Weekly Market Commentary – July 30, 2018

Is it a sugar rush or something more sustainable?

Economic growth in the United States was strong during the second quarter. Gross domestic product (GDP), which is the value of all goods and services produced in the United States, grew by 4.1 percent. That’s the fastest growth in four years, reported the BBC.

The news was received with varying levels of enthusiasm. President Trump said the gain is “an economic turnaround of historic importance” and thinks the economy should continue to grow rapidly, reported Shawn Donnan in Financial Times.

Economists were less certain. They think second quarter’s GDP gains were underpinned by one-time factors. These included high levels of profitability attributable to last year’s corporate tax cuts and an increase in exports as U.S. producers and their buyers abroad tried to avoid upcoming tariffs, reported Financial Times.

Another consideration is the business cycle. The business cycle tracks the rise and fall of a country’s productivity over time. The U.S. appears to be in the latter stages of the current cycle. John Authers of Financial Times explained: “…President Donald Trump’s self-congratulation yesterday was fully merited. Things are going according to plan. This business cycle looks ever more like a normal one, which is a fantastic and welcome development after an epochal crisis and then a decade of doldrums…The advent of a normal cycle is itself a problem because a normal cycle terminates with high interest rates and declining growth. The president has voiced his disapproval of these things, but they are the logical and sensible consequence of the economic developments that are now unfolding.”

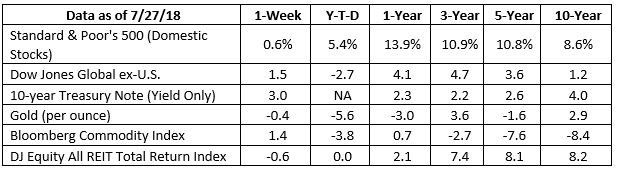

In the United States, the Dow Jones Industrial Average and the Standard & Poor’s 500 Index moved higher while the NASDAQ Composite gave up some ground.

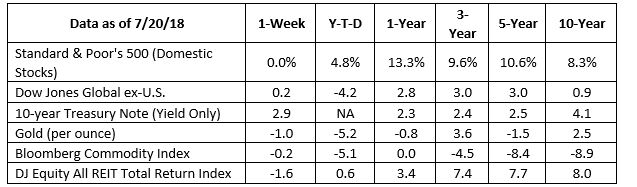

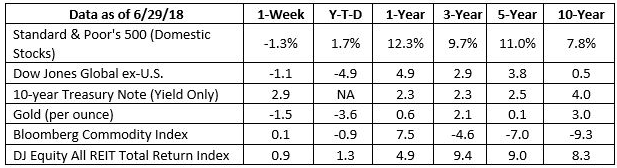

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

it’s camping season! In 1869, the first recreational camping guide, Adventures in Wilderness, was authored by minister William H.H. Murray and became a bestseller. The book’s success may have owed something to a new train route that made the Adirondacks more accessible. Time.com reported his practical guide offered advice on important topics: “For sleeping, he describes how to make ‘a bed of balsam-boughs.’ On what to wear, he suggests bringing a ‘felt hat,’ ‘stout pantaloons,’ and a ‘rubber blanket or coat.’ For warding off woodchucks, ‘a stick, a piece of bark, or tin plate shied in the direction of the noise will scatter them like cats.’ As for wolves, his technique would likely not pass muster with fire wardens: ‘touch a match to an old stump and in two hours there will not be a wolf within ten miles of you.’”

His book inspired Kate Field to try camping, and she became an early advocate of land preservation. She wrote for the Adirondack Almanac in 1870. A more recent article in the publication reported: “Field advised her readers to bring a tent rather than kill trees. ‘It is cruel to stab a tree to the heart merely to secure a small strip of bark,’ she said. ‘It is ungrateful to destroy the pine and balsam that have given us our beds of boughs, and fanned us with their vital breath. Let there be tents.’”

Additional advice can be found in Civil War veteran John M. Gould’s 1877 guide to backpacking, titled How To Camp Out. He warned against the allure of new gear: “Do not be in a hurry to spend money on new inventions. Every year there is put upon the market some patent knapsack, folding stove, cooking-utensil, or camp trunk and cot combined; and there are always for sale patent knives, forks, and spoons all in one…Let them all alone: carry your pocket-knife…”

He might have been willing to make an exception for some of the gear available today!

Weekly Focus – Think About It

“Camping is nature’s way of promoting the motel business.”

–Dave Barry, Humorist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in

the subject.

Sources:

https://www.bbc.co.uk/news/business-44979607

https://www.ft.com/content/fe50168c-9197-11e8-b639-7680cedcc421

https://www.investopedia.com/terms/b/businesscycle.asp

https://www.ft.com/content/a3d6a03a-91a2-11e8-b639-7680cedcc421

http://www.barrons.com/mdc/public/page/9_3063-economicCalendar.html (Click on “U.S. & Intl Recaps”, then on “Geopolitical nerves”)

http://time.com/5343675/history-of-camping/

https://www.adirondackalmanack.com/2014/03/babe-woods-kate-field-adirondack-preservation.html

https://archive.org/stream/howtocampout17575gut/17575.txt

https://www.brainyquote.com/quotes/dave_barry_128131?src=t_camping