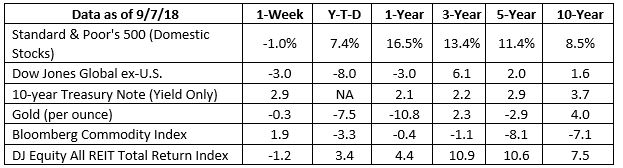

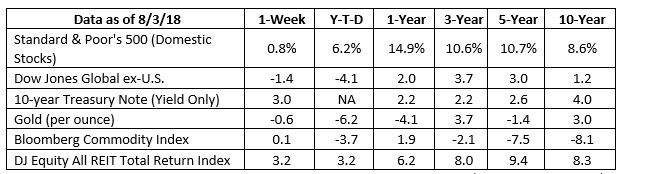

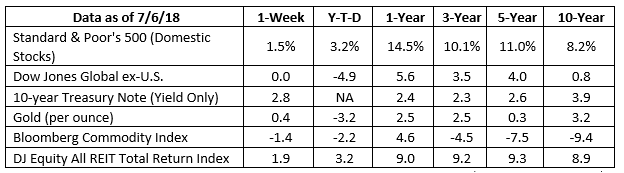

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

There’s a carbon dioxide (CO2) shortage. really, it’s true. Many people agree the world has too much CO2. It’s the reason representatives from countries around the world signed the Paris Climate Agreement. They committed to “adopt green energy sources, cut down on climate change emissions, and limit the rise of global temperatures,” reported National Public Radio. The effort has been less successful than many had hoped, according to the International Energy Association (IEA). After several years without increases, energy-related emission rose by 1.4 percent in 2017. That’s the rough equivalent of putting 170 million more cars on the road, reported Scientific American. Emissions rose primarily in Asia, although the European Union (EU) saw increases, too. The biggest decline was in the United States. There’s a certain irony there, since President Trump announced he would withdraw from the agreement in June 2017, reported The Washington Post. Despite realizing a 1.5 percent increase in emissions, the EU is experiencing a shortage of food-grade CO2. The Economist reported: “Food-grade CO2 is a vital ingredient: it puts the fizz in carbonated drinks and beer, knocks out animals before slaughter and, as one of the gases inside packaging, delays meat and salad from going off. A shortage of the stuff has therefore created havoc in food makers’ supply chains.” The EU’s food-grade CO2 is a harvested by-product of processes for making ammonia and other chemicals, reported The Economist. Three of Britain’s five ammonia plants have been closed because farmers are using less fertilizer, and CO2 does not deliver enough revenue to keep the plants running. Let’s hope the shortage of CO2 doesn’t affect the supply of beverages available to World Cup fans.

Weekly Focus – Think About It

“My garden is an honest place. Every tree and every vine are incapable of concealment, and tell after two or three months exactly what sort of treatment they have had. The sower may mistake and sow his peas crookedly; the peas make no mistake, but come up and show his line.”

–Ralph Waldo Emerson

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

http://www.aaii.com/sentimentsurvey

http://www.aaii.com/sentimentsurvey/sent_results

https://www.nytimes.com/2018/04/02/business/stock-markets-technology-trade.html

https://www.cnbc.com/2018/06/08/gdp-for-second-quarter-on-track-to-double-2018-full-year-pace-of-2017.html

https://insight.factset.com/earnings-insight-q118-by-the-numbers-infographic

https://www.npr.org/sections/thetwo-way/2017/06/01/531048986/so-what-exactly-is-in-the-paris-climate-accord

https://www.iea.org/geco/emissions/

https://www.scientificamerican.com/article/global-co2-emissions-rise-after-paris-climate-agreement-signed/

https://www.washingtonpost.com/news/energy-environment/wp/2018/06/01/trump-withdrew-from-the-paris-climate-plan-a-year-ago-heres-what-has-changed/?noredirect=on&utm_term=.c673c6f445ec

https://www.economist.com/business/2018/07/05/shortages-of-carbon-dioxide-in-europe-may-get-worse

https://books.google.com/books?id=YvyUAwAAQBAJ&printsec=frontcover&dq=The+heart+of+emerson%27s+journals&hl=en&sa=X&ved=0ahUKEwinmq3P2IrcAhXJx4MKHcu1DcoQ6AEIKTAA#v=onepage&q=The%20heart%20of%20emerson’s%20journals&f=false