Prepare yourself. There is a good chance markets will be volatile in the coming weeks.

Precautions designed to slow the spread of the coronavirus may also slow Chinese economic growth and, by extension, global economic growth.

On Thursday, the World Health Organization declared the coronavirus to be an international health emergency. The U.S. State Department issued a travel advisory for China, and major U.S. airlines suspended flights to the nation, reported Forbes.

In six Chinese provinces, factories and businesses are shuttered until at least February 10. The closures have created issues for global supply chains, and Financial Times reported, “Companies from luxury retailers to airlines and banks are reeling as the disease accelerates.”

Events sparked a bond rally as investors shifted assets into safe haven investments. The Economist wrote that previous viruses have not had lasting effects on economic growth. “Other recent epidemics have reinforced the impression that economists should not be overly worried, so long as good doctors are on the job. Neither avian flu in 2006 nor swine flu in 2009 dimmed the global outlook. Yet even flint-hearted investors are wondering whether the new epidemic might be worse. Stocks in Hong Kong have fallen by nearly 10 percent as reported infections have steadily increased. Tremors have also rippled through global markets.”

China’s government is prepared to step into the breach. On Saturday, Reuters reported, “Chinese authorities have pledged to use various monetary policy tools to ensure liquidity remains reasonably ample and to support firms affected by the virus epidemic…” The Chinese central bank is expected to begin offering support on February 3 before the Chinese stock market reopens for the first time since January 23.

The European Union may also be in need of economic stimulus. Financial Times reported the Eurozone economy came to a virtual standstill (up 0.1 percent) in the fourth quarter and grew just 1.2 percent during 2019. Economies in France and Italy, the second and third largest in the region, both contracted during the fourth quarter.

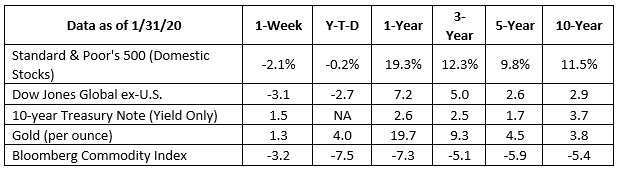

Major U.S. stock indices moved lower last week.

The Things We Do For Pets. While there is some debate about how many American households include pets – The Washington Post reports estimates from the American Pet Products Association are about 11 percent higher than those of the American Veterinary Medical Association – there is little debate about how much people love their pets.

With Valentine’s Day coming up soon, you may be wondering how to show your pet you care. Here are a few ideas:

- Doggie playlists and podcasts. Want to make certain your pup doesn’t get lonely (or into too much trouble) when left at home alone? One major media company is making canine playlists and podcasts. Reuters reported the podcasts feature, “…soothing music, ‘dog-directed praise,’ stories, and messages of affirmation and reassurance narrated by actors to alleviate stress…”

- Video chat or…bark? Wouldn’t it be great to take a break and chat with your pet during lunch hour? One social media user, cited by The Insider, thought so. “I taught my dog to acceptcalls through my laptop at home while I’m at work. Then, we just talk.”

- Travel somewhere fun. Millions of people travel with their pets, according to Forbes. One travel magazine publishes a pet-friendly article each month. The LA Travel Magazine archive includes titles like, ‘TopDawg’ Resorts in the U.S. and The Pawfect Guide to Dog Beaches in SoCal.

- Just don’t supersize it. A pet owner, cited by the Odyssey, occasionally indulges her pets with people food. “When we go out for [fast food] or something, my mom and I buy them each their own burger and sometimes include fries so they can have a meal.”

On Valentine’s Day, remember to do something nice for the people you love, too.

Weekly Focus – Think About It

“The more cats you have, the longer you live. If you have a hundred cats, you’ll live ten times longer than if you have ten. Someday this will be discovered, and people will have a thousand cats and live forever.”

–Charles Bukowski, Poet and novelist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Special content from Jack, very short read!

Uh oh! Signs of a potential financial market correction may be on the horizon: The S&P 500 is down 4% from its all-time high. Investors are showing increased interest in...

Special Edition from Research Financial Strategies

Dear Friends and Clients, This week, a good friend and client brought something significant to my attention. Despite our initial struggles to uncover the full story, my...

The Fed’s Drive To 2% Inflation

February isn't over yet, but the Cleveland Fed has released its projections for a few key economic markers. Why are these markers important? The Fed likes to look at the...

Consumers Expect Better Days Ahead

Many consider the University of Michigan the gold standard for reporting on consumer sentiment and trends. Among its 50 monthly reports, the most well-known is the "UMich...

Wishing You A Happy And Safe Thanksgiving

Thanksgiving is almost here: a time to enjoy friends, family, great food, and maybe a whole lot of football. As we give thanks for what we have received and celebrate the...

Another Successful Kids Charity Golf Tournament!

Lollipop Golf TournamentThanks to everyone for helping us make this another successful event! Clients, advisors and friends always make this one of our favorites each...

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.forbes.com/sites/sergeiklebnikov/2020/01/31/markets-plummet-dow-drops-over-600-points-as-coronavirus-infections-outpace-sars/#5e9264725ddc

https://travel.state.gov/content/travel/en/traveladvisories/traveladvisories/china-travel-advisory.html

https://www.ft.com/content/b8027b84-4514-11ea-aeb3-955839e06441 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-03-20_FinancialTimes-Apple_Shuts_42_China_Retail_Stores_Due_to_Coronavirus-Footnote_3.pdf)

https://www.ft.com/content/f3fcdc5a-4119-11ea-bdb5-169ba7be433d (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-03-20_FinancialTimes-The_Impact_of_Coronavirus_Across_Industry_and_Finance-Footnote_4.pdf)

https://www.economist.com/international/2020/01/30/chinas-coronavirus-semi-quarantine-will-hurt-the-global-economy (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-03-20_TheEconomist-Chinas_Coronavirus_Semi-Quarantine_will_Hurt_the_Global_Economy-Footnote_5.pdf)

https://www.reuters.com/article/us-china-health-cenbank/china-central-bank-to-inject-174-billion-via-reverse-repos-on-february-3-idUSKBN1ZW074

https://www.ft.com/content/f3088ca8-43f9-11ea-abea-0c7a29cd66fe (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-03-20_FinancialTimes-Eurozone_Grows_Just_0.1_Percent_as_France_and_Italy_Shrink-Footnote_7.pdf)

https://www.washingtonpost.com/science/2019/01/31/how-many-americans-have-pets-an-investigation-into-fuzzy-statistics/

https://www.reuters.com/article/us-odd-spotify-dogs/spotify-launches-playlists-for-dogs-left-home-alone-idUSKBN1ZE1D8

https://www.insider.com/ways-people-spoil-their-pets-2018-10#they-taught-their-dog-how-to-facetime-1

https://www.forbes.com/sites/michaelgoldstein/2019/02/22/americans-spending-billions-on-pet-travel-and-boarding/#40c74baa24f7

https://latravelmagazine.com/activities/pet-friendly/

https://www.theodysseyonline.com/14-strangest-things-people-do-with-their-pets

https://www.goodreads.com/work/quotes/44216022-on-cats