How strong is the United States economy?

That’s the question investors were mulling after last week’s jobs report.

More jobs were created in May than economists expected, and the labor force participation rate rose, meaning even more people are returning to work. Overall, the unemployment rate remained at 3.6 percent. However, unemployment rates varied by age, sex and race:

- Adult men: 4 percent

- Adult women: 4 percent

- Asian: 4 percent

- Black: 2 percent

- Hispanic: 3 percent

- White: 2 percent

- Teenagers: 4 percent

From an inflation perspective, there was some good news in the employment report as earnings increased at a slower pace than in previous months. Apart from that bit of good news, “More jobs added and higher wages are signs of a strong economy…the concern is that inflation will remain close to its recent peak,” reported Joel Woelfel and Jacob Sonenshine of Barron’s.

Some pointed to layoffs at technology companies as a sign the economy might be weakening. However, as Randall Forsyth of Barron’s reported:

“…16,800 pink slips were handed out last month by 66 technology companies, the most since May 2020 at the depth of the pandemic…Many of those cuts came from outfits with much promise, but no profits, that burned through copious amounts of cash bestowed by a once-ebullient equity market.”

Investors who hoped the Fed would ease up were disappointed by the strength of the employment report. The data reinforced expectations that the Federal Reserve will continue to tighten monetary policy, causing the economy to cool down and inflationary forces to recede, reported Barron’s.

Bond markets appear to agree that the Fed will have to work harder to tame inflation. The U.S. Treasury yield curve moved higher as rates on all maturities of U.S. Treasuries marched higher during the week. That also suggests recession concerns may be overblown, reported Ben Levisohn of Barron’s.

Major U.S. stock indices moved lower last week.

|

Data as of 6/3/22 |

1-Week |

Y-T-D |

1-Year |

3-Year |

5-Year |

10-Year |

|

Standard & Poor’s 500 Index |

-1.2% |

-13.8% |

-2.0% |

14.4% |

11.0% |

12.4% |

|

Dow Jones Global ex-U.S. Index |

0.4 |

-13.0 |

-15.9 |

3.8 |

1.7 |

4.3 |

|

10-year Treasury Note (yield only) |

3.0 |

N/A |

1.6 |

2.1 |

2.2 |

1.5 |

|

Gold (per ounce) |

-0.4 |

1.4 |

-1.2 |

11.9 |

7.6 |

1.2 |

|

Bloomberg Commodity Index |

0.0 |

34.9 |

43.5 |

20.0 |

10.3 |

0.5 |

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

WHAT’S WRONG WITH THIS PICTURE? Consumers are feeling more pessimistic than they have in a decade. The University of Michigan Consumer Sentiment Survey shows that sentiment has been sliding lower all year. In May, consumer sentiment was down 10.4 percent from April and 29.6 percent year-over-year. Surveys of Consumers Director Joanne Hsu explained:

“This recent drop [in sentiment] was largely driven by continued negative views on current buying conditions for houses and durables, as well as consumers’ future outlook for the economy, primarily due to concerns over inflation.”

One reason analysts keep an eye on consumer sentiment is that it helps predict what will happen to consumer spending. In theory, when consumers are optimistic, spending should increase and when they are pessimistic, spending should decline.

That’s not what happened this year, though.

Despite high levels of pessimism, inflation-adjusted consumer spending has increased every month in 2022, supported by solid wage gains and abundant savings. Here’s the month-by-month rundown:

- January +1.5 percent from the preceding month

- February +0.1 percent from the preceding month

- March +0.5 percent from the preceding month

- April +0.7 percent from the preceding month

Consumer spending includes everything we buy: furniture, cars, clothing, food, shelter, fuel, healthcare, education – you get the idea. It is the primary driver behind the American economy, comprising about 70 percent of economic growth (as measured by gross domestic product or GDP).

It’s possible that consumers are less pessimistic than the Consumer Sentiment survey suggests. Hsu wrote, “Less than one quarter of consumers expected to be worse off financially a year from now. Looking into the long term, a majority of consumers expected their financial situation to improve over the next five years; this share is essentially unchanged during 2022. A stable outlook for personal finances may currently support consumer spending.”

So, consumers are pessimistic – and they also seem to be optimistic. It’s an interesting conundrum.

Weekly Focus – Think About It

“The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function.”

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

Most Popular Financial Stories

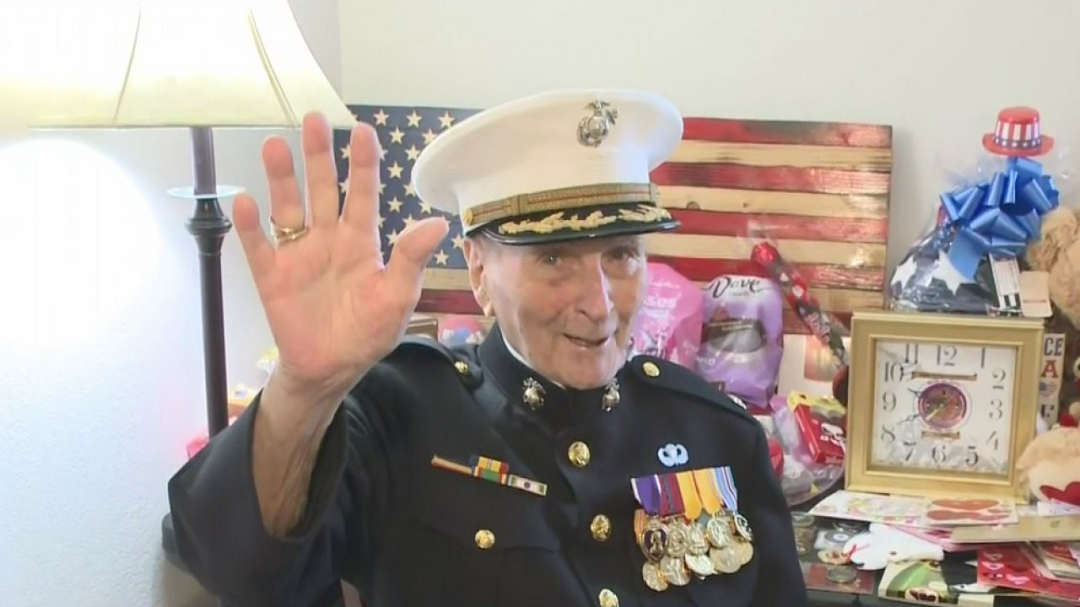

Father’s Day Tribute

Father's Day Tribute June is the month for Father’s Day — but it’s also the month for family vacations and road trips! Whenever I plan a vacation with my...

John Dough’s Investment Strategy

John Dough’s Investment Strategy Buy and Hold Back in the late 1990s, John Dough had it all figured out. He had worked for the same government agency for more...

Memorial Day Thoughts

Memorial Day Thoughts When I was young, I remember asking my parents why we observe Memorial Day. While some people use it mainly as a chance to throw a backyard...

Stimulus Bill Analysis

The New Stimulus Bill President Biden just signed another stimulus bill, aimed to help those affected by the virus (and to deal with a few other matters found in...

Trending Now-2021-S&P Hits 4000

milestone (noun)1 a stone functioning as a milepost 2. a significant event or stage in the life, progress, development, or the like of a person, nation, etc. The...

End Of Week Market Update

End Of Week Market Update One year. It seems incredible, but it’s been one year since COVID-19 struck our shores. One year since the World Health Organization...

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

Sources:

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.barrons.com/articles/stock-market-today-51654175140?mod=Searchresults (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-06-22_Barrons_The%20Dow%20Dropped%20After%20the%20Jobs%20Report_2.pdf)

https://www.barrons.com/articles/stock-market-rebound-51654296872?mod=Searchresults (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-06-22_Barrons_The%20Jobs%20Report%20is%20Bad%20News%20for%20Anyone%20Betting%20on%20a%20Less-Aggressive%20Fed_3.pdf)

https://www.barrons.com/articles/the-jobs-report-is-bad-news-for-anyone-betting-on-a-less-aggressive-fed-51654268950

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2022

https://www.barrons.com/articles/stock-market-dow-nasdaq-sp500-51654306153?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-06-22_Barrons_The%20Stock%20Market%20is%20Charting%20a%20New%20Course_6.pdf)

https://www.cnbc.com/2022/06/02/stock-market-futures-open-to-close-news.html

http://www.sca.isr.umich.edu (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-06-22_Survey%20of%20Consumers_Final%20Results%20for%20May_8.pdf)

https://data.sca.isr.umich.edu/fetchdoc.php?docid=69956

https://www.richmondfed.org/~/media/richmondfedorg/publications/research/economic_quarterly/2003/fall/pdf/mehra.pdf

https://www.bea.gov/sites/default/files/2022-05/pi0422.pdf

https://fred.stlouisfed.org/series/DPCERE1Q156NBEA

https://www.goodreads.com/quotes/64918-the-test-of-a-first-rate-intelligence-is-the-ability-to