Last week was like an overstuffed suitcase that busts open on the baggage carousel. A lot was unpacked in a surprising and disorderly fashion.

There was some positive news for investors who prioritize fundamentals. Third quarter’s earnings season – the period of time when companies let investors know how they performed during the previous quarter – got off to a strong start.

Fifteen percent of companies in the Standard & Poor’s 500 Index have reported so far and 84 percent had earnings that beat analysts’ expectations. FactSet said better than expected earnings from companies in the Healthcare and Financials sectors balanced the weaker performance of companies in the Energy sector.

There was some negative economic news, too.

In the United States, retail sales declined in September. It was the first monthly decline since February, reported MarketWatch, and analysts had expected an increase.

In China, gross domestic product growth was 6 percent year-over-year, the slowest growth rate since the 1990s, reported Reuters.

On the geopolitical front, The Wall Street Journal reported U.S. and European investors were cheered by news that Britain and the European Union (EU) had reached an agreement under which Britain could amicably exit the EU. That optimism was dashed on Saturday when Parliament withheld approval of the deal until all supporting legislation has been passed, reported The Washington Post.

The world was also rocked by Turkey’s invasion of Syria.

At the end of the week, the Standard & Poor’s 500 Index and Nasdaq Composite had held onto gains while the Dow Jones Industrials finished lower.

It’s that time again. During the past few weeks, Nobel Prize winners have been announced as well as Ig Nobel Prize winners. The Igs are awarded for improbable research that makes people laugh and then think. A lucky few have won both Ig Nobel and Nobel prizes.

The honorees at the Ig Nobel ceremony received their awards from “a group of genuine, genuinely bemused Nobel Laureates, in Harvard’s historic and largest theater.” This year’s winners included:

- Medicine: Cancer researcher Silvano Gallus and associates researched and wrote the paper, Does Pizza Protect Against Cancer? They received the Ig Nobel for “collecting evidence that pizza might protect against illness and death, if the pizza is made and eaten in Italy.”

- Biology: A group of researchers from the School of Physical and Mathematical Sciences at Nanyang Technological University in Singapore were recognized for “discovering that dead magnetized cockroaches behave differently than living magnetized cockroaches.”

- Engineering: Iman Farahbakhsh of Iran was recognized for patenting an infant diaper changer and washer. The patent explained, “…once the infant is placed inside the apparatus, various steps may in some cases be carried out automatically without needing the operator to touch the infant or interact manually with the diaper or infant during the changing process…”

- Economics: Father and son, Timothy and Andreas Voss, and their associates received an Ig Nobel for “testing which country’s paper money is best at transmitting dangerous bacteria.”

Other winners explored the pleasure of scratching an itch (Peace Prize), the volume of saliva produced daily by a five-year-old child (Chemistry Prize), and whether holding a pen in your mouth increases happiness (Psychology Prize).

Weekly Focus – Think About It

“There is nothing in the world so irresistibly contagious as laughter and good humor.”

–Charles Dickens, English author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

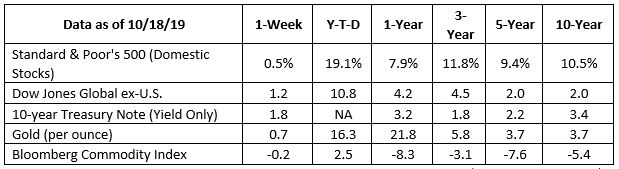

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

A.I. Is Everywhere

If you've heard CEOs mention "A.I." multiple times during second-quarter conference calls or on the news, you're not imagining it. There have been an astounding 1,072...

Happy Independence Day

The Fourth of July is just ahead – a chance for us all to get together and celebrate what makes America so special. As Americans, we have the liberty to act, speak, think,...

Wishing You a Happy Father’s Day

Let’s hear it for the dads, the ones who help us grow, give us guidance, and look out for us in a million different ways. In celebration of Father’s Day, here are some of...

The Cost of Procrastination

Some of us share a common experience. You're driving along when a police cruiser pulls up behind you with its lights flashing. You pull over, the officer gets out, and your...

This Memorial Day…

Memorial Day is a time for Americans to honor and remember those who lost their lives while serving in the armed forces. Veterans will think back on the men and women who...

Schwab’s State of Health

Are you concerned about the potential banking crisis? We are happy to announce that Schwab, our custodian for the majority of our investment accounts, is in great shape and...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://insight.factset.com/sp-500-earnings-season-update-october-18-2019 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-21-19_FactSet-S_and_P_500_Earnings_Season_Update_October_18_2019-Footnote_1.pdf)

https://www.marketwatch.com/story/us-retail-sales-snap-6-month-winning-streak-in-september-as-receipts-fall-03-2019-10-16

https://www.reuters.com/article/us-china-economy-gdp/chinas-gdp-growth-grinds-to-near-30-year-low-as-tariffs-hit-production-idUSKBN1WX05A

https://www.wsj.com/articles/pound-dips-as-brexit-talks-hit-a-roadblock-11571303767 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-21-19_WSJ-Stocks_Climb_on_Strong_Earnings_Brexit_Deal-Footnote_4.pdf)

https://www.washingtonpost.com/world/europe/boris-johnson-faces-historic-brexit-vote-in-parliament/2019/10/19/dba7cc70-f1a8-11e9-bb7e-d2026ee0c199_story.html

https://www.barrons.com/articles/dow-jones-industrial-average-ends-week-lower-as-boeing-ibm-bruise-benchmark-51571443912?mod=hp_DAY_4 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/10-21-19_Barrons-The_Dow_Found_a_Way_to_Waste_a_Perfectly_Good_Week-Footnote_6.pdf)

https://www.improbable.com/whatis/

https://www.improbable.com/ig-about/2019-ceremony/

https://www.improbable.com/ig-about/winners/#ig2019

https://onlinelibrary.wiley.com/doi/full/10.1002/ijc.11382

https://www.nature.com/articles/s41598-018-23005-1

https://patentimages.storage.googleapis.com/e1/ed/d0/6cb8dd7a5c6a96/US20170143168A1.pdf (In the Summary 0006)

https://www.goodreads.com/quotes/tag/laughter