2019 will be a hard act to follow.

Investors may find themselves reluctant to ring out the old and ring in the new this week. During 2019, stock and bond markets delivered exceptional returns.

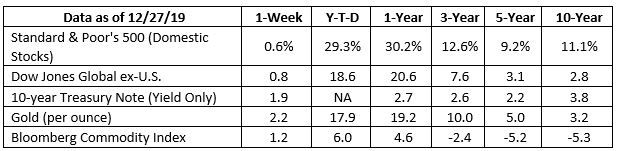

Ben Levisohn of Barron’s reported the Dow Jones Industrial Average was up 23 percent at the end of last week, the Standard & Poor’s (S&P) 500 Index had gained 29 percent, and the Nasdaq Composite was up 36 percent. The S&P 500 and Dow both closed at all-time highs.

Bond indices showed gains in the United States and around the world. The Bloomberg Barclays U.S. Aggregate Total Return Index was up 8.87 percent at the end of last week. Its global counterpart, the Bloomberg Barclays Global Aggregate Total Return Index, was up 6.63 percent for the same period.

After a year like 2019, when stock indices delivered exceptional returns, investors’ perceptions about their appetite for risk can change. Great market performance has a way of persuading people their tolerance for risk is higher than it has been in the past. The phenomenon has something to do with recency bias, which is a tendency to remember and weight recent events more heavily than past events.

In other words, during bull markets some people tend to forget about bear markets.

2019 was a wonderful year, but not every year will be like 2019. At the end of last week, the average annual return for the S&P 500 Index over the last 60 years, with dividends reinvested, was about 9.5 percent.

The fact that 2020 may not be like 2019 does not mean it’s time to sell. Successful financial plans and investment strategies should include well-diversified portfolios that are grounded in the investor’s life and financial goals. Every strategy and portfolio should be reviewed periodically and modified when goals have changed, a major life event has occurred, or the investor’s risk tolerance has changed.

If you would like to talk about your strategy and review your portfolio allocations, give us a call. We’d like to hear from you.

The holidays are almost over.

Ahh, the season of good cheer and regifting is coming to an end. Before we head into 2020, the Ohio Department of Transportation deserves a holiday salute for promoting safe driving with holiday humor. About 130 highway message boards across the state offered communications like these:

- Life is fra-gee-lay. Drive safe.

- Stay to the right. Santa needs the left lane tonight.

- If your relatives make you drink, don’t drive.

- Can I refill your eggnog, Eddie? — Clark

- Deck the halls/ No phone calls/ Fa la la la la

- Drop the phone. We triple dog dare you.

Weekly Focus – Think About It

“I hope that in this year to come, you make mistakes. Because if you are making mistakes, then you are making new things, trying new things, learning, living, pushing yourself, changing yourself, changing your world. You’re doing things you’ve never done before, and, more importantly, you’re doing something.

So that’s my wish for you, and all of us, and my wish for myself. Make new mistakes. Make glorious, amazing mistakes. Make mistakes nobody’s ever made before. Don’t freeze, don’t stop, don’t worry that it isn’t good enough, or it isn’t perfect, whatever it is: art, or love, or work, or family, or life.

Whatever it is you’re scared of doing, do it.

Make your mistakes, next year and forever.”

–Neil Gaiman, Author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Special Message

Look! Have You Noticed? Listen to any politician or any news commentator these days, and they always begin a discussion or answer a question like this: Look, when I served...

Special Market Update

Inflation is proving to be far more tenacious than financial markets had hoped.The idea that inflation peaked in March was put to rest last week when the...

Special Message

Bonds CAN’T Fall Any Lower… Or Can They?What once was considered a “safe” investment has taken a drubbing in 2022. As of yesterday (June 06, 2022) the AGG (US...

Memorial Day

Friends,Memorial Day is a time for Americans to honor and remember those who lost their lives while serving in the armed forces. Veterans will think back on the...

Signs on the Horizon

A Strange World All around us we see the same thing: weirdness. According to a client of mine, a McDonald’s on Interstate 81 posted a sign in the window: Apply...

Important Market Update

Dear friends and clients,You’ve heard about it on the news, you’ve felt it at the grocery store and at the gas pump, you’re having to deal with it every day. It...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/dow-jones-industrial-average-closes-at-record-high-good-luck-next-year-51577491993?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-30-19_Barrons-The_Dow_is_Closing_Out_2019_with_a_Bang-Good_Luck_in_2020-Footnote_1.pdf)

https://www.bloomberg.com/quote/LBUSTRUU:IND (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-30-19_Bloomberg-US_Aggregate_Total_Return_Value_Unhedged_USD-Footnote_2.pdf)

https://www.bloomberg.com/quote/LEGATRUU:IND (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-30-19_Bloomberg-Global_Aggregate_Total_Return_Index_Value_Unhedged_USD-Footnote_3.pdf)

https://bucks.blogs.nytimes.com/2012/02/13/tomorrows-market-probably-wont-look-anything-like-today/

https://dqydj.com/sp-500-historical-return-calculator/ (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-30-19_DQYDJ-S_and_P_500_Historical_Return_Results-Footnote_5.pdf)

https://www.news5cleveland.com/news/state/santa-needs-the-left-lane-tonight-odot-promotes-safe-driving-with-holiday-inspired-signs

http://www.dot.state.oh.us/news/Pages/Christmas-2019-Messages.aspx

https://www.goodreads.com/quotes/tag/new-year