So, what comes next?

Last week was a good week for investors. Ben Levisohn of Barron’s explained:

“The Federal Reserve and European Central Bank both pledged to do what they could to underpin their respective economies. The United Kingdom gave Boris Johnson’s Conservative Party a landslide victory, virtually guaranteeing that the Brexit saga will end, finally.”

‘Get Brexit done’ was the slogan of Prime Minister Boris Johnson’s conservative party and British voters confirmed that’s what they want. As a result, Parliament is likely to accept the Prime Minister’s withdrawal agreement. Under current deadlines, the United Kingdom will begin to transition out of the European Union (EU) at the end of January, reported The Economist.

Prime Minister Johnson promised to complete the transition by December 2020 despite skepticism about whether trade agreements can be negotiated and ratified in such a short time. The Economist reported, “…unless Mr. Johnson is ready to ask for an extension, the risk of Britain leaving the EU with no trade deal in place at the end of next year will be significant. The result would be high barriers to exports and severe disruption to trade.”

There was another important event last week. The United States government announced, “…a phase-one deal with China had been completed and that negotiations on phase two would begin immediately. Details were lacking, but it was surely good news,” reported Levisohn.

The Wall Street Journal reported the deal has been agreed to in principle, although nothing has been signed, and neither the United States nor the Chinese government released the text of the agreement or a detailed summary.

The information released indicates the United States cancelled tariffs scheduled to take effect last Sunday and reduced current tariffs on $120 million of Chinese goods. In return, China agreed to increase purchases of agricultural goods over the next two years. The agreement is scheduled to be signed in January.

Let’s hope they ink the deal!

life begins at 40. In 1932, psychologist Walter Pitkin published a self-help book called ‘Life Begins at Forty.’ The Economist summarized his findings like this, “The theory goes that years of hard work are rewarded with less stress and better pay; children begin to fly the nest; and with luck, a decent period of good health remains.”

At the time, the book was something of a revelation. After all, throughout much of the 1800s, life expectancy at birth was about 40. When Pitkin wrote his book, newborn Americans were expected to reach age 60, on average.

It turns out Pitkin was on to something.

The Economist reviewed the findings of the 2019 World Happiness Report, which uses data from the Gallup World Poll. It found people in the United States and around the world generally are happy in their teens and early 20s. By the time they reach their 30s, however, happiness levels have dropped. People begin to recover a more positive state of mind at age 40. For many, by age 70, self-reported happiness is higher than it was in their teens and 20s.

There are differences in self-reported happiness from country to country. For instance, happiness in former Soviet states tends to decline with age. In addition, overall, self-reported happiness in India has declined during the past several years.

So, who are happiest people in the world? American women age 70 and older!

Weekly Focus – Think About It

“I am still every age that I have been. Because I was once a child, I am always a child. Because I was once a searching adolescent, given to moods and ecstasies, these are still part of me, and always will be…Far too many people misunderstand what ‘putting away childish things’ means, and think that forgetting what it is like to think and feel and touch and smell and taste and see and hear like a three-year-old or a thirteen-year-old or a twenty-three-year-old means being grownup. When I’m with these people I, like the kids, feel that if this is what it means to be a grown-up, then I don’t ever want to be one. Instead of which, if I can retain a child’s awareness and joy, and be fifty-one, then I will really learn what it means to be grownup.”

–Madeleine L’Engle, Author and poet

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

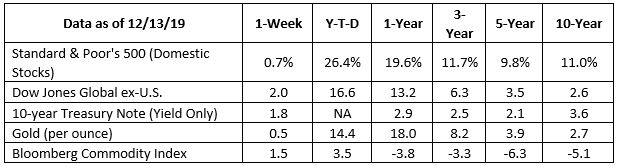

Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Year-End Tax Tips That Will Trim Your Tax Bill

December 31 is an essential deadline for taxpayers who want to lower their tax bill and build up their savings. There is no better time than now to start to make...

The Three Key Challenges of Retirement

Planning for your retirement can be challenging. It can be scary, and it can be frustrating. I have seen many clients who felt their plan was a disaster waiting...

Social Security Increases Benefits by 2.8% for 2019

The pay raise for Social Security recipients is the largest since 2012, and over 67 million Americans will see the increase in their payments beginning in...

End of Year Financial Tips

I guess I do not have to remind you that the end of the year is quickly approaching? Holiday lights are popping up around the neighborhood and retailers are...

What is Thanksgiving?

Thanksgiving has always been about being thankful for what you have. Even before it was set as an official holiday, it was a centuries-old tradition to have a...

Breaking down what could affect the markets in the months ahead

“A player surprised is a player half-beaten.” – Chess Proverb The World Chess Championship is currently being played in London, and for the first time in...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/lots-went-right-for-investors-this-week-the-dow-still-ended-friday-on-a-flat-note-51576282633?mod=hp_DAY_4 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-16-19_Barrons-Lots_Went_Right_for_Investors_this_Week-The_Dow_Still_Ended_Friday_on_a_Flat_Note-Footnote_1.pdf)

https://www.economist.com/britain/2019/12/13/boris-johnsons-big-win?cid1=cust/ednew/n/bl/n/2019/12/13n/owned/n/n/nwl/n/n/NA/360436/n (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-16-19_TheEconomist-Boris_Johnsons_Big_Win-Footnote_2.pdf)

https://www.wsj.com/articles/us-china-confirm-reaching-phase-one-trade-deal-11576234325 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-16-19_WSJ-US_China_Agree_to_Limited_Deal_to_Halt_Trade_War-Footnote_3.pdf)

https://www.amazon.com/Life-Begins-Forty-Walter-Pitkin/dp/B00085JNB4

https://www.economist.com/graphic-detail/2019/04/12/do-people-become-happier-after-40 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-16-19_TheEconomist-Do_People_Become_Happier_After_40-Footnote_5.pdf)

https://www.infoplease.com/us/mortality/life-expectancy-age-1850-2011

https://www.thecut.com/2014/09/25-famous-women-on-aging.html