Ahh, the power of distraction.

On Friday, the unemployment report flashed its numbers like a hair model in a shampoo commercial. The Bureau of Labor Statistics reported 266,000 new jobs were created in November. That was better than expected even after deducting the 40,000-plus General Motors employees returning to work, reported CNBC.

The sign of economic strength helped major U.S. stock indices recover from losses suffered earlier in the week – mostly.

The week got off to a rough start when President Trump indicated there was little urgency to resolving the trade dispute with China. The statement upset expectations a phase one trade deal would be completed before December 15. That’s the date the United States is scheduled to put additional tariffs on Chinese consumer goods. New tariffs could inspire additional actions by the Chinese government that affect economic growth in the United States.

To date, U.S. economic growth has slowed from 3.1 percent in the first quarter of 2019 to 1.9 percent in the third quarter.

The slowdown was caused, in part, by Chinese tariffs on American products. Tariffs have had a negative effect on manufacturing and agriculture, as well as other sectors of the market. Trade uncertainty also has led to a decline in business investment. When business investment drops so does the economy’s growth potential. The main engine behind U.S. economic growth has been and remains the American people. Consumer spending accounted for 68 percent of U.S. economic growth in the third quarter.

The Standard & Poor’s 500 Index finished the week in positive territory. The Dow Jones Industrial Average and Nasdaq Composite finished down 0.1 percent.

The evolving etiquette of social media.

Social media etiquette makes remembering when to use the little fork on the right – you know, the one next to the two knives and spoon (the oyster fork) – seem like a snap.

When social media platforms were gaining popularity, they offered an opportunity to reconnect and stay in touch with friends and family. During the past decade, many people joined platforms and built networks. They also started to engage in some unwelcome behaviors. Sometimes, social media is a place where people: “…can say mean things without showing their face, discriminate with little consequence, and spill details nobody truly wants to hear,” explained Influence.co. “…it’s vital for people to remember that social media is meant to bring people together and that our online behavior can quickly come between us.”

To make it easier to understand which behaviors these are, the organization conducted a survey. The top digital don’ts included:

- Bullying others in comments (91.1 percent)

- Sharing discriminatory content (89.2 percent)

- Posting fake news (88.8 percent)

- Making passive-aggressive posts (78.5 percent)

- Oversharing personal details (77.4 percent)

- Complaining about a partner (75.8 percent)

- Giving medical advice (48.3 percent)

- Excessive hashtag use (33.8 percent)

It’s also a poor idea to post content about another person without their permission. One in 10 respondents had ended a friendship over it. Finally, many people find it irritating when asked to delay eating a meal so a dinner companion can photograph it.

It’s food for thought.

Weekly Focus – Think About It

“One of the big no-no’s in cyberspace is that you do not go into a social activity, a chat group, or something like that, and start advertising or selling things. This etiquette rule is an attempt to separate one’s social life, which should be pure enjoyment and relaxation, from the pressures of work.”

–Judith Martin, a.k.a. Miss Manners, Etiquette authority

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

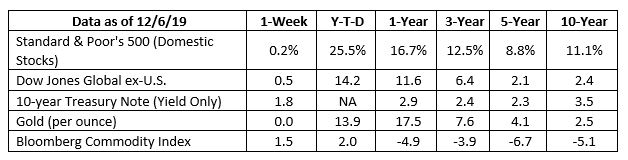

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Three financial principles our fathers taught us

It’s June, and that means Father’s Day! As you know, Father’s Day is a chance to tell our dads how much we love and appreciate them. A chance to say “thanks”...

Red Flags for Tax Auditors

No one wants to see an Internal Revenue Service (IRS) auditor show up at his or her door. The IRS can’t audit every American’s tax return, so it relies on...

Don’t Forget To Include Your Pets In Your Home Evacuation Plan

Many homeowners will form evacuation plans for their homes and practice them with family members, but most have failed to include their pets. An evacuation plan...

Memorial Day – 75th D-Day Anniversary

Normandy. D-Day. Operation Overlord. The events of June 6, 1944 are known by many names, and have been commemorated in countless books, dramas, and...

Examining the cause and effect of the new tariffs between the U.S. and China

After months of relative quiet, the trade war between the U.S. and China has erupted again in a big way. The markets are the most immediate casualty, with the Dow plunging...

Have you been watching the markets lately?

Bear Or Bull Market...Which Is It? “We are now in a bear market – here’s what that means.” – CNBC headline on December 24, 20181 “The stock market rally to start...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.cnbc.com/2019/12/06/us-nonfarm-payrolls-november-2019.html

https://www.barrons.com/articles/dow-jones-industrial-average-ends-week-lower-despite-strong-jobs-report-51575684786?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-09-19_Barrons-The_Jobs_Numbers_were_Great-The_Dow_Still_Finished_Down_for_the_Week-Footnote_3.pdf)

https://www.marketwatch.com/story/did-trump-talk-bluster-or-was-he-hinting-that-china-talks-collapse-either-way-stock-futures-slump-2019-12-03

https://apps.bea.gov/scb/2019/11-november/pdf/1119-gdp-economy.pdf

https://www.bea.gov/news/2019/gross-domestic-product-1st-quarter-2019-advance-estimate

https://www.npr.org/2019/12/06/785280703/how-hard-are-tariffs-hitting-the-economy-it-depends-on-who-you-ask

https://fred.stlouisfed.org/series/W790RC1Q027SBEA

https://www3.nd.edu/~cwilber/econ504/504book/outln11b.html

https://emilypost.com/advice/formal-place-setting/

https://influence.co/go/content/social-media-etiquette.htm

https://www.brainyquote.com/quotes/judith_martin_581570?src=t_etiquette