From trade wars to impeachment inquiries, investors had a lot to ponder during the third quarter. Toward the end of September, they appeared to become more cautious, although it’s difficult to say which issues weighed most heavily. Here are a few questions they may have been asking:

Is recession looming closer?

While there are signs of slower economic growth – including last week’s weakening economic data – the chance of the economy moving into a recession during the next 12 months remained relatively low, according to the New York Federal Reserve. It put the probability of recession by August 2020 at 38 percent. In other words, the likelihood there would not be a recession was 62 percent.

“We would recommend a little less focus on the ‘recession on/off’ debate and position on a slowdown thesis,” suggested a research director cited by Barron’s.

Will the United States-China trade war end?

The ongoing and escalating trade war with China created an environment of uncertainty for American businesses during the third quarter of 2019. Lack of clarity could slow economic growth. The Economist reported,

“In boardrooms across America, business people are scrambling to assess the impact of the latest escalation in the commercial confrontation between the two superpowers…Most companies make plans over a five- to ten-year horizon and invest in assets with a life of 10-20 years. But with each new tariff announcement, the rules for trading their products become less stable.”

Investors remain concerned about the potential impact of trade on global growth, too. Last week, the World Trade Organization downgraded its forecast for global trade growth in 2019 and 2020, reported the Washington Post.

How much risk do I want to take?

The prospect of slower growth at home and abroad appears to have affected investors’ appetite for risk. This was apparent late in the third quarter when some highly anticipated initial public offerings (IPOs) were delayed. (IPOs occur when private companies offer shares of stock to the public.) [5] Yahoo!Finance explained, “…the recent IPO run is telling us that retail investors (you, a regular person) and institutional investors…are becoming less interested in taking on that risk. If it was once appealing to buy shares in a hot tech name that isn’t yet making money and won’t necessarily make money for a long time, it isn’t very appealing anymore.”

What is the bond market trying to tell us?

Around the world, about $17 trillion worth of bonds are offering negative yields. The number grew by $3.1 trillion in August, reported the Financial Times (FT). Governments in Europe and Japan are the primary issuers of bonds offering yields below zero. However about $1 trillion of corporate bonds have negative yields, too.”

“US dollar-denominated debt accounts for roughly 90 percent of all bonds that still have a positive yield, according to Bank of America,” wrote FT, which also pointed out that real Treasury yields, which are yields minus inflation, have edged into negative territory.

Will the impeachment inquiry affect stock markets?

The impeachment inquiry is unlikely to overshadow key economic indicators, but it increases uncertainty and that won’t help companies or investors. Yahoo!Finance cited strategists at JP Morgan Chase who wrote,

“Despite the drama this process will inject into the rest of the President’s first term, there is little justification for altering asset allocation now, unless one thinks that this issue is the decisive one that tips the US economy into sub-trend growth and/or a profits recession…To us, impeachment more seems yet another constraint on returns over the next year, given the newer uncertainties created around international and domestic policy.”

You know what they say: Markets hate uncertainty. As a result, markets may remain volatile for some time.

SMALL THINGS CAN CHANGE THE WORLD.

A Planet Money staffer asked a couple of Harvard professors what small things they would do to improve the world. These two ideas are counterintuitive, but backed by science.

- Sign forms at the top rather than the bottom. Signing at the top focuses the mind on the importance of honesty, said Business Professor Francesca Gino. In one study with 13,000 participants, people who signed at the top of an insurance form were more truthful about how many miles they drove.

- Have one line at supermarkets. In banks, a single line leads to all cash registers. Health Economics Professor Kate Baicker said it should work that way at supermarkets, too. “There’s a whole branch of operations research that goes back, like, a hundred years about how to get throughput most efficiently through a system. If we all wait in one line, the average wait time is the same, but the variance goes away. Nobody wins, nobody loses.”

If you could, what small change would you make in the world?

Weekly Focus – Think About It

“Act as if what you do makes a difference. It does.”

— William James, Philosopher and psychologist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

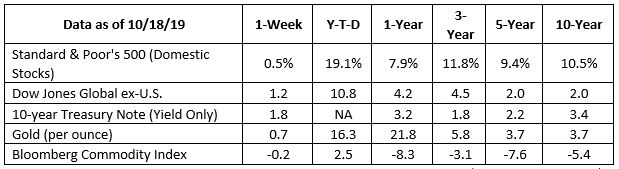

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Year-End Tax Tips That Will Trim Your Tax Bill

December 31 is an essential deadline for taxpayers who want to lower their tax bill and build up their savings. There is no better time than now to start to make...

The Three Key Challenges of Retirement

Planning for your retirement can be challenging. It can be scary, and it can be frustrating. I have seen many clients who felt their plan was a disaster waiting...

Social Security Increases Benefits by 2.8% for 2019

The pay raise for Social Security recipients is the largest since 2012, and over 67 million Americans will see the increase in their payments beginning in...

End of Year Financial Tips

I guess I do not have to remind you that the end of the year is quickly approaching? Holiday lights are popping up around the neighborhood and retailers are...

What is Thanksgiving?

Thanksgiving has always been about being thankful for what you have. Even before it was set as an official holiday, it was a centuries-old tradition to have a...

Breaking down what could affect the markets in the months ahead

“A player surprised is a player half-beaten.” – Chess Proverb The World Chess Championship is currently being played in London, and for the first time in...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.newyorkfed.org/medialibrary/media/research/capital_markets/Prob_Rec.pdf

https://www.barrons.com/articles/dow-jones-industrial-average-battles-back-as-recession-fears-recede-51570238255?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-07-19_The_Dow_Was_Getting_Whacked_Until_It_Wasn’t._Here’s+Why_2.pdf)

https://www.economist.com/finance-and-economics/2019/08/15/the-trade-war-is-leading-some-firms-to-crimp-investment (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-07-19_The_Trade_War_is_Leading_some_firms_to_crimp_investment_3.pdf)

https://www.washingtonpost.com/business/2019/10/01/wto-cuts-forecast-global-trade-growth-amid-us-china-dispute-broader-economic-slowdown/

https://finance.yahoo.com/news/whats-really-behind-the-ipo-unicorn-funeral-142210130.html

https://www.ft.com/content/4e030886-ca97-11e9-af46-b09e8bfe60c0 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-07-19_How_Markets_Become_Curiouser_And_Curiouser_in_August_6.pdf)

https://finance.yahoo.com/news/trump-impeachment-inquiry-means-for-stock-market-125702464.html

https://www.npr.org/2015/07/22/425377064/planet-money-asks-what-small-thing-would-you-do-to-improve-the-world

https://www.goodhousekeeping.com/health/wellness/g2401/inspirational-quotes/?slide=1