Pandemics – Protests – Wildfires – Market Crashes – Recession

If someone ever tries to tell the story of 2020 on film, it will take more movies than Star Wars. At one point, we even had to worry about murder hornets. Murder hornets! There’s no question this year has been a crazy one. But it’s about to get even crazier. After all, a new presidential election is only a week away.

Over the last few weeks, several clients have asked me what the election could mean for the markets. At a time when there is so much uncertainty to deal with, the thought of adding an election to the mix can seem overwhelming. So, I thought I’d write about how we should prepare for both the run-up and aftermath of the election.

What exactly does the upcoming election mean for the markets?

Short-Term View: Prepare for Volatility

Uncertainty: That’s the key word. Investors hate it, the year has been full of it, and the lead-up to a presidential election just brings more of it. As a result, the markets often see increased turbulence just before an election. For example, in October of the last four presidential election years, the markets fell.1 I don’t ever try to predict the future, but we should be especially prepared for volatility this year. That’s because there are still so many question marks surrounding our economy and the pandemic.

Pandemic. It is showing no signs of stopping, and indeed cases may climb again as winter sets in. The economy has improved, but is still on thin ice, with unemployment rates still stubbornly high. Investors are watching Congress with bated breath, waiting to see whether they’ll enact a new stimulus package. If not, that could spell trouble, as many economists believe more stimulus is needed for the economy to recover.

Election Turmoil. There’s another reason why we should prepare for volatility: The possibility of delayed—or worse, disputed—election results. Thanks to the pandemic, more people are likely to vote by mail than ever before. Mail-in ballots take longer to count than traditional ones, and some states “will count ballots that are delivered after the election if they are postmarked by a deadline.”2 Because election officials are more concerned with counting votes correctly than quickly, we may not have a winner declared for several days or even weeks. In fact, earlier this year, during primary season, several states needed more than a week before they could declare a winner.

Remember 2000? If the losing candidate feels there are grounds to contest the results, that could delay the process even further, leading to—you guessed it—more uncertainty and thus more volatility. We don’t have to look far back in history to see what the markets did the last time results were delayed. Remember the drama surrounding the 2000 election? On election night, Florida’s results were considered too close to call. Over the next month, Americans learned more than they ever wanted about things like dimpled chads and butterfly ballots. The S&P 500, meanwhile, dropped over 8% between election day and December 15 when the result was finally decided.3

Now, none of this is to say that pre- and post-election volatility is guaranteed. It’s not. We should, however, prepare ourselves for it. Because the more mentally prepared we are to weather short-term uncertainty, the better equipped we are to remember…

The Long-Term View: Follow the Indicators of the Market

Every four years, I hear people say, “If the Democrats/Republicans win, I’m going to sell (or buy) because that means the markets will fall (or rise).” It’s understandable why people think this way. After all, politics play an increasingly large role in our daily lives. Why wouldn’t they impact our portfolio, too? But the truth is, presidential elections are relatively unimportant when it comes to the markets, at least in the long-term.

A quick look at history bears this out. Historically, the S&P 500 has gone up 10.8% under Democratic presidents and 5.6% under Republican presidents.4 That’s not a large difference and can be attributed to a whole range of factors besides politics.

Either way, the markets tend to go up over time. One thing I’ve noted in recent years is that as elections get more partisan, so too does the rhetoric about how the candidates will impact the markets. For example, here’s the opening sentence from a CNBC article published on November 3, 2016, shortly before the election:

Wall Street’s long-running view that Hillary Clinton would easily become the next president has been replaced by a new fear that Donald Trump could win, and it probably won’t be a pretty picture for stocks if he does.5

Here’s a snippet from an article in the New York Post written a few months before Barack Obama was first elected:

…it’s hard to see how a President Obama would be good for Wall Street. He wants to raise the capital-gains tax…[which] would be great for the tax-shelter business, but stocks would tank…in other words, the markets could fall further from their already-beaten down levels once the street begins to focus on an Obama presidency.6

Both these predictions ended up being wide of the mark. In the first year of President Obama’s presidency, the markets rose 23.45%.7 In President Trump’s first year, the markets gained 19.42%.8

Doom and gloom is predicted more and more with each election. Yet the markets keep going up over time. This is exactly why, overall, we are long-term investors.

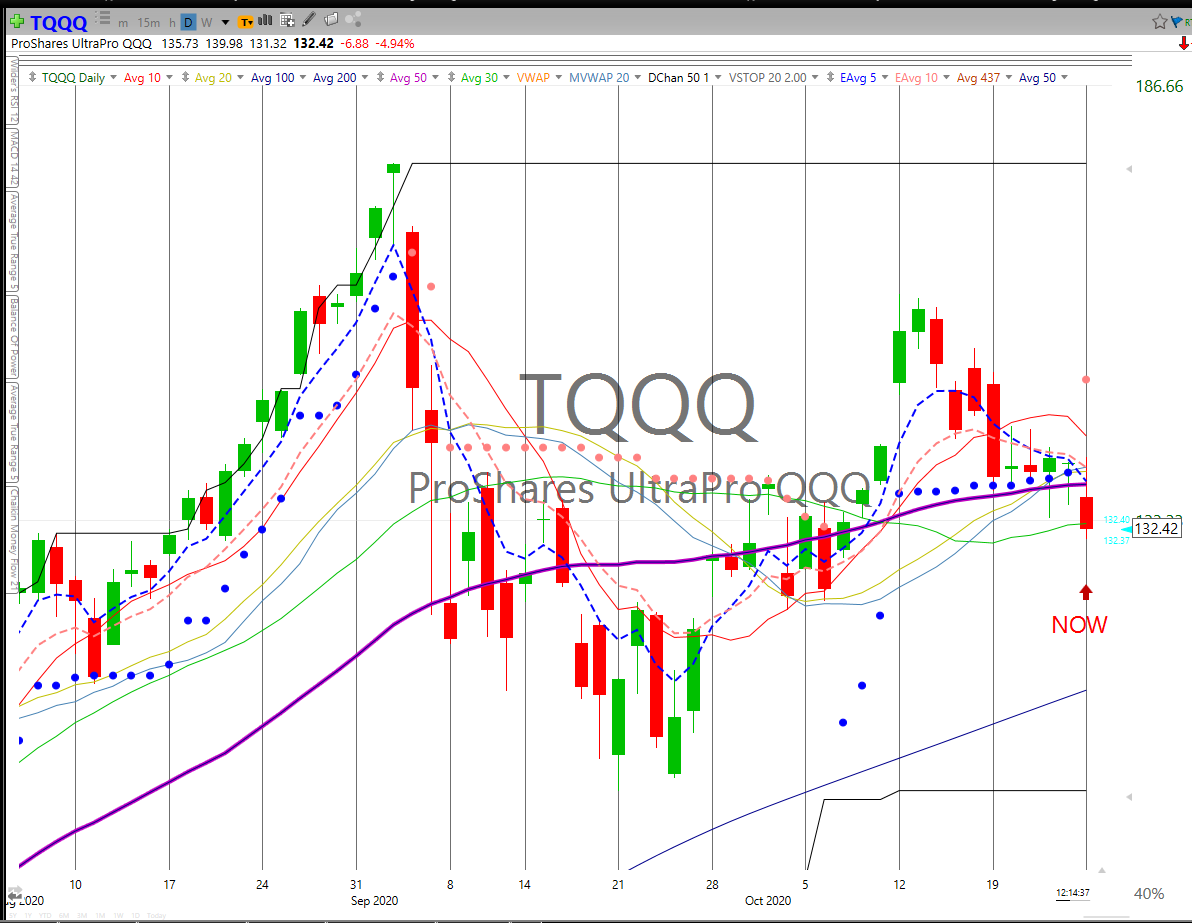

But we will not sit by and watch your assets deteriorate. As usual, we’ll be watching our indicators like a hawk, and when we see trouble brewing, we will act. On the 22nd, for example, a signal alerted us to weakness developing in our TQQQ position (an ETF, based on the Nasdaq’s top 100 companies, we hold in our growth-oriented portfolios). We sold that position and now wait for further evidence of weakness, at which time we’ll take on defensive positions and lighten up on long positions.

As a rule, we like to keep politics out of your portfolio and instead focus on our technical indicators. It’s true that Trump and Biden have different economic policies, and some of their policies will affect the markets to a degree. But the markets reflect millions of investment decisions by millions of investors. The president is just one ingredient. Far more important are supply and demand, innovation and invention, mergers and acquisitions, the ebb and tide of trade, and a host of other economic developments both large and small.

Making major investment decisions based on politics alone makes little sense. Instead, we’ll make our decisions based on what the market has to say.

So, what does the election mean for the markets? In the short-term, potentially a lot. In the long term, probably not much.

After Trump and Biden Are Gone

2020 has been a long, crazy year. It’s possible the next few months could be even crazier. But in the grand scheme of things, they are still just a few months, and this is still just one year. We’ll be investing long after Trump and Biden are both names in the history books.

In the meantime, always remember that my team and I are here for you. We’re happy to review your portfolio, answer your questions, and address your concerns.

Thank you for the trust you’ve placed in us, and please let us know if we can ever be of service. Be well, stay safe, and enjoy the rest of your year!

Most Popular Financial Stories

EVs―The Next Big Thing

EVs―The Next Big ThingAn Interesting EmailWe recently received an interesting email from a reader of our RFS website. Katie Griffin is a Senior Communications Specialist at...

Inflation Is Trending Lower. Now What?

The December inflation report had some encouraging news. It showed that consumer prices trended lower for the month, but more importantly, it confirmed that overall prices...

Happy Thanksgiving

Thanksgiving is a time to appreciate what we value most, a time to cherish the many gifts we have, and the people that make life special. We can also be thankful that we...

Veterans Day 2022

Join us in honoring Veterans Day and recognizing the deeply appreciated service of the U.S. military.

The World’s Chip Crisis

This is the most important article you will read this year. It is the details behind what we wrote about in Tuesday’s email. China wants Taiwan. Not to “reunite with the...

Market Update

Yesterday the RFS investment committee made the tough decision to sell your “short” positions, SQQQ and SPXS. So far it is working. You're probably wondering what has...

Sources

1 “S&P 500 Historical Prices,” The Wall Street Journal, https://www.wsj.com/market-data/quotes/index/SPX/historical-prices

2 “When Will We Know the 2020 Presidential Election Results? A Guide to Possible Delays,” The Wall Street Journal, https://www.wsj.com/articles/will-we-know-who-is-elected-president-on-election-night-a-guide-to-possible-delays-11596629410

3 “Why stock market investors are starting to freak out about the 2020 election,” MarketWatch. https://www.marketwatch.com/story/why-stock-market-investors-are-starting-to-freak-out-about-the-2020-election-11600964863

4 “Democratic presidents are better for the stock market and economy than Republicans, one study shows,” Business Insider. https://markets.businessinsider.com/news/stocks/stock-market-election-democratic-republican-presidents-better-performanceeconomy-gdp-2020-8-1029528932#

5 “This is what could happen not the stock market if Donald Trump wins,” CNBC. https://www.cnbc.com/2016/11/02/this-is-whatcould-happen-to-the-stock-market-if-donald-trump-wins.html

6 “Wall St. Death Wish,” The New York Post. https://nypost.com/2008/08/04/wall-st-death-wish/\

7 https://tickertape.tdameritrade.com/investing/can-election-predict-market-performance-15555

8 “S&P 500 Historical Annual Returns,” Macrotrends, https://www.macrotrends.net/2526/sp-500-historical-annual-returns

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

Most Popular Financial Stories

EVs―The Next Big Thing

EVs―The Next Big ThingAn Interesting EmailWe recently received an interesting email from a reader of our RFS website. Katie Griffin is a Senior Communications Specialist at...

Inflation Is Trending Lower. Now What?

The December inflation report had some encouraging news. It showed that consumer prices trended lower for the month, but more importantly, it confirmed that overall prices...

Happy Thanksgiving

Thanksgiving is a time to appreciate what we value most, a time to cherish the many gifts we have, and the people that make life special. We can also be thankful that we...

Veterans Day 2022

Join us in honoring Veterans Day and recognizing the deeply appreciated service of the U.S. military.

The World’s Chip Crisis

This is the most important article you will read this year. It is the details behind what we wrote about in Tuesday’s email. China wants Taiwan. Not to “reunite with the...

Market Update

Yesterday the RFS investment committee made the tough decision to sell your “short” positions, SQQQ and SPXS. So far it is working. You're probably wondering what has...

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Investment advice offered through Research Financial Strategies, a registered investment advisor.