They did it.

The Federal Reserve lowered interest rates last week, as expected. There were no enthusiastic fans singing the Baby Shark song, but the Federal Open Market Committee’s decision was well received.

Reuters reported, “Gaps between market expectations and the Fed’s own outlook have been wide at times this year, a source of concern for policymakers who don’t want to kowtow to markets, but also don’t want to surprise or disrupt them. But, the two are now roughly in line with the idea that the Fed is on hold and the economy continuing to chug along, a fact highlighted by data showing 128,000 jobs were created in October…”

Last week’s unemployment report was full of good news. It reported job gains and moderate pay increases, according to Barron’s, but there was a counterintuitive twist. The unemployment rate increased even though the economy added new jobs. That was good news, too, because it meant more people are returning to the workforce.

The only bad news was found in manufacturing. The October ISM manufacturing index ticked higher, but remains in contraction territory. CNBC reported, “Manufacturing has been at the heart of the economy’s sluggishness, with a drop in business investment a big reason for the third quarter’s sluggish 1.9 percent [economic] growth pace.”

Barron’s attributed softness in manufacturing to the ongoing U.S.-China trade war.

By the end of the day on Friday, the Standard & Poor’s 500 Index had closed at a record high three times in five days. The Nasdaq Composite also reached a record high.

What will we do with Parking garages? As the popularity of ride-sharing services and personal transportation options (like scooters and bicycles) grows, the need for cars in urban areas may diminish.

The arrival of autonomous vehicles could reduce demand even further.

Pew Research explained, “By 2030, 15 percent of new cars sold will be totally autonomous, according to one estimate. One in 10 will be shared. And, as it becomes easier for people to summon shared or autonomous cars when they need them, fewer people will want to own their own vehicle, meaning fewer cars overall.”

So, what’s going to happen to all of the parking garages?

There are a lot of interesting ideas about how parking garages might be repurposed. Some companies plan to reserve the spaces for autonomous vehicles. Others are remodeling garages to accommodate businesses and services.

For example, one company is buying properties with the intention of turning them into “commercial kitchens for delivery-only restaurants and other consumer services.” Other possibilities include:

- Recreational areas

- Gyms

- Movie theaters

- E-commerce distribution centers

- Flood protection areas

- Urban farms

- Apartment buildings

The co-CEO of an architecture and design firm told Axios News, “An obvious and functional challenge we face is that these structures were not originally designed for human habitation. These spaces often require us to raise the floor height, level the floors between ramps and incorporate design techniques that bring natural light into the space.”

Redeveloping parking garages may be challenging and costly, but it could create opportunities for investors.

Weekly Focus – Think About It

“Before you become too entranced with gorgeous gadgets and mesmerizing video displays, let me remind you that information is not knowledge, knowledge is not wisdom, and wisdom is not foresight. Each grows out of the other, and we need them all.”

–Arthur C. Clarke, Science fiction writer and futurist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

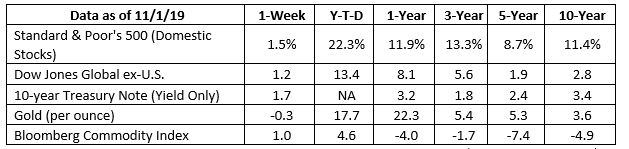

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

The World’s Chip Crisis

This is the most important article you will read this year. It is the details behind what we wrote about in Tuesday’s email. China wants Taiwan. Not to “reunite with the...

Market Update

Yesterday the RFS investment committee made the tough decision to sell your “short” positions, SQQQ and SPXS. So far it is working. You're probably wondering what has...

Bitcoin – There’s No There There

The Big Guys Move InOn September 13, 2022, the biggest of the big guys on Wall Street came out with a rather earth-shaking announcement. None other than Fidelity, Citadel...

Thoughts On The Market

The market’s having a trying month. Fortunately, we are attuned to the economic reports that are coming out daily and will safeguard your portfolios by adjusting...

Uh Oh! Signs of Danger Ahead

It Was the Best of Times ….On Friday the 26th, we locked in a big win.Nine days earlier, on Wednesday the 17th, as a protective shield, we purchased a large...

Pinching Pennies, Pensions, and 401k’s

Tough TimesWhen times get rough, the natural human urge becomes one of extreme frugality. Certainly those who survived the Great Depression developed...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.reuters.com/article/us-usa-fed/after-year-long-bumpy-ride-fed-appears-to-make-soft-landing-idUSKBN1XB4DD

https://www.barrons.com/articles/what-the-perfect-jobs-report-means-51572627916 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-04-19_Barrons-This_Perfect_Jobs_Report_Looks_Like_a_Game-Changer-Footnote_2.pdf)

https://www.cnbc.com/2019/10/31/jobs-numbers-out-friday-but-another-report-could-be-more-important.html

https://www.reuters.com/article/us-usa-stocks/sp-500-nasdaq-set-records-on-jobs-data-trade-headway-idUSKBN1XB3ZD

https://www.axios.com/the-future-of-parking-near-and-far-2c91eec1-32ef-4347-bd6a-fe1c91aad657.html

https://www.pewtrusts.org/en/research-and-analysis/blogs/stateline/2017/12/12/why-downtown-parking-garages-may-be-headed-for-extinction

https://www.axios.com/newsletters/axios-cities-3c36bdfc-2b64-4926-85c9-a58a4369058f.html

https://www.goodreads.com/quotes/tag/technology