No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

So, what comes next?

Last week was a good week for investors. Ben Levisohn of Barron’s explained:

“The Federal Reserve and European Central Bank both pledged to do what they could to underpin their respective economies. The United Kingdom gave Boris Johnson’s Conservative Party a landslide victory, virtually guaranteeing that the Brexit saga will end, finally.”

‘Get Brexit done’ was the slogan of Prime Minister Boris Johnson’s conservative party and British voters confirmed that’s what they want. As a result, Parliament is likely to accept the Prime Minister’s withdrawal agreement. Under current deadlines, the United Kingdom will begin to transition out of the European Union (EU) at the end of January, reported The Economist.

Prime Minister Johnson promised to complete the transition by December 2020 despite skepticism about whether trade agreements can be negotiated and ratified in such a short time. The Economist reported, “…unless Mr. Johnson is ready to ask for an extension, the risk of Britain leaving the EU with no trade deal in place at the end of next year will be significant. The result would be high barriers to exports and severe disruption to trade.”

There was another important event last week. The United States government announced, “…a phase-one deal with China had been completed and that negotiations on phase two would begin immediately. Details were lacking, but it was surely good news,” reported Levisohn.

The Wall Street Journal reported the deal has been agreed to in principle, although nothing has been signed, and neither the United States nor the Chinese government released the text of the agreement or a detailed summary.

The information released indicates the United States cancelled tariffs scheduled to take effect last Sunday and reduced current tariffs on $120 million of Chinese goods. In return, China agreed to increase purchases of agricultural goods over the next two years. The agreement is scheduled to be signed in January.

Let’s hope they ink the deal!

life begins at 40. In 1932, psychologist Walter Pitkin published a self-help book called ‘Life Begins at Forty.’ The Economist summarized his findings like this, “The theory goes that years of hard work are rewarded with less stress and better pay; children begin to fly the nest; and with luck, a decent period of good health remains.”

At the time, the book was something of a revelation. After all, throughout much of the 1800s, life expectancy at birth was about 40. When Pitkin wrote his book, newborn Americans were expected to reach age 60, on average.

It turns out Pitkin was on to something.

The Economist reviewed the findings of the 2019 World Happiness Report, which uses data from the Gallup World Poll. It found people in the United States and around the world generally are happy in their teens and early 20s. By the time they reach their 30s, however, happiness levels have dropped. People begin to recover a more positive state of mind at age 40. For many, by age 70, self-reported happiness is higher than it was in their teens and 20s.

There are differences in self-reported happiness from country to country. For instance, happiness in former Soviet states tends to decline with age. In addition, overall, self-reported happiness in India has declined during the past several years.

So, who are happiest people in the world? American women age 70 and older!

Weekly Focus – Think About It

“I am still every age that I have been. Because I was once a child, I am always a child. Because I was once a searching adolescent, given to moods and ecstasies, these are still part of me, and always will be…Far too many people misunderstand what ‘putting away childish things’ means, and think that forgetting what it is like to think and feel and touch and smell and taste and see and hear like a three-year-old or a thirteen-year-old or a twenty-three-year-old means being grownup. When I’m with these people I, like the kids, feel that if this is what it means to be a grown-up, then I don’t ever want to be one. Instead of which, if I can retain a child’s awareness and joy, and be fifty-one, then I will really learn what it means to be grownup.”

–Madeleine L’Engle, Author and poet

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

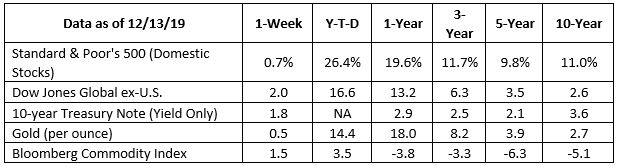

Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/lots-went-right-for-investors-this-week-the-dow-still-ended-friday-on-a-flat-note-51576282633?mod=hp_DAY_4 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-16-19_Barrons-Lots_Went_Right_for_Investors_this_Week-The_Dow_Still_Ended_Friday_on_a_Flat_Note-Footnote_1.pdf)

https://www.economist.com/britain/2019/12/13/boris-johnsons-big-win?cid1=cust/ednew/n/bl/n/2019/12/13n/owned/n/n/nwl/n/n/NA/360436/n (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-16-19_TheEconomist-Boris_Johnsons_Big_Win-Footnote_2.pdf)

https://www.wsj.com/articles/us-china-confirm-reaching-phase-one-trade-deal-11576234325 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-16-19_WSJ-US_China_Agree_to_Limited_Deal_to_Halt_Trade_War-Footnote_3.pdf)

https://www.amazon.com/Life-Begins-Forty-Walter-Pitkin/dp/B00085JNB4

https://www.economist.com/graphic-detail/2019/04/12/do-people-become-happier-after-40 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-16-19_TheEconomist-Do_People_Become_Happier_After_40-Footnote_5.pdf)

https://www.infoplease.com/us/mortality/life-expectancy-age-1850-2011

https://www.thecut.com/2014/09/25-famous-women-on-aging.html

Ahh, the power of distraction.

On Friday, the unemployment report flashed its numbers like a hair model in a shampoo commercial. The Bureau of Labor Statistics reported 266,000 new jobs were created in November. That was better than expected even after deducting the 40,000-plus General Motors employees returning to work, reported CNBC.

The sign of economic strength helped major U.S. stock indices recover from losses suffered earlier in the week – mostly.

The week got off to a rough start when President Trump indicated there was little urgency to resolving the trade dispute with China. The statement upset expectations a phase one trade deal would be completed before December 15. That’s the date the United States is scheduled to put additional tariffs on Chinese consumer goods. New tariffs could inspire additional actions by the Chinese government that affect economic growth in the United States.

To date, U.S. economic growth has slowed from 3.1 percent in the first quarter of 2019 to 1.9 percent in the third quarter.

The slowdown was caused, in part, by Chinese tariffs on American products. Tariffs have had a negative effect on manufacturing and agriculture, as well as other sectors of the market. Trade uncertainty also has led to a decline in business investment. When business investment drops so does the economy’s growth potential. The main engine behind U.S. economic growth has been and remains the American people. Consumer spending accounted for 68 percent of U.S. economic growth in the third quarter.

The Standard & Poor’s 500 Index finished the week in positive territory. The Dow Jones Industrial Average and Nasdaq Composite finished down 0.1 percent.

The evolving etiquette of social media.

Social media etiquette makes remembering when to use the little fork on the right – you know, the one next to the two knives and spoon (the oyster fork) – seem like a snap.

When social media platforms were gaining popularity, they offered an opportunity to reconnect and stay in touch with friends and family. During the past decade, many people joined platforms and built networks. They also started to engage in some unwelcome behaviors. Sometimes, social media is a place where people: “…can say mean things without showing their face, discriminate with little consequence, and spill details nobody truly wants to hear,” explained Influence.co. “…it’s vital for people to remember that social media is meant to bring people together and that our online behavior can quickly come between us.”

To make it easier to understand which behaviors these are, the organization conducted a survey. The top digital don’ts included:

It’s also a poor idea to post content about another person without their permission. One in 10 respondents had ended a friendship over it. Finally, many people find it irritating when asked to delay eating a meal so a dinner companion can photograph it.

It’s food for thought.

Weekly Focus – Think About It

“One of the big no-no’s in cyberspace is that you do not go into a social activity, a chat group, or something like that, and start advertising or selling things. This etiquette rule is an attempt to separate one’s social life, which should be pure enjoyment and relaxation, from the pressures of work.”

–Judith Martin, a.k.a. Miss Manners, Etiquette authority

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

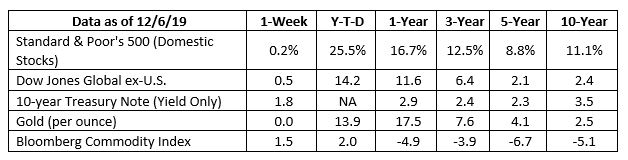

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.cnbc.com/2019/12/06/us-nonfarm-payrolls-november-2019.html

https://www.barrons.com/articles/dow-jones-industrial-average-ends-week-lower-despite-strong-jobs-report-51575684786?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-09-19_Barrons-The_Jobs_Numbers_were_Great-The_Dow_Still_Finished_Down_for_the_Week-Footnote_3.pdf)

https://www.marketwatch.com/story/did-trump-talk-bluster-or-was-he-hinting-that-china-talks-collapse-either-way-stock-futures-slump-2019-12-03

https://apps.bea.gov/scb/2019/11-november/pdf/1119-gdp-economy.pdf

https://www.bea.gov/news/2019/gross-domestic-product-1st-quarter-2019-advance-estimate

https://www.npr.org/2019/12/06/785280703/how-hard-are-tariffs-hitting-the-economy-it-depends-on-who-you-ask

https://fred.stlouisfed.org/series/W790RC1Q027SBEA

https://www3.nd.edu/~cwilber/econ504/504book/outln11b.html

https://emilypost.com/advice/formal-place-setting/

https://influence.co/go/content/social-media-etiquette.htm

https://www.brainyquote.com/quotes/judith_martin_581570?src=t_etiquette

It’s a shopping revolution!

Sometime, probably not so long ago, comedian Dave Barry wrote, “Once again, we come to the Holiday Season, a deeply religious time that each of us observes, in his own way, by going to the mall of his choice.”

Not so much anymore.

On Black Friday 2019, many shoppers didn’t venture any farther than their favorite digital device. CNBC reported, “The pullback in brick-and-mortar stores mirrored a surge in Black Friday online shopping, which hit $7.4 billion, an all-time record for the day, according to Adobe Analytics.” There was some good news for brick-and-mortar stores. In-store sales on Thanksgiving Day were up 2.3 percent from a year ago.

Despite relatively strong retail sales, overall, major stock indices in the United States dipped on Friday for reasons unrelated to evolving business models in the retail industry. Indices trended lower for the same reason they have on numerous occasions this year: Investors were worried about a setback in U.S.-China trade talks. Barron’s explained: “The Dow Jones Industrial Average, the S&P 500 index, and the Nasdaq Composite dipped on the final day of a boffo November. U.S. legislation supporting Hong Kong’s pro-democracy protesters, to which Beijing reacted furiously, dampened hopes that the highly anticipated phase-one trade deal with China would be inked soon.”

Despite losses on Friday, major U.S. indices were up for the week and the month, reported The Wall Street Journal. In November, U.S. stocks posted the strongest monthly performance since June.

U.S. government bonds have been delivering positive returns, too. Interest rates on 30-year Treasuries have fallen over the course of the year and were down again last week. When bond rates fall, bond prices move higher. When bond rates begin to move higher, prices will fall.

It’s remarkable when stock and bond markets move in the same direction at the same time. Often, strong performance in one market is accompanied by weaker performance in the other.

What makes a billionaire a billionaire?

During the five years through the end of 2018, the population of billionaires around the globe increased by 350 people to 2,101. The wealth of billionaires grew, too. After a 4.3 percent loss overall in 2018, billionaires’ wealth increased by 34.5 percent during the past five years.

According to The Billionaire Effect, which was released by UBS and PWC last month, three specific personality traits explain the success of many billionaires. It seems the typical exceptionally rich person is a smart risk-taker, focused on business, and determined to succeed. If that describes someone you know who has not yet reached billionaire status, perhaps it’s the industry. The only field where billionaire wealth increased during 2018 was Technology.

Women are becoming billionaires at a faster rate than men (46 percent versus 39 percent during the past five years), although there are still significantly fewer women (233) among the superrich.

Most of these exceptionally wealthy folks are found in Asia and the Americas:

While personality traits may influence success, what really makes billionaires is the success of their companies. The report stated: “Over the 15 years to the end of 2018, billionaire-controlled companies listed on the equity market returned 17.8 percent versus the 9.1 percent of the MSCI [All Country World Index (ACWI)], almost twice the annualized average performance of the market. Their companies are also more profitable, earning an average return on equity of 16.6 percent over the last 10 years, compared to the 11.3 percent of the MSCI ACWI.”

Weekly Focus – Think About It

“Human greatness does not lie in wealth or power, but in character and goodness. People are just people, and all people have faults and shortcomings, but all of us are born with a basic goodness.”

–Anne Frank, Diarist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

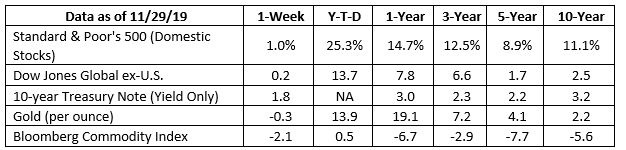

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.davebarry.com/misccol/christmas.htm

https://www.cnbc.com/2019/11/30/black-friday-shopping-at-brick-and-mortar-stores-dropped-by-6percent.html

https://www.barrons.com/articles/the-next-best-stocks-to-buy-could-be-small-caps-51575071290?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-02-19_Barrons-The_Stock_Markets_Next_Breakout_Stars-Footnote_3.pdf)

https://www.wsj.com/articles/stocks-edge-down-ahead-of-start-to-u-s-shopping-season-11575023295 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-02-19_WSJ-US_Stocks_Notch_Best_Month_Since_June-Footnote_4.pdf)

https://www.marketwatch.com/investing/bond/tmubmusd30y?countrycode=bx&mod=md_bond_overview_quote (Choose 5-year and YTD time periods at top of chart)

https://www.investopedia.com/ask/answers/why-interest-rates-have-inverse-relationship-bond-prices/

https://www.cnbc.com/2019/06/26/in-a-rare-occurrence-both-stock-and-bonds-are-having-a-great-year.html

https://www.ubs.com/global/en/wealth-management/uhnw/billionaires-report.html (For the number of billionaires, click on ‘By year’ and choose 2014 and 2018. For the quote, click on download report and go to page 6) (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-02-19_UBS-Billionaires_Insights-Footnote_8.pdf)

https://www.brainyquote.com/quotes/anne_frank_752405?src=t_wealth

Thanksgiving is in the air!

On Thursday, U.S. investors may find themselves giving thanks for the bull market.

Year-to-date, the Standard & Poor’s 500 Index, Dow Jones Industrial Average, and Nasdaq Composite have all gained more than 20 percent with dividends reinvested. The MSCI World Index also is up 20 percent year-to-date.

Bond markets have rallied, too. U.S. government bond yields have dropped since January, and prices have risen. Not all asset classes have packed an oomph, but investors are feeling optimistic, reported Michael Mackenzie of the Financial Times.

Ben Levisohn of Barron’s expressed some skepticism about the current level of optimism.

“If you believe the current narrative, everything is right with the world. By cutting interest rates three times, the Federal Reserve has averted a recession. And with the U.S. and China slowly making progress on a trade deal, capital spending could revive and boost the economy. And right on time, the S&P 500 index hit a new all-time high, seemingly confirming this rosy narrative…Strangely, market sentiment appears to be getting better even as the economic data appear to be getting worse.”

He’s not wrong. Economic data suggest U.S. and Chinese economies have begun to experience negative effects related to the two-year-old trade war. Reuters reported economic growth in China has slowed to a 30-year low. Growth in the United States has slowed, too.

While many remain optimistic about progress in resolving the U.S.-China trade dispute, Barron’s Nicholas Jasinski spoke with the chief investment officer of an international wealth management firm, who commented, “Our view of U.S. and China is that it’s a competition that’s going to go on for a generation economically, diplomatically, militarily.”

Last week, major U.S. indices finished lower on concerns about trade talk progress.

Happy Thanksgiving! We’re thankful for you.

Why do presidents pardon turkeys?

A turkey may not be on the Great Seal of the United States, as Ben Franklin would have preferred, but the bird has a surprisingly robust history at the White House.

From the 1870s until 1913, turkeys were provided to the White House for holiday meals primarily by Rhode Island poultry producer Horace Vose. After his death, it was a free for all. The White House Historical Association wrote, “By 1914, the opportunity to give a turkey to a President was open to everyone, and poultry gifts were frequently touched with patriotism, partisanship, and glee. In 1921, an American Legion post furnished bunting for the crate of a gobbler en route from Mississippi to Washington, while a Harding Girls Club in Chicago outfitted a turkey as a flying ace, complete with goggles. First Lady Grace Coolidge accepted a turkey from a Vermont Girl Scout in 1925. The turkey gifts had become established as a national symbol of good cheer.”

The first time a turkey was granted clemency was in 1863. President Abraham Lincoln instructed the White House staff to spare a bird which had become a favorite of his son, reported the Constitution Daily.

Some say President Truman pardoned a turkey or two, but the Truman Library does not agree.

Records indicate it was 1963 before another President spared a turkey destined for the White House kitchen. While both President Lincoln and President John F. Kennedy showed mercy, neither officially pardoned their birds. President Ronald Reagan joked about a pardon, but the first official Presidential turkey pardon was issued by President George H.W. Bush in 1989.

So, why do Presidents pardon turkeys? We’re not really sure. We know where pardoned turkeys go, though.

For many years, like Super-Bowl-winning quarterbacks, they went to amusement parks in Florida and California. The turkeys helped lead Thanksgiving Day Parades. More recently, “…the spared turkeys are sent to an enclosure at Virginia Tech called ‘Gobbler’s Rest’… where they get to frolic with other free turkeys,” reported The Independent.

Weekly Focus – Think About It

You may have heard of Black Friday and Cyber Monday. There’s another day you might want to know about: Giving Tuesday. The idea is pretty straightforward. On the Tuesday after Thanksgiving, shoppers take a break from their gift-buying and donate what they can to charity.”

— Bill Gates, Business magnate and philanthropist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

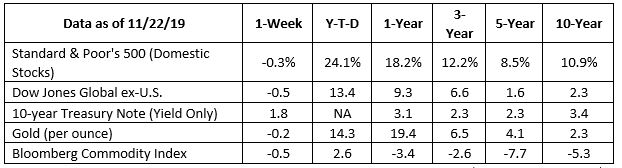

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/dow-jones-industrial-average-snaps-four-week-winning-streak-51574469902?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-25-19_Barrons-The_Dows-Winning-Streak-Ended-With-a-Whimper-as-Trade-Worries-Return-Footnote_1.pdf)

https://www.ft.com/content/0d445fe2-0c60-11ea-b2d6-9bf4d1957a67 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-25-19_FinancialTimes-Investment-Outlooks-Hinge-on-Deciphering-Conflicting-Signals-Footnote_2.pdf)

https://www.cnbc.com/2019/11/18/the-bond-phenomenon-of-2019-isnt-over-yet-says-trader.html (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-25-19_Barrons-The-Bull-Market-Could-Still-End-in-2020-Here’s-How-to-Prepare-Footnote_3.pdf)

https://www.barrons.com/articles/prepare-for-the-end-of-the-bull-market-51574439667?mod=hp_LEAD_3

https://www.reuters.com/article/us-global-markets-themes/take-five-a-spanner-in-the-global-economic-works-idUSKBN1XW1PB

https://www.history.com/news/did-benjamin-franklin-propose-the-turkey-as-the-national-symbol

https://www.whitehousehistory.org/pardoning-the-thanksgiving-turkey

https://constitutioncenter.org/blog/the-real-story-behind-the-presidential-turkey-pardon

https://www.trumanlibrary.gov/education/trivia/did-truman-pardon-turkey

https://en.wikipedia.org/wiki/National_Thanksgiving_Turkey_Presentation

https://www.independent.co.uk/life-style/turkey-pardon-where-do-they-go-president-donald-trump-white-house-peas-and-carrots-a8643626.html

https://www.brainyquote.com/topics/thanksgiving-quotes

The longest bull market in history showed no signs of slowing last week.

U.S. stock markets climbed higher for the sixth week straight – the longest rally in U.S. markets in two years – and the Dow Jones Industrial Average surpassed 28,000 for the very first time, reported Bloomberg.

The Economist reported, “It has been a year of mood swings in financial markets. In the spring and summer, anxious investors piled into the safety of government bonds, driving yields down sharply. Yields have recovered in recent weeks…Equity prices in America have reached a new peak. But what is more striking is the performance of cyclical stocks relative to defensive ones. Within America’s market the prices of industrial stocks, which do well in business-cycle upswings, have risen relative to the prices of utility stocks, a safer bet in hard times.”

Last week, Federal Reserve Chair Jerome Powell confirmed the United States appears to be in good economic shape. The U.S. economic outlook remains favorable despite weakening business investment, which has slowed because of sluggish global growth and uncertainty surrounding trade. The unemployment rate remains low and more people are returning to the workforce, which is a positive development. Overall, Powell and his colleagues believe economic expansion is likely to continue.

A similar phenomenon has occurred in European markets.

Randall Forsyth of Barron’s cited a source who stated, “…the global economic backdrop has, for the first time in 18 months, begun to improve.” Forsyth went on to explain, “It’s not just because of prospects of a trade deal. Recession risks have, well, receded. Growth may slow to a 1 percent annual rate in the current quarter, but odds of falling into an outright recession have slid.”

Whenever investors are happy and markets are moving higher, contrarians begin to ask questions. For example, a leading contrarian indicator is the Investors Intelligence Sentiment Survey. The survey queries investors and investment professionals about whether they are feeling bullish or bearish. When the ratio of bulls to bears is above 1.0, the market may be overly bullish. When it is less than 1.0, it may be too bearish.

Yardeni Research reported the ratio stood at 3.22 last week; 57 percent bulls and 18 percent bears

In case you missed it, the winner was #435.

For the last five years, Katmai National Park and Preserve in Western Alaska has hosted ‘Fat Bear Week’ to celebrate bears as they prepare for hibernation. The participants are coastal brown bears who live along Alaska’s Brooks River.

The event helps people better understand hibernation. You may not have realized it, but bears spend the summer fattening up because they lose about one-third of their body weight during the winter. It’s an interesting scientific phenomenon. The Katmai National Park Service website explained:

“Hibernation is a state of dormancy that allows animals to avoid periods of famine. It takes many forms in mammals but is particularly remarkable in bears…After a summer and fall spent gorging on food, a bear’s physiology and metabolism shifts in rather incredible ways to help them survive several months without food or water.”

In Katmai, conservancy media rangers select twelve participants from among the park’s 2,000 bears and post before-and-after photos on social media to showcase the effects of summer feasting. People near and far can participate by watching bear cams. There is even an ursine madness bracket where voters choose the fat bear that wins each pairing, and the crowd favorite moves on to the next match-up.

This year, the Fat Bear Week champion was number 435, a.k.a. Holly. The Katmai announcement touting 435’s win stated, “All hail Holly whose healthy heft will help her hibernate until the spring. Long live the Queen of Corpulence!”

Weekly Focus – Think About It

“If we had no winter, the spring would not be so pleasant: if we did not sometimes taste of adversity, prosperity would not be so welcome.”

–Anne Bradstreet, Poet

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

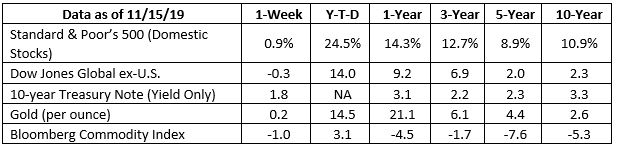

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.bloomberg.com/news/articles/2019-11-15/stocks-breeze-to-records-as-trade-hopes-cover-up-economic-gloom?srnd=markets-vp

https://www.economist.com/finance-and-economics/2019/11/14/the-improved-mood-in-financial-markets (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-18-19_TheEconomist-The_Improved_Mood_in_Financial_Markets-Footnote_2.pdf)

https://www.federalreserve.gov/newsevents/testimony/powell20191113a.htm

https://www.barrons.com/articles/next-stop-dow-30-000-it-could-happen-51573871667?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-18-19_Barrons-Next_Stop-Dow_30000-It_Could_Happen-Footnote_4.pdf)

https://investinganswers.com/dictionary/b/bullbear-ratio

https://www.yardeni.com/pub/stmktbullbear.pdf (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-18-19_Yardeni-Stock_Market_Indicators-Bull_Bear_Ratios-Footnote_6.pdf)

https://www.npr.org/2019/10/06/767384374/its-fat-bear-week-in-alaska-s-katmai-national-park-time-to-fill-out-your-bracket

https://www.npr.org/2019/10/09/768475870/stuffed-with-sockeye-salmon-holly-wins-fat-bear-week-heavyweight-title

https://www.nps.gov/katm/blogs/bear-hibernation.htm

https://www.goodreads.com/quotes/tag/winter

Last week, major United States stock indices finished at historic highs.

According to a source cited by Barron’s, U.S. stock markets are responsible for creating $6 trillion in paper wealth this year. ‘Paper’ wealth is when an asset is estimated to be worth a specific amount. The wealth becomes ‘real’ when the asset is sold.

If you’re having difficulty comprehending $6 trillion, imagine this: 3,786 miles of stacked $100 bills. That’s about 15 times higher than the space station. It’s roughly the distance of a drive from the East Coast to the West Coast of the United States and about halfway back again.

To date, 2019 has been an exceptional year for U.S. stocks. At the end of last week, the Dow Jones Industrial Average was up 18.7 percent year-to-date, the S&P 500 had gained 23.4 percent, and the Nasdaq Composite had risen 27.7 percent.

Returns like these sometimes inspire investors to ignore their risk tolerance and increase allocations to U.S. stocks. That may not be a wise move. In an article titled, ‘How not to understand money,’ Financial Times explained: “One of the first things to know about equity investing is that stocks go up as well as down, and even the most successful ones never go up in a straight skyward trajectory.”

There is a theory which holds that, over time, returns revert to the mean. Investopedia describes the phenomenon like this: A reversion to the mean involves retracing any condition back to a previous state. In cases of mean reversion, the thought is that any price that strays far from the long-term norm will again return, reverting to its understood state.”

Since the current U.S. bull market in stocks has delivered above average returns for more than a decade, some analysts anticipate future returns may be less robust as returns revert to the mean.

Suffice it to say, it’s not a good idea to be lured into holding more stocks because recent returns have been exceptional. Those returns are, after all, in the past.

The newest new math.

If you learned ‘old’ math, you may find ‘new’ math bewildering, and that can make helping with homework really challenging. It’s possible we’ll soon have an even newer math curriculum.

Many Americans learned old math: addition and subtraction, multiplication tables, and long division. Some may have absorbed linear equations in algebra and isosceles triangles in geometry. The new math entails a similar but different skill set. For instance, new math requires students to:

If you are familiar with any of these new problem-solving methods, congratulations! You are ahead of the curve.

Unfortunately, the new math hasn’t been improving Americans’ performance on the Program for International Student Assessment (PISA), a standardized test administered in 70 countries. In 2018, the U.S. placed 39th in math.

Jo Boaler, the Nomellini-Olivier Professor of Mathematics Education at Stanford University, and Steven Levitt, an economist and author, think we need to change what we’re teaching. In an opinion piece in the Los Angeles Times, they wrote: “What we propose is as obvious as it is radical: to put data and its analysis at the center of high school mathematics. Every high school student should graduate with an understanding of data, spreadsheets, and the difference between correlation and causality. Moreover, teaching students to make data-based arguments will endow them with many of the same critical-thinking skills they are learning today through algebraic proofs, but also give them more practical skills for navigating our newly data-rich world.”

Get ready for 21st century math!

Weekly Focus – Think About It

“Instead of being like a circus where the trainer uses his stick to make animals do stunts to serve the interest of the audience, the system of education should be like an orchestra where the conductor waves his stick to orchestrate the music already within the musicians’ hearts in the most beautiful manner. The teacher should be like the conductor in the orchestra, not the trainer in the circus.”

–Abhijit Naskar, Neuroscientist and author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

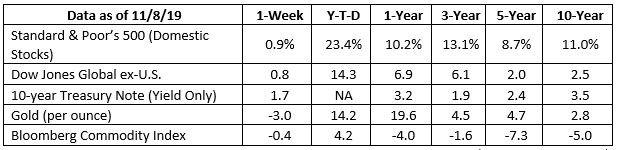

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/stocks-keep-hitting-record-highs-where-to-find-values-now-51573261145?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-11-19_Barrons-Stocks_Keep_Hitting_Record_Highs-Where_to_Find_Values_Now-Footnote_1.pdf)

https://corporatefinanceinstitute.com/resources/knowledge/valuation/paper-wealth/

https://www.thecalculatorsite.com/articles/finance/how-much-is-a-trillion.php

https://www.worldatlas.com/webimage/countrys/namerica/usstates/uslandst.htm

https://ftalphaville.ft.com/2019/11/07/1573161957000/How–not-to-understand-money-/ (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-11-19_FinancialTimes-How_Not_to_Understand_Money-Footnote_5.pdf)

https://www.investopedia.com/terms/m/meanreversion.asp

https://www.investopedia.com/why-morgan-stanley-says-the-60-40-portfolio-is-doomed-4775352

http://theconversation.com/the-common-core-is-todays-new-math-which-is-actually-a-good-thing-46585

https://www.understood.org/en/school-learning/learning-at-home/homework-study-skills/9-new-math-problems-and-methods

http://factsmaps.com/pisa-worldwide-ranking-average-score-of-math-science-reading/

https://www.latimes.com/opinion/story/2019-10-23/math-high-school-algebra-data-statistics

https://www.goodreads.com/quotes/tag/education-reform