Don’t let volatility get you down.

Last week was the 40th anniversary of BusinessWeek’s infamous cover headline: ‘The Death of Equities: How inflation is destroying the stock market.’ The publication’s current iteration, Bloomberg Businessweek, reported it is still getting grief over the headline and subsequent bull market. In its defense, stocks trended lower for about three years after the magazine hit newsstands.

Since its 1982 low point, “The total return on the Standard & Poor’s 500-stock index…with dividends reinvested has been nearly 7,000 percent. Not bad for a corpse.”

Investors worried back in 1979, just as they do today.

At that time, the Federal Reserve was waging a war against inflation. Late in the summer of 1979, the annual average inflation rate in the United States was 10 percent. Homebuyers were locking in mortgage rates of 11.1 percent on 30-year fixed mortgages and feeling good about it as mortgage rates rose to 18.5 percent by October 1981.

Today, investors aren’t worried about inflation. They are concerned about the U.S.- China trade war, the pace of global economic growth, the influence of monetary policy, negative interest rates…the list goes on.

Recent stock market volatility reflects those concerns.

It’s possible we’re nearing the end of the longest bull market for U.S. stocks. Further inversion of the yield curve last week suggested recession could be ahead. However, it’s unlikely to arrive immediately.

If a recession does arrive, remember economic downturns are temporary and are relatively short. The Great Recession lasted 18 months and it was the longest since WWII. Typically, a recession averages six to 16 months, according to the Minneapolis Federal Reserve.

Right now, there is reason to believe the U.S. economy still has some oomph. Barron’s reported, “The economy is obviously slowing, but not necessarily heading for recession. That means it is time for caution, not panic.”

Upcycling is modern day alchemy. When people take items that have been discarded and turn them into something of greater value, it’s known as upcycling. Repurposing objects is appealing to people who want to live sustainably, people who embrace creativity, and/or people who like to make things…it’s got a lot of appeal for a lot of people.

Here are a few interesting upcycling projects you may encounter as you travel:

Bird Calls Phone. A Maryland city wanted an interactive public art exhibit. The artist took a mint-condition payphone and wired it to play calls of local birds when dialed. (Takoma Park, MD)

People’s Bike Library of Portland. It’s an iconic sculpture that is a tribute to the popularity of cycling, as well as a bike rack and a bike ‘lending library.’ (Portland, OR)

Carhenge. It’s built to resemble Stonehenge, but there is no mystery surrounding Carhenge in western Nebraska. The arrangement of repurposed vintage autos was built in the memory of the designer’s father. (Alliance, NE)

The Heidelberg Project. This project isn’t a single piece of art; it’s an open air urban art environment. The artist and children from the neighborhood decorate vacant houses. Heidelberg Houses have included: Doors of Opportunity, The Taxi House, The Clock House, Obstruction of Justice, and others. (Detroit, MI)

City Museum. A 10-story, 100-year-old shoe factory in St. Louis was transformed into an urban playground using salvaged materials. It features, “a sky-high jungle gym making use of two repurposed airplanes, two towering 10-story slides…a rooftop Ferris wheel,” and more. (St. Louis, MO)

It has been said that art is in the eye of the beholder. It’s also in the portfolios of some investors. The 2018 U.S. Trust Insights on Wealth and Worth® survey found, “…financially driven collectors are increasingly incorporating art into their long-term wealth plans.”

Weekly Focus – Think About It

“Art is something that makes you breathe with a different kind of happiness.”

–Anni Albers, Textile artist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

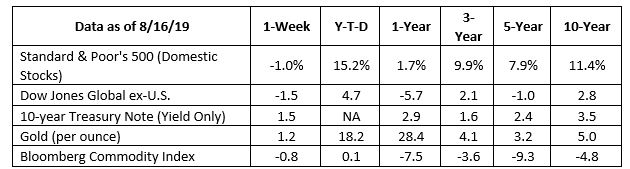

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Stock Pullbacks Are Helpful, Not Hurtful

Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year....

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over?...

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our...

Happy New Year!

Sending you warm thoughts and best wishes for a wonderful new year. May the days ahead be filled with joy, laughter, and prosperity for you and those you hold most dear.

Happy Thanksgiving

Thanksgiving will be here soon. The holiday always gives us a chance to appreciate what we have – friendships, relationships, and a sense of togetherness. These gifts are...

IRS Releases 2025 Tax Brackets

The Internal Revenue Service released the updated income tax brackets, standard deduction, and retirement contribution limits for the 2025 tax year. While these changes...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.bloomberg.com/news/articles/2019-08-13/it-s-been-40-years-since-our-cover-story-declared-the-death-of-equities

U.S. Bureau of Economic Analysis, Personal consumption expenditures excluding food and energy [DPCCRC1M027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis, August 18, 2019: https://fred.stlouisfed.org/series/DPCCRC1M027SBEA (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/08-19-19_FRED-Personal_Consumption_Expenditures_Excluding_Food_and_Energy-Footnote_2.pdf)

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis, August 17, 2019: https://fred.stlouisfed.org/series/MORTGAGE30US (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/08-19-19_FRED-30-Year_Fixed_Rate_Mortgage_Average_in_the_United_States-Footnote_3.pdf)

https://www.reuters.com/article/us-global-economy-centralbanks-analysis/going-negative-as-trade-war-rages-central-banks-ponder-radical-steps-idUSKCN1V328N

https://www.barrons.com/articles/stocks-swing-wildly-as-yield-curve-flips-51566002682?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/08-19-19_Barrons-Stocks_Swing_Wildly_as_Yield_Curve_Flips-Is_There_a_Recession_Out_There-Footnote_5.pdf)

https://www.investopedia.com/ask/answers/08/cause-of-recession.asp

https://www.minneapolisfed.org/publications/special-studies/recession-in-perspective

https://www.merriam-webster.com/dictionary/upcycle

https://www.upi.com/Odd_News/2019/08/16/Maryland-phone-makes-bird-calls-not-phone-calls/6231565970936/

https://thedyrt.com/magazine/lifestyle/5-recycled-art-installations-and-where-to-camp-nearby/

https://thesavvyage.com/heidelberg-project-perseveres/

https://www.thisiscolossal.com/2015/06/city-museum/

https://www.privatebank.bankofamerica.com/articles/insights-on-wealth-and-worth-art-collectors-2018.html

https://www.healing-power-of-art.org/art-and-quotes-by-famous-artists/