It’s a shopping revolution!

Sometime, probably not so long ago, comedian Dave Barry wrote, “Once again, we come to the Holiday Season, a deeply religious time that each of us observes, in his own way, by going to the mall of his choice.”

Not so much anymore.

On Black Friday 2019, many shoppers didn’t venture any farther than their favorite digital device. CNBC reported, “The pullback in brick-and-mortar stores mirrored a surge in Black Friday online shopping, which hit $7.4 billion, an all-time record for the day, according to Adobe Analytics.” There was some good news for brick-and-mortar stores. In-store sales on Thanksgiving Day were up 2.3 percent from a year ago.

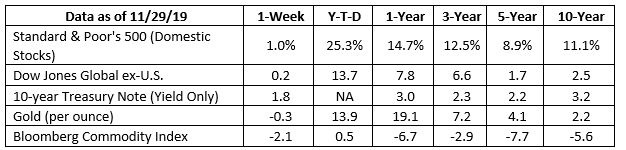

Despite relatively strong retail sales, overall, major stock indices in the United States dipped on Friday for reasons unrelated to evolving business models in the retail industry. Indices trended lower for the same reason they have on numerous occasions this year: Investors were worried about a setback in U.S.-China trade talks. Barron’s explained: “The Dow Jones Industrial Average, the S&P 500 index, and the Nasdaq Composite dipped on the final day of a boffo November. U.S. legislation supporting Hong Kong’s pro-democracy protesters, to which Beijing reacted furiously, dampened hopes that the highly anticipated phase-one trade deal with China would be inked soon.”

Despite losses on Friday, major U.S. indices were up for the week and the month, reported The Wall Street Journal. In November, U.S. stocks posted the strongest monthly performance since June.

U.S. government bonds have been delivering positive returns, too. Interest rates on 30-year Treasuries have fallen over the course of the year and were down again last week. When bond rates fall, bond prices move higher. When bond rates begin to move higher, prices will fall.

It’s remarkable when stock and bond markets move in the same direction at the same time. Often, strong performance in one market is accompanied by weaker performance in the other.

What makes a billionaire a billionaire?

During the five years through the end of 2018, the population of billionaires around the globe increased by 350 people to 2,101. The wealth of billionaires grew, too. After a 4.3 percent loss overall in 2018, billionaires’ wealth increased by 34.5 percent during the past five years.

According to The Billionaire Effect, which was released by UBS and PWC last month, three specific personality traits explain the success of many billionaires. It seems the typical exceptionally rich person is a smart risk-taker, focused on business, and determined to succeed. If that describes someone you know who has not yet reached billionaire status, perhaps it’s the industry. The only field where billionaire wealth increased during 2018 was Technology.

Women are becoming billionaires at a faster rate than men (46 percent versus 39 percent during the past five years), although there are still significantly fewer women (233) among the superrich.

Most of these exceptionally wealthy folks are found in Asia and the Americas:

- There are 754 billionaires in the Asia Pacific region with 436 in China.

- There are 749 in the Americas with 652 in North America.

- There are 598 in Emerging Markets, the Middle East, and Africa with 397 in Western Europe and 151 in Eastern Europe.

While personality traits may influence success, what really makes billionaires is the success of their companies. The report stated: “Over the 15 years to the end of 2018, billionaire-controlled companies listed on the equity market returned 17.8 percent versus the 9.1 percent of the MSCI [All Country World Index (ACWI)], almost twice the annualized average performance of the market. Their companies are also more profitable, earning an average return on equity of 16.6 percent over the last 10 years, compared to the 11.3 percent of the MSCI ACWI.”

Weekly Focus – Think About It

“Human greatness does not lie in wealth or power, but in character and goodness. People are just people, and all people have faults and shortcomings, but all of us are born with a basic goodness.”

–Anne Frank, Diarist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

The World’s Chip Crisis

This is the most important article you will read this year. It is the details behind what we wrote about in Tuesday’s email. China wants Taiwan. Not to “reunite with the...

Market Update

Yesterday the RFS investment committee made the tough decision to sell your “short” positions, SQQQ and SPXS. So far it is working. You're probably wondering what has...

Bitcoin – There’s No There There

The Big Guys Move InOn September 13, 2022, the biggest of the big guys on Wall Street came out with a rather earth-shaking announcement. None other than Fidelity, Citadel...

Thoughts On The Market

The market’s having a trying month. Fortunately, we are attuned to the economic reports that are coming out daily and will safeguard your portfolios by adjusting...

Uh Oh! Signs of Danger Ahead

It Was the Best of Times ….On Friday the 26th, we locked in a big win.Nine days earlier, on Wednesday the 17th, as a protective shield, we purchased a large...

Pinching Pennies, Pensions, and 401k’s

Tough TimesWhen times get rough, the natural human urge becomes one of extreme frugality. Certainly those who survived the Great Depression developed...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.davebarry.com/misccol/christmas.htm

https://www.cnbc.com/2019/11/30/black-friday-shopping-at-brick-and-mortar-stores-dropped-by-6percent.html

https://www.barrons.com/articles/the-next-best-stocks-to-buy-could-be-small-caps-51575071290?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-02-19_Barrons-The_Stock_Markets_Next_Breakout_Stars-Footnote_3.pdf)

https://www.wsj.com/articles/stocks-edge-down-ahead-of-start-to-u-s-shopping-season-11575023295 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-02-19_WSJ-US_Stocks_Notch_Best_Month_Since_June-Footnote_4.pdf)

https://www.marketwatch.com/investing/bond/tmubmusd30y?countrycode=bx&mod=md_bond_overview_quote (Choose 5-year and YTD time periods at top of chart)

https://www.investopedia.com/ask/answers/why-interest-rates-have-inverse-relationship-bond-prices/

https://www.cnbc.com/2019/06/26/in-a-rare-occurrence-both-stock-and-bonds-are-having-a-great-year.html

https://www.ubs.com/global/en/wealth-management/uhnw/billionaires-report.html (For the number of billionaires, click on ‘By year’ and choose 2014 and 2018. For the quote, click on download report and go to page 6) (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-02-19_UBS-Billionaires_Insights-Footnote_8.pdf)

https://www.brainyquote.com/quotes/anne_frank_752405?src=t_wealth