No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Charles Schwab’s has published its’ latest SDBA Indicators Report, a highly regarded, industry-leading benchmark on retirement plan participant investment activity within approximately 137,000 self-directed brokerage accounts (SDBAs). The report stated that participants who worked with an advisor had a more diversified asset allocation mix, higher balances, and less exposure to individual stocks compared to non-advised participants.

While only 19 percent of SBDA participants chose to use an advisor, they reported an average balance of $449,552 – nearly twice as much as the $234,643 reported by non-advised participants. SDBAs are brokerage accounts within retirement plans. These include 401Ks and other types of retirement plans, which participants can use to invest in exchange-traded funds, stocks, bonds, mutual funds and other securities that are not part of their retirement plan’s core investment offerings.

“The report highlights the benefits of working with an advisor. In general, participants who had professional help were more diversified across all of their holdings. In addition, advisors typically rebalance a portfolio more often and keep their clients invested”

-Schwab

Allocation Trends

In advised accounts, mutual funds continued to hold the highest percentage of participant assets at approximately 50 percent. ETFs were the second-largest allocation, followed by equities, cash and fixed income.

Conversely, non-advised participants allocated nearly 35 percent of their portfolio to individual equities. This was followed by mutual funds, cash, ETFs and fixed income.

When comparing equity holdings, both advised and non-advised participants held Apple, Amazon and Berkshire Hathaway as their top three holdings; however, non-advised participants’ positions in Apple and Amazon were nearly double compared to participants who used an advisor. Additionally, advised participants invested in more blue-chip, value companies, whereas self-directed investors allocated to more growth stocks.

“The report highlights the benefits of working with an advisor. In general, participants who had professional help were more diversified across all of their holdings. In addition, advisors typically rebalance a portfolio more often and keep their clients invested,” said Larry Bohrer, vice president, Corporate Brokerage Retirement Services at Charles Schwab. Generally, payroll contributions into SDBAs are allocated to cash. From there, it is up to the participant or advisor to invest. As the report shows, advisors kept clients’ cash allocations low, while individual investors left more of their SDBA in cash pending investment decisions.

Other Highlights

About the SDBA Indicators Report

The SDBA Indicators Report includes data collected from approximately 137,000 retirement plan participants who currently have balances between $5,000 and $10 million in their Schwab Personal Choice Retirement Account. Data is extracted quarterly on all accounts that are open as of quarter-end and meet the balance criteria.

Why did the stock market do that?

The great mystery of stock markets reared its head last week. With no clear driver, the Dow Jones Industrial Average gained more than 3 percent, while the Nasdaq Composite and Standard & Poor’s (S&P) 500 Index moved higher by about 2.5 percent. It was a puzzler. Ben Levisohn of Barron’s explained: “Given those gains, we’d expect a heaping helping of good news, but not much was forthcoming. Earnings reports from [two large multinational companies] left investors wanting. And economic data were either bad or terrible in the United States – industrial production declined in January, the first drop in eight months, while December’s retail sales fell the most for any month since 2009. But who needs good news when the United States and China are reportedly making progress on trade talks? Yes, the details remain a little fuzzy, but at least the tone is more constructive.”

It probably wasn’t just optimism about China that pushed markets higher. Consumer Sentiment, which gauges Americans expectations for the economy, was up more than 4 percent month-to-month. One driver of consumer optimism was relief the government shutdown had ended. Another driver is a change in inflation expectations, which are at the lowest level seen in half a century. Americans think inflation will remain low and they anticipate wages will rise. The Federal Reserve’s newly accommodative attitude hasn’t hurt, either.

Investor sentiment was leaning bullish last week, too. Willie Delwiche of See It Market reported the Investor Intelligence survey of financial advisors showed 49 percent bullish and 21 percent bearish. The AAII Investor Sentiment Survey reported bulls (40 percent) edged bears (37 percent) by a neck. Those indicators were balanced by the Daily Trading Sentiment Composite from Ned Davis Research which suggested optimism was too high.

When markets rise, as they have during the past few weeks, it may be tempting to take a more aggressive stance and tilt your portfolio toward U.S. stocks. This may not be a good idea.

What’s in your wallet?

You’re at the checkout. How do you pay for your purchase? Do you reach for a credit card, debit card, cash, check, or some form of electronic payment, such as a mobile wallet or wearable?

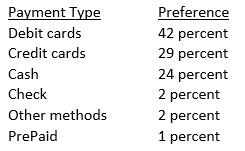

The Federal Reserve Bank of San Francisco’s 2018 Findings from the Diary of Consumer Payment Choice (DCPC) found participants preferred to pay using debit cards. The order of payment preference was like this:

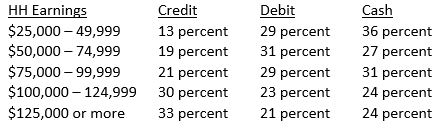

Here’s an interesting side note. The more money a household earned, the more likely they were to pay by credit card.

The shift in preference begs the question: Do wealthier people have more debt? Some do, but wealthier households are more likely to pay off credit card debt each month, according to author Tom Corley who was cited by Credit.com writer Gerri Detweiler.

If you use credit cards frequently and haven’t been paying down your balance each month, it may be a good idea to do a simple calculation to determine how much you are paying in interest each year. Just multiply the interest rate you pay by the amount of debt you carry. The amount may surprise you. Nerdwallet’s American Household Credit Card Debt Study reported, “Households with revolving credit card debt will pay an average of $1,141 in interest this year.”

If retirement is 10 years in the future, saving $1,141 a year, and earning 6 percent annually on the money, could provide about $16,000 in additional savings. If retirement is 30 years away, you could increase your savings by about $96,000*. It’s food for thought.

*This is a hypothetical example and is not representative of any specific investment. Your results may vary.

Weekly Focus – Think About It

“Wealth consists not in having great possessions, but in having few wants.”

–Epictetus, Greek philosopher

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

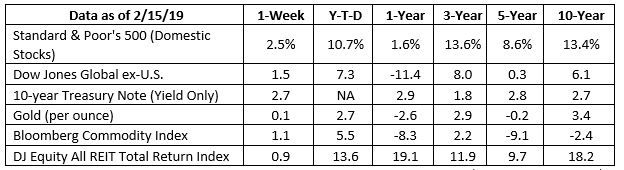

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

http://www.sca.isr.umich.edu (or go to http://www.sca.isr.umich.edu/)

https://www.seeitmarket.com/u-s-equities-update-investor-sentiment-full-circle-18971/

https://blog.credit.com/2015/02/5-credit-card-habits-of-the-rich-108720/

https://www.nerdwallet.com/blog/average-credit-card-debt-household/

http://www.moneychimp.com/calculator/compound_interest_calculator.htm

https://www.forbes.com/sites/robertberger/2014/04/30/top-100-money-quotes-of-all-time/#6db006fb4998

Research Financial Strategies specializes in providing financial advice using a proprietary investment methodology that leverages technical analysis to identify and protect our clients against stock market risk.

Research Financial Strategies provides our clients with a reproducible, non-emotional investment process using technical analysis to monitor market risk within the industries, sectors, and our actual investment decisions. It starts first with understanding our client’s financial goals & needs and helping them plan for the future. Below is an overview of RFS’s investment process.

Technical analysis is an emotionless investment decision making process that does not allow for getting caught up in the company or industry story. Investments are made through a series of technical factors. The most notable factor is one called “relative strength.” When a security price shows a recognizable pattern of higher highs and higher lows it demonstrates that there is higher demand than supply for that security. This means that the “buyers” are in control and not the “sellers.” While we cannot guarantee investment performance, securities that demonstrate this technical behavior have a higher probably increasing in value.

As investment advisors it is our fiduciary responsibility to make sure we understand each of our client’s investment tolerance and risk profile. Research Financial Strategies has the unique capability to create unlimited customized asset allocation blends for our diverse client base.

The oldest law of economics is supply and demand. At Research Financial Strategies, we place a premium on when to make an investment decision based on price movements using technical analysis. Technical analysis is an emotionless investment decision making process that does not allow for getting caught up in the company or industry story. Investments are made through a series of technical factors. The most notable factor is one called relative strength. When a security price shows a recognizable pattern of higher highs and higher lows it demonstrates that there is higher demand than supply for that security. This means that the buyers are in control and not the sellers.

Our ability to minimize portfolio risk for our client is a result of having a Sell-Side Discipline. Prior to investing in a security we establish an exit point based on the % of loss or price our investment advisors determine is acceptable. If the security price is violated then it is sold. This ensures that profits are protected for our clients, or worst case, risk to principle is minimized. Only through having an investment approach that has a pre-determined exit strategy for each investment position, can you mitigate portfolio risk during market corrections.

Thanksgiving is a time to appreciate what we value most, a time to cherish the many gifts we have, and the people that make life special. We can also be thankful that we live in a great country known for its prosperity and abundance.As you gather to enjoy some good...

Join us in honoring Veterans Day and recognizing the deeply appreciated service of the U.S. military.

This is the most important article you will read this year. It is the details behind what we wrote about in Tuesday’s email. China wants Taiwan. Not to “reunite with the motherland”, and all the other BS reasons they dream up. There is one reason, and only one. ...

Yesterday the RFS investment committee made the tough decision to sell your “short” positions, SQQQ and SPXS. So far it is working. You're probably wondering what has changed and why? The S&P 500 index, our main benchmark, has put up 6 green bars out of 9 in...

The Big Guys Move InOn September 13, 2022, the biggest of the big guys on Wall Street came out with a rather earth-shaking announcement. None other than Fidelity, Citadel Securities, and Charles Schwab have launched a new cryptocurrency exchange. In the words of the...

The market’s having a trying month. Fortunately, we are attuned to the economic reports that are coming out daily and will safeguard your portfolios by adjusting to the news.Jerome Powell, Chairman of the Federal Reserve, repeatedly has confirmed the...

As you probably know, there has been a lot of market volatility in recent months. Being a financial advisor, I get asked a lot of questions, even from people who aren’t my clients! Some ask if it’s a good time to invest in the markets, or if they should be sticking their money under a mattress. Others ask me about what the future holds for the economy. But the most common question I get is this:

“What,” they say, “is the number one financial tip you can give me?”

Here’s my answer:

You’re probably wondering what I mean. It’s simple. When is the worst time to buy a home security system? After a break-in. When’s the worst time to check your tire pressure? After you’ve already had a blowout. When’s the worst time to put your seatbelt on?

You get the idea.

It’s a fundamental fact of life, and it extends to your finances, too. I can’t say for sure when the next bear market will come – and the recent volatility is not necessarily an indication that a bear is just around the corner. What I can say, however, is that a bear market is inevitable, because the markets can take hits just like everything else.

Whether the next bear market comes this year or next, there’s only one thing to do about it, and that’s to have a plan. But a plan is nearly useless after the fact.

We’ve known this lesson since we were kids. Aesop, that ancient master of common sense, says it better than I can in his story, “The Caged Bird and the Bat.”

A singing bird was confined in a cage which hung outside a window and had a way of singing at night when all other birds were asleep. One night, a bat came and clung to the bars of the cage. The bat asked the bird why she was silent by day and sang only at night.

“I have a very good reason for doing so,” said the bird. “It was once when I was singing in the daytime that a fowler was attracted by my voice. He set his nets for me and caught me. Since then, I have never sung except by night.” The bat replied, “It is no use your doing that now when you are a prisoner. If only you had done so before you were caught, you might still have been free.”

As your financial advisor, one of my most important responsibilities is to help you do now what people in the future will wish they had done earlier. That includes preparing for more market volatility.

By reviewing your portfolio, your goals, your current vulnerability to risk, and your overall finances, we can do what needs to be done now rather than waiting until it’s too late. We can plan for the future before the future becomes the present. We can take precautions before the next market crisis. Please fill the questionnaire out and return it to me as soon as possible. By doing this, we can determine:

• Whether it’s time to focus on preserving your money over growing your money.

• Whether you currently own investments not under my management that are unsuitable for your financial goals – especially with more volatility knocking on the door.

• How the recent volatility may be affecting you and what we can do about it.

Market volatility is on the rise. By taking suitable precautions with your money, you’ll find that it’s always there to support you.

Because, after all… Precautions are useless after a crisis.

As always, thank you for your business! We look forward to hearing from you soon.

Me and You. True Love. Be Mine.

People have been giving candy hearts with little messages on them for Valentine’s Day for over 100 years. But most likely not this year. A new company purchased the rights to the sweets but announced they would not have enough time to make them for this Valentine’s Day.1

For the first time in over a century, everyone will have to celebrate Valentine’s without the day’s most popular candy.2

A crisis? Not really. When I saw the news circulating on the internet, it got me pondering about something called The Five Love Languages. You see, there’s a theory that every person expresses and experiences love in different “languages”. To put it simply, each of us has our own preferred way of receiving love from others.

For example, some people feel the most loved when they hear words of gratitude and affirmation.

You inspire me.

I love you.

Thank you.

Others feel the most loved when they receive acts of service.

Breakfast in bed.

Folding the laundry.

Watching the kids so he/she can sleep in.

Some feel most loved when they receive gifts.

That new book they’ve been wanting to read.

Flowers.

Their favorite chocolate.

Others simply want to spend quality time with their spouse or partner.

Conversation.

Date night!

A weekend away at a B&B.

For the rest, there’s no stronger sign of love than physical touch.

A passionate kiss.

A long hug.

A tender massage.

First proposed in 1995 by author Gary Chapman, the theory has inspired many people to practice expressing love for their partner in the way that means the most to them. But here’s the amazing thing. Whichever love language you or your significant other prefers, they all have something in common: They are all so easy to speak!

That’s the thing about true love: It doesn’t take much to express it!

How difficult is it to tell someone you love them every day?

How much time does it take to do the dishes?

How much effort does it require to spend an intimate evening with the person who means more to you than anyone else?

The answer: Not difficult/Not much time/Not much effort at all.

Most of the time, we make a big deal about the pageantry and traditions of Valentine’s Day, when really, the day is simply an opportunity. An opportunity to do something, give something, or say something in a way that means the most to the person who matters the most.

And that’s why Valentine’s Day doesn’t need candy hearts. Because, in the end: Candy hearts take months to make, but connecting hearts takes only seconds or minutes.

On behalf of everyone at Research Financial Strategies, I wish you and yours a lovely Valentine’s Day!

1 “America’s favorite Valentine’s Day candy is unavailable this year,” CNBC, January 23, 2019. https://www.cnbc.com/2019/01/23/americas-favorite-valentines-day-candy-is-unavailable-this-year.html

2 “Most Popular Valentine’s Candy by State,” CandyStore.com, January 17, 2019. https://www.candystore.com/blog/holidays/valentines-candy-popular-states/

3 “The Five Love Languages,” Wikipedia, https://en.wikipedia.org/wiki/The_Five_Love_Languages