“It ain’t over ‘til it’s over.” Words of wisdom from baseball legend Yogi Berra. And words that Fed Chair Jerome Powell has taken to heart.

“Inflation has eased over the past year but remains elevated,” Powell said following the Fed’s June meeting. In other words, “it ain’t over ‘til it’s over.” The Fed wants to see more progress toward the Committee’s 2 percent inflation objective before considering any changes to monetary policy.

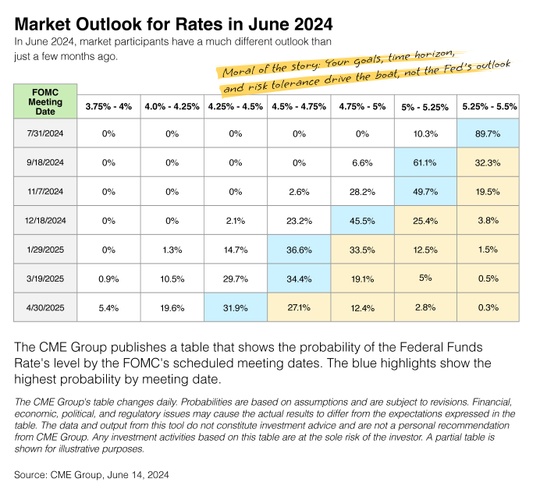

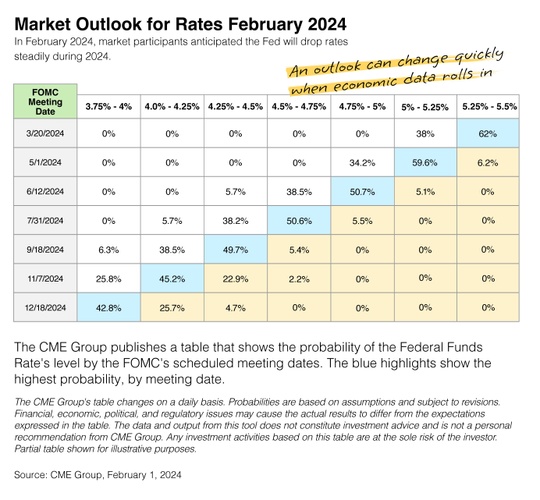

Recall that just a few months ago, the Fed seemed prepared to cut rates three times in 2024. However, an uptick in inflation in Q1 forced them to revise their outlook. At the June meeting, Fed officials anticipate cutting short-term interest rates just once this year.1,2

The Fed’s about-face serves as a good lesson for everyone.

Changes in your goals, time horizon, and risk tolerance should drive portfolio adjustments rather than forecasts and best guesses. The economy changes. Markets shift. And the Federal Reserve will adjust its strategy in response to what’s happening.

When I say “staying the course” and don’t overreact, it’s because I’ve experienced several economic cycles that take longer than expected to resolve. I’ve also seen others take shorter than expected to conclude. So today, I ask myself, “Is the Fed going to stick to its one-cut strategy or update its approach at the next meeting?” Recent history would suggest it’s about a 50/50 chance!

Our strategy isn’t dependent on anything the Fed does–or doesn’t do. Let’s stay the course and remember, “It ain’t over ‘til it’s over.”