boasts two:

The January Effect explains why U.S. smaller company stocks tend to outperform the market in January. The original theory held that tax-loss harvesting pushed stock prices lower in December, making shares more attractive to investors in January. An article published in International Journal of Financial Research explained the effect could also owe something to the optimism that accompanies a new year, as well as year-end cash windfalls.

In his book, A Random Walk Down Wall Street, Burton Malkiel described the January Effect this way, “…the effect is not dependable in each year. In other words, the January ‘loose change’ costs too much to pick up, and in some years it turns out to be a mirage.”

The January Barometer suggests the performance of stocks during the first month of the year offers insight to the direction of stocks for the year as a whole.

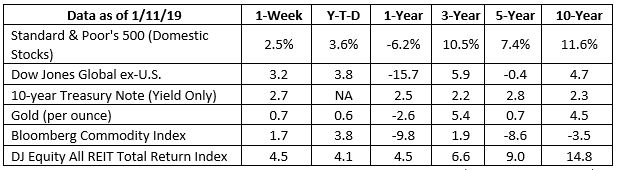

Last week, the Standard & Poor’s 500 Index (S&P 500) was up 2.5 percent. If the Index finishes this month higher, then the January Barometer suggests it should finish the year in positive territory.

Of course, you need look no further than 2018 to see the January Barometer is not completely accurate. In January 2018, the S&P 500 gained 5.6 percent, and it finished the year in negative territory.

According to Fidelity, the theory is flawed because, while stocks move higher for the year a significant percentage of the time after gaining value in January, they also move higher for the year a significant percentage of the time after losing value in January.

This is why mental shortcuts are often poor investment guides.

There is one rule of thumb investors may want to consider adopting: A well-allocated and diversified portfolio that aligns with long-term financial aspirations to help meet goals along with periodic reviews with their financial professional.

Oh, What A Year! Every year brings unexpected events. Here are a few remarkable stories you may have missed in 2018:

Abuzz in NYC

“…a menacing horde of honeybees descended on a hot dog vendor’s umbrella, bringing Times Square to a standstill and drawing swarms of gawking tourists. After a brief flurry of excitement, the buzzing interlopers were apprehended by a police officer armed with a vacuum cleaner-like device that sucked them up. The bees were then whisked away to safety.”

–Reuters, December 17, 2018

Mostly indivisible

“There’s a new behemoth in the ongoing search for ever-larger prime numbers – and it’s nearly 25 million digits long. A prime is a number that can be divided only by two whole numbers: itself and 1… We would write the number out for you, but it would fill up thousands of pages, give or take…”

–NPR, December 21, 2018

Hoop dreams

“Basketball is apparently being embraced by North Korea as a fundamental part of its ideology…‘Promoting basketball is not only a sports-related matter, but an important project that upholds the objectives of the [Workers] Party,’ the North Korean paper reportedly stated. ‘We must rush to elevate the sport to global levels.’”

–NPR, December 21, 2018

None for you

“A California court ruled…in a case involving a Celebes crested macaque who took a selfie using a nature photographer’s camera…the court rejected a lawsuit filed on the monkey’s behalf by People for the Ethical Treatment of Animals, which argued the primate was the legal owner of all photos he took. In a decision that likely left the plaintiffs crestfallen, the court ruled that monkeys cannot sue for copyright protection.”

–Reuters, December 17, 2018

We hope 2019 brings you good health, good humor, and great happiness.

Weekly Focus – Think About It

“As we navigate our lives, we normally allow ourselves to be guided by impressions and feelings, and the confidence we have in our intuitive beliefs and preferences is usually justified. But not always. We are often confident even when we are wrong, and an objective observer is more likely to detect our errors than we are.”

–Daniel Kahneman, psychologist and author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of the The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.researchgate.net/publication/321495311_Does_the_January_Effect_Still_Exists Page 51

Burton Malkiel, ‘A Random Walk Down Wall Street,’ W.W. Norton & Company, Page 271, January 1, 2019

https://www.investopedia.com/terms/j/januarybarometer.asp

https://www.fidelity.com/viewpoints/active-investor/january-barometer

https://www.cnbc.com/2018/12/31/stock-market-wall-street-stocks-eye-us-china-trade-talks.html

https://www.fidelity.co.uk/markets-insights/daily-insight/what-the-january-effect-really-tells-us

https://www.reuters.com/article/us-usa-oddly/bees-brothels-and-monkey-selfies-oh-my-2018-abuzz-with-odd-u-s-stories-idUSKBN1OG213

https://www.npr.org/2018/12/21/679207604/the-world-has-a-new-largest-known-prime-number

https://www.npr.org/2018/12/21/679291823/north-korea-promotes-basketball-as-an-important-project

Daniel Kahneman, ‘Thinking, Fast and Slow,’ Farrar, Straus and Giroux, Page 4, April 2, 2013

Every January, it’s customary to look back at the year that was. What were the highlights? What were the “lowlights”? What were the events we’ll always remember? Most importantly, what did we learn?

Before we get into that, though, let’s take a brief jaunt back to the 1800s.

The famous 19th century composer, Robert Schumann, used to moonlight as a music critic when he wasn’t writing his own work. What’s notable about his reviews is that instead of writing from his perspective, he often wrote from the perspective of two imaginary characters, Florestan and Eusebius. Florestan represented Schumann’s passionate, witty side; Eusebius, his thoughtful and introspective side. These two characters would debate a piece of music, each bringing a different perspective to the table because their personalities were so different. Was a composition ardent and exciting – or merely flashy and melodramatic? Sincere and thought-provoking, or dull and trite? Both characters had their own opinions, proving that two people can experience the same thing very differently depending on their personality – or in the case of Schumann, that one person can.

Why am I telling you all this? Because when you look back on the year that was, it’s possible to draw very different conclusions. If you were to Google “2018 year in review in the markets”, you’d find wildly varying opinions from analysts, pundits, bankers, economists, and others. They’re all reviewing the same year – but their interpretations tend to be very different.

So, with that in mind, let’s review the year the way Schumann would. I present to you two characters: Volatilis and Tranquillitas, the Latin words for volatile and calm.

The Markets

Volatilis: “Look, it was a volatile year. The Dow, S&P 500, and Nasdaq all ended the year lower than they started – the first time that’s happened since 2008.1 The S&P and Nasdaq are in or near bear market territory, and the Dow had its worst December since the Great Depression.”2

Tranquillitas: “Oh, come now, the year wasn’t so bad as all that. In fact, the markets spent most of 2018 climbing rather than falling. The Dow soared to never-before-seen heights, and at one point, the Nasdaq was up 17.5% for the year!1 A few down months can’t erase all the good that came before.”

Volatilis: “Quite the contrary. When it comes to the markets, losses can quite literally wipe out gains! In fact, since October, the markets have lost all they gained and more. And even earlier in the year, we still saw dramatic peaks and valleys. The markets shot out of the gate in January after the new tax law went into effect, but then quickly plunged in February. The same pattern occurred in March and April. We’ve already covered what happened in summer and autumn – a tremendous rise, followed by a tremendous fall. My dear Tranquillitas, don’t you know that’s what volatility means?”

The Economy

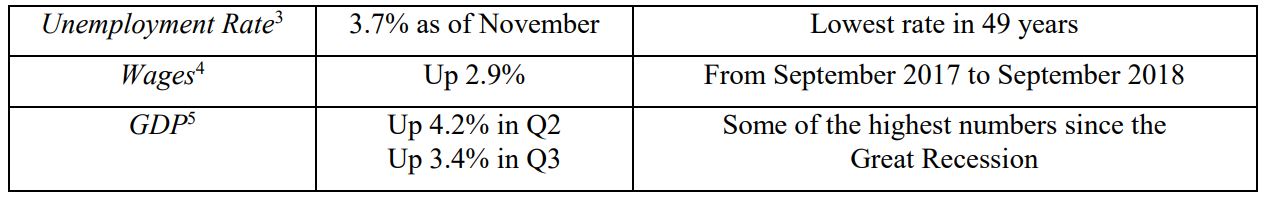

Tranquillitas: “But the markets are not the same as the economy, and the economy soared in 2018. Observe these numbers:

“Those numbers paint a picture of a strong economy – and it’s a beautiful picture, indeed!”

Volatilis: “A lovely chart, but it doesn’t tell the whole story – which is that the economy is likely slowing down. The economic expansion has been driven for years by historically low interest rates – rates the Federal Reserve continues to raise. This, in turn, has affected the housing market and the stock market. Oil prices have plummeted, too, which is good for consumers at the gas pump, but bad for the energy industry. Meanwhile, many of the world’s largest economies are also slowing down, especially in China and Europe. In this ever-more connected global economy we all participate in, that spells trouble. “I don’t need to tell you that if these trends continue, 2019 could be more volatile still.”

The Future

Tranquillitas: “Slowing is not the same as stopping. Interest rates are rising but are still relatively low. Corporate profits remain steady, consumer spending is thriving, as is the labor market. These are all indicators of a healthy economy in 2019, even if it’s not quite producing at the same pace it was before.”

Volatilis: “I see your indicators and raise a few of my own. There’s a ceasefire in the trade war with China, but it could pick up again at any time. The federal government is experiencing another shutdown. Furthermore, a large portion of the economy’s growth over the last decade has been prompted by fiscal stimulus from the government – stimulus that will be harder and harder to provide as the nation’s deficit climbs and climbs.6 Take away that prop, and what happens to growth? “The fact is, investors often tend to be both irrational and impatient – a volatile combination. While the economy may be technically strong, trends are what anxious investors pay attention to. And if the economy looks like it’s trending down, it’s quite possible the markets will follow.”

Tranquillitas: “Yes, Volatilis, but have you considered –”

***

Okay, you get it. In many of Schumann’s reviews, it was at this point that a third character would appear: Master Raro, a teacher who through pure logic and reason would serve as a final arbiter over Florestan’s and Eusebius’ debates. I’ll try to do the same – though I certainly don’t claim to be more capable of “pure logic” than other people!

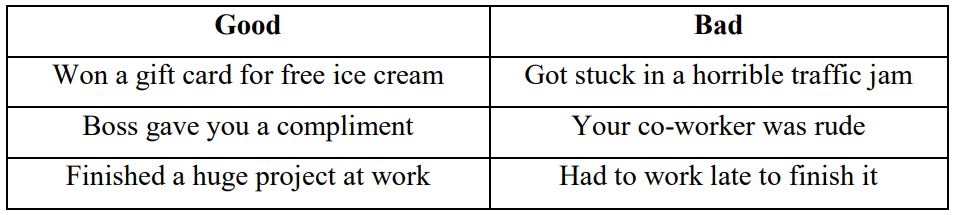

If you look at all the points and counterpoints made above, though, the logical conclusion is that 2018 was neither a “good” year or a “bad” year. It was…a year! The markets were volatile, but the economy was strong. Similarly, there are indicators of economic strength for 2019, as well as signs that market volatility may continue. Both our fictional characters, Volatilis and Tranquillitus, made good points based on actual facts. But their interpretations of those facts were very different – and that says more about them than anything else. Here’s why that’s important. When we form an opinion about something, it’s often colored by which facts we value more than others. For example, think about when someone asks, “How was your day?” Most days are usually a mixture of good and bad things, aren’t they?

This is a trivial example, but the point is, whether you saw your day as good or bad would depend largely on which events mattered more to you. If you’re someone who thrives off praise and accomplishment, it was probably a great day! If you’re someone who is extremely schedule-oriented, the fact you got stuck in traffic and worked extra late would probably make it a bad day – or at least, not one you’d remember with any fondness. Either way, the facts didn’t change – only your interpretation of them.

Similarly, what we expect of 2019 largely depends on which facts we value more than others. As investors, it’s critical that we remind ourselves about this tendency. Whenever we select an investment, formulate a plan, or make a decision, it’s useful to ask ourselves, “Which facts are causing me to think this way? Which facts am I overemphasizing more than others?” By doing this, we can avoid both undue optimism and overt pessimism – becoming more balanced, less emotional investors in the process!

Whatever 2019 has in store, rest assured there will be both obstacles to avoid and opportunities to seize. But whatever happens, we here at Research Financial Strategies will continue analyzing all the facts and data to help you make smart, unbiased, unemotional financial decisions – music to any investor’s ears. As always, please let me know if there is anything I can do for you in 2019.

Happy New Year!

1 “Investors Find Few Places to Hide,” The Wall Street Journal, December 18, 2018. https://www.wsj.com/articles/market-slidefoils-investors-11545154550?mod=ig_2018yearinreview

2 “Dow closes lower, ending a volatile week on Wall Street,” CNBC, December 27, 2018. https://www.cnbc.com/2018/12/28/usstocks-and-futures-dow-sp-and-nasdaq-on-roller-coaster-week.html

3 “Let the Good Times…Stay a Little Longer?” The Wall Street Journal, December 16, 2018. https://www.wsj.com/articles/letthe-good-times-stay-a-little-longer-11544993632?mod=ig_2018yearinreview

4 “U.S. workers see fastest wage growth in a decade,” The Washington Post, October 31, 2018. https://www.washingtonpost.com/business/economy/us-workers-see-fastest-wage-increase-in-a-decade/2018/10/31/3c2e7894- dc85-11e8-85df-7a6b4d25cfbb_story.html

5 “U.S. Economy at a Glance,” Bureau of Economic Analysis, September 19, 2018. https://www.bea.gov/news/glance

6 “U.S. deficits and the debt in 5 charts,” Politifact, November 2, 2018. https://www.politifact.com/truth-ometer/article/2018/nov/02/five-charts-about-debt/

Investors will think of the last quarter of 2018 for years to come, but they won’t remember it fondly.

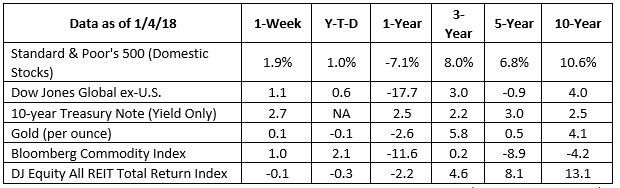

The Economist described it like this, “After a rotten October and limp November, the S&P 500 tumbled in value by 15 percent between November 30th and December 24th. Despite an astonishing bounce of 5 percent the day after Christmas, the index finished the year 6 percent below where it started…”

Last quarter’s volatility and the slide in share prices owed much to uncertainty about economic growth. Investors were concerned about a variety of issues, including:

As anxiety rose during the fourth quarter of 2018, some investors rushed to the perceived safety of bonds. High demand pushed the yield on 10-year Treasury bonds lower. It dropped from 2.99 percent to 2.69 percent during December, according to Yahoo! Finance.

While increasing bond exposure may have been a prudent portfolio adjustment for investors who were taking more risk than they could bear, those who moved out of stocks on fear missed out. The Standard & Poor’s 500 Index and the Dow Jones Industrial Average posted their biggest one-day point gains on record on December 26, reported Emily McCormick for Yahoo! Finance.

At this point, some investors feel overwhelmed and worried about their ability to reach personal financial goals. If you’re one of them, please give us a call. Sometimes, reviewing life and financial goals, and the reasoning behind portfolio choices, may be reassuring. We look forward to hearing from you.

What is midwest nice?

The Economist recently explored whether there was a basis for the idea that Americans who live in mid-western states are more congenial than people from other states. The publication explained ‘Midwest nice’ this way, “It is apologizing involuntarily when scooting past someone, both to warn of your presence and to express regret for any inconvenience your mere existence may have caused. It is greeting people as they step into a lift and wishing them well as they leave. It is a strong preference for avoiding confrontation.”

The Economist found it all depends on how you measure ‘nice.’

If the standard is volunteerism, the Corporation for National and Community Service reported three of the five states where people volunteer the most are in the Midwest:

1) Utah (West)

2) Minnesota (Midwest)

3) Wisconsin (Midwest)

4) South Dakota (Midwest)

5) Idaho (West)

If the standard is personality, the Midwest shares the blue ribbon for friendliness. A group of researchers from the United States, Britain, and Finland mapped the psychological topography of the United States and found people in Middle America and the South to be friendly and conventional, while those on the West Coast, in Rocky Mountains, and along the Sunbelt were relaxed and creative. Americans in the Mid-Atlantic and Northeast regions were temperamental and uninhibited.

When it comes to charitable giving, Utah and the Southern states come out on top. Southerners give the highest percentage of earnings to charities. The money primarily goes to churches.

The preponderance of the data considered by The Economist suggest that ‘Midwest nice’ has a basis in reality.

Weekly Focus – Think About It

“The wind comes across the plains not howling but singing. It’s the difference between this wind and its big-city cousins: the full-throated wind of the plains has leeway to seek out the hidden registers of its voice. Where immigrant farmers planted windbreaks a hundred and fifty years ago, it keens in protest; where the young corn shoots up, it whispers as it passes, crossing field after field in its own time, following eastward trends but in no hurry to find open water. You can’t usually see it in paintings, but it’s an important part of the scenery.”

– John Darnielle, Musician and author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95 percent of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.economist.com/finance-and-economics/2019/01/05/what-the-market-turmoil-means-for-2019

https://www.bloomberg.com/news/articles/2019-01-04/powell-says-fed-ready-to-adjust-policy-if-needed-can-be-patient

https://www.cnn.com/2019/01/04/investing/dow-stock-market-today/index.html

https://www.nytimes.com/2018/12/27/us/politics/trump-tax-cuts-jobs-act.html

https://insight.factset.com/sp-500-2018-earnings-preview-highest-earnings-growth-in-eight-years

https://insight.factset.com/largest-cuts-to-quarterly-sp-500-eps-estimates-since-q3-2017 (download report)

https://www.cnbc.com/2019/01/04/stock-market-comeback-is-now-in-the-hands-of-china-us-trade-talks.html

https://www.washingtonpost.com/business/2019/01/04/stock-market-has-been-going-down-down-down-so-why-do-so-many-analysts-think-itll-go-way-up-this-year/?noredirect=on&utm_term=.59bd81bd0720

https://finance.yahoo.com/quote/%5ETNX/history?p=%5ETNX

https://finance.yahoo.com/news/stock-futures-rise-christmas-eve-sell-off-134312777.html

https://richardlangworth.com/success

https://www.economist.com/graphic-detail/2018/12/27/is-there-any-truth-to-the-idea-of-midwestern-nice

https://www.nationalservice.gov/vcla/state-rankings-volunteer-rate

https://www.apa.org/pubs/journals/releases/psp-a0034434.pdf

https://www.goodreads.com/quotes/tag/midwest

It’s been over a year since Equifax, one of the three largest credit reporting agencies in the U.S., revealed they’d been hacked. Because the hackers were able to access everything from Social Security numbers to payment histories to driver’s license numbers, the cyberattack put over 145 million Americans at risk of identity theft.1

What did you do to protect your data?

If you’re like most Americans, the answer is probably, “not much.” According to a survey by AARP, only 14% of adults chose to freeze their credit after the hack – even though freezing your credit is one of the best ways to prevent identity theft.2

One possible reason for this is that credit freezes have traditionally cost money. But now you can freeze your credit for free!

Thanks to the “Economic Growth, Regulatory Relief, and Consumer Protection Act,” a new law enacted in May, credit reporting bureaus like Equifax, TransUnion, and Experian must offer free credit freezes.3

SEC. 301. PROTECTING CONSUMERS’ CREDIT.

“(A) IN GENERAL.— Upon receiving a direct request from a consumer that a consumer reporting agency place a security freeze, and upon receiving proper identification from the consumer, the consumer reporting agency shall, free of charge, place the security freeze not later than…1 business day after receiving a request by telephone or electronic means…[or] 3 business days after a request that is by mail.”3

– Economic Growth, Regulatory Relief, and Consumer Protection Act

What is a credit freeze?

To calculate your credit, agencies like Equifax store important data like loan and payment history, birth dates, Social Security numbers, and more. Whenever you apply for a loan or approval on a credit card, banks and other lenders will request that information from a credit reporting agency.

When you apply for a credit freeze, the agency will essentially lock, or freeze, your file so that it can’t be accessed. That way, even if a lender requests your information, the agency will not release it until you “thaw” the freeze first. It’s an excellent way to keep your personal information from falling into the wrong hands. That’s because it “makes it harder for criminals to use stolen information to open fraudulent accounts, or borrow money, in your name.”4

In many cases, you can safely keep your credit frozen year-round unless you need to apply for a loan. Unfortunately, many people don’t take advantage of this. Some probably didn’t want to pay the money, while others find the process to arduous. And some, likely, don’t think identity theft will ever happen to them. That’s despite the fact that, in 2014 alone, 17.6 million Americans experienced identity theft!5

In our opinion, freezing your credit is definitely an option to consider.

A few things to know:

• To get the most protection, you should freeze your credit at all three of the major credit reporting agencies. Visit these websites to learn how:

TransUnion: transunion.com/credit-freeze

Experian: experian.com/freeze/center.html

Equifax: equifax.com/personal/credit-report-services

• The new law also enables parents to freeze their children’s credit for free if they are under age 16. While a child’s identity is usually not as vulnerable as an adult’s, it still should be protected, and it’s a terrific way to teach children about the dangers of identity theft!

• While a credit freeze is a valuable weapon in the fight against identity theft, it won’t protect you from everything. That’s why you should check your credit report regularly. (You can still request a credit report even if your credit is frozen.)

• Freezing your credit will not affect your credit score.

To learn more, visit the Federal Trade Commission’s website at https://www.consumer.ftc.gov/articles/0497-credit-freeze-faqs.

Identity theft is one of the biggest threats to reaching your financial goals. Take steps to protect your identity as soon as possible. Please let me know if you have any questions – and be sure to visit the links listed above to learn more!

1 Stacy Cowley, “2.5 Million More People Potentially Exposed in Equifax Breach”, The New York Times, October 2, 2017. https://www.nytimes.com/2017/10/02/business/equifax-breach.html?module=inline

2 “Up for Grabs: Taking Charge of Your Digital Identity,” AARP National Survey, August 2018. https://www.aarp.org/content/dam/aarp/research/surveys_statistics/econ/2018/taking-charge-of-your-digital-identitynational.doi.10.26419-2Fres.00228.000.pdf

3 “Text of the Economic Growth, Regulatory Relief, and Consumer Protection Act,” https://www.congress.gov/bill/115thcongress/senate-bill/2155/text

4 Ann Carrns, “Freezing Credit Will Now Be Free,” The New York Times, September 14, 2018. https://www.nytimes.com/2018/09/14/your-money/credit-freeze-free.html

5 “17.6 million U.S. residents experienced identity theft in 2014,” Bureau of Justice Statistics, https://www.bjs.gov/content/pub/press/vit14pr.cfm