No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Take a deep breath.

We have experienced downturns before.

Think back to 2018. During the last quarter of the year, major stock indices in the Unites States suffered double-digit losses, much of it during December. What happened next? By the end of 2019, those indices had reached new highs.

The reasons for, and performance following, market downturns varies. The key is not to panic.

Last week, U.S. stock indices lost significant value when the coronavirus spread outside of China, and expectations for companies’ performance in 2020 changed. At the start of the week, markets anticipated positive earnings growth (i.e., higher profits) during 2020. By the end of the week, they suspected earnings might be flat for the year.

At the end of last week, FactSet reported 68 companies in the Standard & Poor’s 500 Index had offered negative earnings guidance for the first quarter. In other words, the companies didn’t expect to be as profitable from January through March as analysts anticipated. That’s fewer companies than normal, relative to the five-year average. However, the number could increase. FactSet’s John Butters explained: “…early in the quarter, a number of S&P 500 companies stated they were unable to quantify an impact from the coronavirus or did not include the impact from the coronavirus in their guidance. Thus, there may be an increase in the number of companies issuing negative guidance later in the first quarter as these companies gain clarity on the impact of the coronavirus on their businesses.”

Changing profit expectations are one concern for investors. Another is fear. Investors are afraid the current economic expansion and bull market may end. At this point in the economic cycle, investors often are both hopeful and doubtful. The Economist explained: “[Investors] hope that the good times will last, so they are reluctant to pull their money out. They also worry that the party may suddenly end. This is the late-cycle mindset. It reacts to occasional growth scares – about trade wars or corporate debt or some other upset. But it tends not to take them seriously for long.”

Currently, investors are reacting to the coronavirus. They fear it will be the catalyst that sparks recession. While that’s possible, in the past, markets have responded negatively to coronaviruses and then recovered. (Keep in mind, past performance is no indication of future results.) Barron’s cited a private wealth manager who pointed out: “…this isn’t the first time that an epidemic has rocked the stock market. The S&P 500 fell 15 percent after SARS hit the market in 2003 but was up just over 1 percent six months after the outbreak began.”

No matter the reason, it is unnerving to be an investor when stock markets head south. There is nothing comfortable about watching the value of your savings and investments decline. Regardless of the discomfort, selling when markets are falling has rarely proved to be a good idea. Investors who stay the course may have opportunities to regain lost value if the market recovers, as it has before.

Investors also may have opportunities to buy shares of attractive companies at reduced prices. Warren Buffet offered this reminder last week in a Barron’s article: “…[the coronavirus] makes no difference in our investments. There’s always going to be some news, good or bad, every day. If somebody came and told me that the global growth rate was going to be down 1 percent instead of 1/10th of a percent, I’d still buy stocks if I liked the price, and I like the prices better today than I liked them last Friday.”

Until the full effect of the coronavirus is known, markets are likely to remain volatile.

What you should know about the coronavirus. The coronavirus is now officially known as Coronavirus Disease 2019 or COVID-19. Last week, it spread to countries outside of China. If there is any good news about the contagious disease, it is COVID-19 may be relatively mild.

In its February 28 briefing, the Director-General of the World Health Organization (WHO) stated, “It also appears that COVID-19 is not as deadly as other coronaviruses including SARS and MERS. More than 80 percent of patients have mild disease and will recover.”

The Director-General identified the symptoms of COVID-19 stating, “…for most people, it starts with a fever and a dry cough, not a runny nose. Most people will have mild disease and get better without needing any special care.”

Currently, more than 20 vaccines are being developed. In the meantime, there are things you can do to protect yourself. They include:

WHO also recommended educating yourself about the coronavirus. Make certain to gather information from reliable sources, such as WHO or the United States’ Centers for Disease Control (CDC), and have healthy skepticism when it comes to unknown sources. Misinformation and disinformation about COVID-19 have been spreading almost as quickly as the virus itself.

The Director-General closed last week’s briefing by saying, “Together, we are powerful…Our greatest enemy right now is not the virus itself. It’s fear, rumors, and stigma. And, our greatest assets are facts, reason, and solidarity.”

If you would like to talk about the potential economic effects, give us a call. We look forward to talking with you.

Weekly Focus – Think About It

“The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

–Sir John Templeton, Investor, asset manager, philanthropist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

Sources:

https://www.cnbc.com/2018/12/31/stock-market-wall-street-stocks-eye-us-china-trade-talks.html

https://www.cnbc.com/2019/12/26/us-stocks-year-end-rally.html

https://insight.factset.com/are-analysts-slashing-sp-500-eps-estimates-for-q1-due-to-the-coronavirus

https://www.barrons.com/articles/dow-jones-industrial-average-suffers-worst-week-since-2008-recession-watch-begins-51582941142?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-02-20_Barrons-This_Downturn_Might_Just_be_Getting_Started-Let_the_Recession_Watch_Begin-Footnote_4.pdf)

https://www.economist.com/finance-and-economics/2020/02/27/markets-wake-up-with-a-jolt-to-the-implications-of-COVID-19 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-02-20_TheEconomist-Markets_Wake_Up_with_a_Jolt_to_the_Implications_of_COVID-19-Footnote_5.pdf)

https://www.barrons.com/articles/cash-rich-stocks-to-buy-amid-the-coronavirus-selloff-51582936062?mod=hp_HERO (or go to

Risk on or risk off?

The coronavirus appears to have inspired two distinct schools of thought among investors. Some investors currently favor opportunities that are considered lower risk, like Treasury bonds and gold, because they’re concerned about the potential impact of the coronavirus on the global economy. Others are piling into higher risk assets, like stocks, that could benefit if central banks (like the United States Federal Reserve) take steps to stimulate economic growth, reported Randall Forsyth of Barron’s.

Currently, the Federal Reserve (Fed) is holding interest rates steady. The minutes of the January Federal Open Market Committee meeting indicated the Fed, “…generally saw the distribution of risks to the outlook for economic activity as somewhat more favorable than at the previous meeting,” reported Lindsay Dunsmuir of Reuters.

Last week, Fed Chair Jerome Powell said it was too soon to know whether the economic effects of the coronavirus on the U.S. economy would warrant a change in monetary policy.

During periods of uncertainty, like this one, the benefits of holding well-allocated, well-diversified portfolios become clear:

Choosing a well-allocated and diversified portfolio that aligns with your goals, objectives, and risk tolerance can provide peace-of-mind when markets are volatile.

Last week, major U.S. stock indices moved lower. Al Root of Barron’s reported, “The Dow Jones Industrial Average dropped 1.4 percent this past week, snapping two weeks of solid gains…The S&P 500 index dropped 1.2 percent for the week…The Nasdaq Composite dropped 1.6 percent on the week…”

The CBOE Volatility Index (VIX), known as Wall Street’s fear gauge, moved higher.

Some people must still take required minimum distributions at 70½.

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law late in 2019. One of its provisions changed the rules for required minimum distributions (RMDs).

RMDs are the amounts owners of IRAs, 401(k)s, and other tax-advantaged retirement plan accounts must withdraw from those accounts every year to avoid tax penalties. In some cases, retirees take more than the required minimum amount, especially when they are using the funds for income.

Prior to passage of the SECURE Act, Americans were required to take RMDs in the year they reached age 70½. This rule continues to apply to anyone who reached age 70½ prior to 2020. The Internal Revenue Service (IRS) defines age 70½ this way: The date that is six calendar months after your 70th birthday.

Beginning in 2020, owners of tax-advantaged retirement accounts do not have to begin taking RMDs until the year in which they reach age 72.

While the SECURE Act changed the age for RMDs, Qualified Charitable Distributions (QCDs) from IRAs were not affected by the new law. QCDs still can begin at age 70½.

RMDs can be complex, especially for households that have several IRA and retirement plan accounts. It’s a good idea to consult with a financial or tax professional before making any RMD decision. If you would like to discuss the finer points of RMDs, or receive some assistance calculating RMDs, get in touch. We’re happy to help.

Weekly Focus – Think About It

“Friendship…is born at the moment when one [person] says to another “What! You too? I thought that no one but myself…”

–C.S. Lewis, writer and theologian

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/the-bull-market-in-both-risky-and-safe-assets-51582333794?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-24-20_Barrons-The_Two-Day_Stock_Selloff_Hurts-Footnote_1.pdf)

https://www.reuters.com/article/us-usa-fed-minutes/fed-policymakers-cautiously-optimistic-on-us-economy-despite-new-risks-minutes-show-idUSKBN20D2K3

https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners’-guide-asset

https://www.barrons.com/articles/stocks-drop-on-the-week-but-still-look-bubbly-prepare-for-a-correction-51582334151?mod=hp_DAY_2 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-24-20_Barrons-Stocks_Drop_on_the_Week_but_Still_Look_Bubbly-Footnote_4.pdf)

http://www.cboe.com/vix (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-24-20_CBOE_Volatility_Index_Charts_and_Data-Footnote_5.pdf)

https://www.congress.gov/bill/116th-congress/house-bill/1865/text#toc-HA6E69DEA642642799C7E8CF1D7E50D72 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-24-20_Congress.gov-House_Bill_1865-Footnote_6.pdf)

https://www.investopedia.com/terms/r/requiredminimumdistribution.asp

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

https://www.barrons.com/articles/answers-to-your-questions-on-the-secure-acts-impact-on-iras-rmds-and-qcds-51578502801 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-24-20_Barrons-The_SECURE_Acts_New_Rules_are_Causing_A_Lot_of_Confusion-Footnote_9.pdf)

https://www.goodreads.com/quotes

Many stock markets around the world moved higher last week.

Investors’ optimism in the face of economic headwinds has confounded some in the financial services industry. Laurence Fletcher and Jennifer Ablan of Financial Times cited several money managers who believe investors have become complacent. One theory is investors’ buy-the-dip mentality has become so firmly ingrained that any price drop is seen as a buying opportunity, regardless of share price valuation.

Another theory is investors remain confident in the face of declining economic growth expectations because they expect central bankers to save the day:

“Key stock markets are hovering close to record highs even while the death count from the China-centered virus rises and travel in, out, and around the country remains heavily restricted, hurting the outlook for domestic and international companies. Regardless, stumbles in stocks are quickly reversed. To some traders, this is proof that investors believe major central banks will pump more stimulus into the financial system.”

Ben Levisohn of Barron’s doesn’t think investors in U.S. stocks are complacent. He wrote: “Yes, [investors have] decided to stay invested in U.S. stocks, but compare it with the other options. Emerging market stocks near the epicenter of the outbreak? Treasury notes with yields of just 1.59 percent? Cash? But, they haven’t sat idly by, either. They’ve dumped the stocks most exposed to coronavirus and to a slowing economy – things like energy, cruise lines, airlines, steel.”

Treasury bond markets are telling a less optimistic story than stock markets. The U.S. treasury bond yield curve has flattened in recent weeks. On Friday, 3-month treasuries were yielding 1.58 percent while 10-year treasuries yielded 1.59 percent. When there is little difference between yields for short- and long-term maturities, the yield curve is considered to be flat.

Historically, the slope of the yield curve – a line that shows yields for Treasuries of different maturities – is believed to provide insight to what may be ahead for economic growth. Normal yield curves may indicate expansion ahead, while inverted yield curves suggest recession may be looming. Flat yield curves suggest a transition is underway.

What’s your favorite remedy for a Hangover? Consuming too much alcohol comes with an unwelcome side effect: the hangover. Symptoms of a hangover typically include dehydration, fatigue, vertigo, headache, nausea, and muscle aches. If you’ve ever had one you may understand the growing market for hangover treatments.

By one estimate, Americans experience 2.6 billion hangovers each year. That may be why market research analysts think hangover remedies have the potential to become a billion-dollar industry. The Washington Post reported the number of recovery (and ‘precovery’) treatments has ballooned during the past three years. So far, the hangover remedy industry has:

The hangover market is small potatoes when compared to the market for alcoholic beverages ($1.4 trillion). However, the market for non-alcoholic cocktails is growing, too. In New York City, booze-free bars charge $13 a pop for dry cocktails.

Here’s a question: Are alcohol-free drinks a precovery hangover solution or a beverage?

Weekly Focus – Think About It

“A hangover is the wrath of grapes.”

–Dorothy Parker, American poet

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://markets.ft.com/data/world (Click on ‘Global indices’ at the bottom left of the map and choose ‘5 day’) (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-18-20_FinancialTimes-Global_World_Markets_Indices-Footnote_1.pdf)

https://www.ft.com/content/8732e814-4e82-11ea-95a0-43d18ec715f5 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-18-20_FinancialTimes-Investor_Complacency_Sets_in_While_Coronavirus_Spreads-Footnote_2.pdf)

https://www.barrons.com/articles/dow-jones-industrial-average-gained-1-this-week-as-stocks-ignore-the-coronavirus-51581726118?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-18-20_Barrons-The_Dow_Jones_Industrial_Average_Gained_1_Percent_this_Week-Let_It_Ride-Footnote_3.pdf)

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/textview.aspx?data=yield

https://www.investopedia.com/terms/y/yieldcurve.asp

https://www.health.harvard.edu/staying-healthy/7-steps-to-cure-your-hangover-and-ginkgo-biloba-whats-the-verdict

https://www.washingtonpost.com/business/2019/12/19/drinking-with-no-consequences-this-was-year-hangover-hack/

https://www.businessinsider.com/bars-no-alcohol-sober-dry-january-nyc-2020-1

https://www.goodreads.com/quotes/370656-a-hangover-is-the-wrath-of-grapes

Last week, major U.S. indices posted strong gains. That’s welcome news, but the drivers behind share price appreciation appear to have little to do with company fundamentals.

Fourth quarter earnings season is underway. During earnings season, companies let investors know how profitable they were during the previous quarter. With 45 percent of companies in the Standard & Poor’s 500 (S&P 500) Index reporting, earnings are slightly down. If the trend continues, this will be the fourth consecutive quarter of year-over-year earnings declines, according to FactSet.

Falling company profits, in tandem with rising share prices, have made U.S. stocks relatively expensive. The price-to-earnings ratio of the S&P 500 Index was 25.04 on Friday. That’s significantly higher than its long-term average of 15.78.

Expectations for economic growth may have been behind last week’s gains. Axios reported, “U.S. economic data had been strengthening ahead of the [coronavirus] outbreak – last month the all-important services sector notched its best reading since September, a private payrolls survey showed the highest job growth in five years, and consumer confidence held at historically high levels.”

The Economist Intelligence Unit (EIU) estimates U.S. economic growth will be 1.7 percent in 2020, although the coronavirus could create issues that slow growth.

Economic growth also could be inhibited by the national debt. The Federal Reserve Bank of St. Louis showed U.S. debt at about 105 percent of gross domestic product (GDP) at the end of the third quarter of 2019 (GDP is the value of all goods and services produced by the United States). According to the Council on Foreign Relations, high levels of debt can slow economic growth and divert investment from infrastructure, education, and research.

Ben Levisohn of Barron’s suggested last week’s gains might have been the result of limited supply and high demand for U.S. stocks, “…because the world’s problems might actually make U.S. markets more attractive.” Stock market gains may also owe something to supportive central bank policies.

During the next few weeks, stay calm and expect some volatility.

DO you know a financial two-timer?

In an online poll conducted by YouGov, CreditCards.com asked people how open and honest they are with their spouses and partners about money. The survey discovered financial infidelity is not uncommon. Respondents cheat financially in a variety of ways, including:

34 percent have spent more than their spouse/partner would approve

12 percent have secret debt

10 percent have secret credit card accounts

9 percent have secret savings accounts

8 percent have secret checking accounts

Respondents had a variety of reasons for secretive financial dealings:

36 percent said privacy and control were important

27 percent said they never felt the need to share

26 percent were embarrassed by the way they handle money (frequently cited by wealthiest respondents.)

Janice Wood of PsychCentral wrote, “Financial infidelity can take as big a toll on relationships as sexual infidelity and emotional dishonesty…A few things that couples can do to prevent financial infidelity is to talk more, get on the same page regarding both joint and individual goals they might have, and also budget for some occasional indulgences along the way of achieving their long-term financial goals…”

If you’re looking for a great Valentine’s Day gift, talking with your spouse or partner about money is a choice that could deliver long-term rewards.

Weekly Focus – Think About It

“It is better to be hated for what you are than to be loved for what you are not.”

–Andre Gide, Author and Nobel Prize winner

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

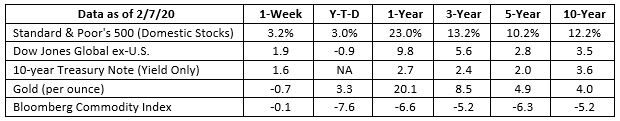

Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.barrons.com/articles/dow-jones-industrial-average-gains-846-points-in-comeback-week-51581124626?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-10-20_Barrons-Coronavirus-Slower_Growth-The_Dow_Just_Had_A_Spectacular_Week-Footnote_1.pdf)

https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_013120.pdf

https://www.investopedia.com/terms/e/earnings.asp

https://www.multpl.com/s-p-500-pe-ratio

https://www.axios.com/newsletters/axios-markets

https://country.eiu.com/united-states

https://country.eiu.com/article.aspx?articleid=148994798&Country=United%20States&topic=Economy (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-10-20_TheEconomist-Fed_Continues_Delicate_Balancing_Act-Footnote_7.pdf)

https://fred.stlouisfed.org/series/GFDEGDQ188S

https://www.cfr.org/backgrounder/national-debt-dilemma

https://www.cfr.org/global/global-monetary-policy-tracker/p37726

https://www.creditcards.com/credit-card-news/financial-infidelity-cheating-poll.php

https://psychcentral.com/news/2019/12/31/financial-infidelity-can-take-a-toll-on-relationships/152583.html

https://www.goodreads.com/quotes/tag/love

Prepare yourself. There is a good chance markets will be volatile in the coming weeks.

Precautions designed to slow the spread of the coronavirus may also slow Chinese economic growth and, by extension, global economic growth.

On Thursday, the World Health Organization declared the coronavirus to be an international health emergency. The U.S. State Department issued a travel advisory for China, and major U.S. airlines suspended flights to the nation, reported Forbes.

In six Chinese provinces, factories and businesses are shuttered until at least February 10. The closures have created issues for global supply chains, and Financial Times reported, “Companies from luxury retailers to airlines and banks are reeling as the disease accelerates.”

Events sparked a bond rally as investors shifted assets into safe haven investments. The Economist wrote that previous viruses have not had lasting effects on economic growth. “Other recent epidemics have reinforced the impression that economists should not be overly worried, so long as good doctors are on the job. Neither avian flu in 2006 nor swine flu in 2009 dimmed the global outlook. Yet even flint-hearted investors are wondering whether the new epidemic might be worse. Stocks in Hong Kong have fallen by nearly 10 percent as reported infections have steadily increased. Tremors have also rippled through global markets.”

China’s government is prepared to step into the breach. On Saturday, Reuters reported, “Chinese authorities have pledged to use various monetary policy tools to ensure liquidity remains reasonably ample and to support firms affected by the virus epidemic…” The Chinese central bank is expected to begin offering support on February 3 before the Chinese stock market reopens for the first time since January 23.

The European Union may also be in need of economic stimulus. Financial Times reported the Eurozone economy came to a virtual standstill (up 0.1 percent) in the fourth quarter and grew just 1.2 percent during 2019. Economies in France and Italy, the second and third largest in the region, both contracted during the fourth quarter.

Major U.S. stock indices moved lower last week.

The Things We Do For Pets. While there is some debate about how many American households include pets – The Washington Post reports estimates from the American Pet Products Association are about 11 percent higher than those of the American Veterinary Medical Association – there is little debate about how much people love their pets.

With Valentine’s Day coming up soon, you may be wondering how to show your pet you care. Here are a few ideas:

On Valentine’s Day, remember to do something nice for the people you love, too.

Weekly Focus – Think About It

“The more cats you have, the longer you live. If you have a hundred cats, you’ll live ten times longer than if you have ten. Someday this will be discovered, and people will have a thousand cats and live forever.”

–Charles Bukowski, Poet and novelist

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

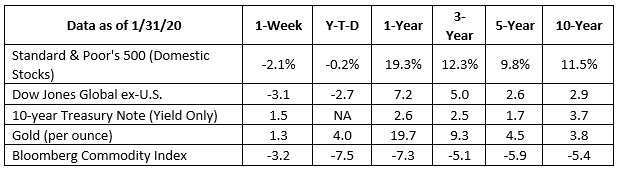

Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.forbes.com/sites/sergeiklebnikov/2020/01/31/markets-plummet-dow-drops-over-600-points-as-coronavirus-infections-outpace-sars/#5e9264725ddc

https://travel.state.gov/content/travel/en/traveladvisories/traveladvisories/china-travel-advisory.html

https://www.ft.com/content/b8027b84-4514-11ea-aeb3-955839e06441 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-03-20_FinancialTimes-Apple_Shuts_42_China_Retail_Stores_Due_to_Coronavirus-Footnote_3.pdf)

https://www.ft.com/content/f3fcdc5a-4119-11ea-bdb5-169ba7be433d (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-03-20_FinancialTimes-The_Impact_of_Coronavirus_Across_Industry_and_Finance-Footnote_4.pdf)

https://www.economist.com/international/2020/01/30/chinas-coronavirus-semi-quarantine-will-hurt-the-global-economy (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-03-20_TheEconomist-Chinas_Coronavirus_Semi-Quarantine_will_Hurt_the_Global_Economy-Footnote_5.pdf)

https://www.reuters.com/article/us-china-health-cenbank/china-central-bank-to-inject-174-billion-via-reverse-repos-on-february-3-idUSKBN1ZW074

https://www.ft.com/content/f3088ca8-43f9-11ea-abea-0c7a29cd66fe (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/02-03-20_FinancialTimes-Eurozone_Grows_Just_0.1_Percent_as_France_and_Italy_Shrink-Footnote_7.pdf)

https://www.washingtonpost.com/science/2019/01/31/how-many-americans-have-pets-an-investigation-into-fuzzy-statistics/

https://www.reuters.com/article/us-odd-spotify-dogs/spotify-launches-playlists-for-dogs-left-home-alone-idUSKBN1ZE1D8

https://www.insider.com/ways-people-spoil-their-pets-2018-10#they-taught-their-dog-how-to-facetime-1

https://www.forbes.com/sites/michaelgoldstein/2019/02/22/americans-spending-billions-on-pet-travel-and-boarding/#40c74baa24f7

https://latravelmagazine.com/activities/pet-friendly/

https://www.theodysseyonline.com/14-strangest-things-people-do-with-their-pets

https://www.goodreads.com/work/quotes/44216022-on-cats

Markets hunkered down last week.

News of the Coronavirus outbreak in Wuhan, China unsettled investors around the world. The respiratory infection is related to severe acute respiratory syndrome (SARS) and Middle East respiratory syndrome (MERS), reported WebMD.

Previous virus outbreaks have affected global economic growth. Research into pandemic preparedness suggests extreme events can reduce global annual income by 0.6 percent per year (including mortality and income loss). Lower income often is equated with slower economic growth.

Viruses can also affect companies and share values. However, not every investment will move in the same direction at the same time, and not every country or industry will be affected in the same way. Barron’s reported:

“SARS infected more than 8,000 people in 2003, killing more than 770. The outbreak occurred between November 2002 and July 2003. Stocks of U.S. airlines – a proxy for travel-related shares – dropped more than 30 percent from pre-SARS highs during that outbreak, about twice the decline of the broader S&P 500 index. All stocks, it appears, were impacted by the outbreak. It took about three months for shares to bottom and another three months to achieve previous highs.”

China responded to the outbreak by imposing a transportation lockdown, and that could affect China’s economic growth. S&P Global explained:

“The coronavirus is hitting China during Lunar New Year, a period when households tend to spend more on travel, entertainment, and gifts. Even if the virus is contained fairly quickly, the initial stages of high uncertainty are likely to affect spending.”

In addition, the city of Wuhan, where the outbreak began, is a major transportation hub and a center for auto production. It is China’s sixth largest city, home to 11 million people, and responsible for 1.6 percent of the country’s economic growth.

Major stock indices in the United States moved lower last week.

A decade of words.

Time Magazine puts a ‘Person of the Year’ on its cover. ESPN awards ESPYs to athletes annually. Nobel and Ig Nobel committees recognize the worthy and the unsuspecting. Merriam Webster selects a ‘Word of the Year.’ It is the word dictionary users searched for more than they had in previous years. Here are the words of the year from the last decade:

2010: Austerity, noun, “The quality or state of being austere, a stern and serious quality, a plain and simple quality.”

2011: Pragmatic, adjective, “Relating to matters of fact or practical affairs often to the exclusion of intellectual or artistic matters: practical as opposed to idealistic.”

2012: Socialism, noun, “Any of various economic and political theories advocating collective or governmental ownership and administration of the means of production and distribution of goods,” tied with Capitalism.

Capitalism, noun, “An economic system characterized by private or corporate ownership of capital goods, by investments that are determined by private decision, and by prices, production, and the distribution of goods that are determined mainly by competition in a free market.”

2013: Science, noun, “The state of knowing: knowledge as distinguished from ignorance or misunderstanding.”

2014: Culture, noun, “The customary beliefs, social forms, and material traits of a racial, religious, or social group, also the characteristic features of everyday existence (such as diversions or a way of life) shared by people in a place or time.”

2015: -ism, noun suffix, “Manner of action or behavior characteristic of a (specified) person or thing, or prejudice or discrimination on the basis of a (specified) attribute.” (The most looked up words were socialism, fascism, racism, feminism, communism, capitalism, and terrorism.)

2016: Surreal, adjective, “Marked by the intense irrational reality of a dream.”

2017: Feminism, noun, “The theory of the political, economic, and social equality of the sexes; organized activity on behalf of women’s rights and interests.”

2018: Justice, noun, “The maintenance or administration of what is just especially by the impartial adjustment of conflicting claims or the assignment of merited rewards or punishments.”

2019: They, pronoun, “Those ones: those people, animals, or things.” The definition was expanded to, “Used to refer to a single person whose gender identity is nonbinary.”

The short-list of words for 2019 included: quid pro quo, impeach, crawdad, egregious, clemency, the, snitty, tergiversation (“evasion of straightforward action or clear-cut statement”), camp, and exculpate.

Weekly Focus – Think About It

“We think of English as a fortress to be defended, but a better analogy is to think of English as a child. We love and nurture it into being, and once it gains gross motor skills, it starts going exactly where we don’t want it to go: it heads right for the…electrical sockets. We dress it in fancy clothes and tell it to behave, and it comes home with its underwear on its head and wearing someone else’s socks. As English grows, it lives its own life, and this is right and healthy. Sometimes English does exactly what we think it should; sometimes it goes places we don’t like and thrives there in spite of all our worrying. We can tell it to clean itself up and act more like Latin; we can throw tantrums and start learning French instead. But we will never really be the boss of it. And that’s why it flourishes.”

—Kory Stamper, Lexicographer and author

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

Sources:

https://www.barrons.com/articles/stocks-catch-a-cold-after-fed-stops-expanding-its-balance-sheet-51579916069?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/01-27-20_Barrons-Stocks_Catch_a_Cold_After_Fed_Stops_Expanding_its_Balance_Sheet-Footnote_1.pdf)

https://www.webmd.com/lung/news/20200124/coronavirus-2020-outbreak-latest-updates

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5791779/

https://www.economicshelp.org/blog/149782/economics/effects-of-slower-economic-growth/

https://www.barrons.com/articles/travel-stocks-coronavirus-china-airlines-health-care-51579714639 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/01-27-20_Barrons-Coronavirus_has_Hit_the_Stock_Market-Heres_What_History_Says_Comes_Next-Footnote_5.pdf)

https://www.spglobal.com/en/research-insights/articles/coronavirus-in-china-early-thoughts-on-the-economic-impact

https://www.merriam-webster.com/words-at-play/word-of-the-year

https://www.merriam-webster.com/dictionary/austerity

https://www.merriam-webster.com/dictionary/pragmatic

https://www.merriam-webster.com/dictionary/socialism

https://www.merriam-webster.com/dictionary/capitalism

https://www.merriam-webster.com/dictionary/science

https://www.merriam-webster.com/dictionary/culture

https://www.merriam-webster.com/dictionary/-ism

https://www.merriam-webster.com/dictionary/surreal

https://www.merriam-webster.com/dictionary/feminism

https://www.merriam-webster.com/dictionary/justice

https://www.merriam-webster.com/dictionary/they

https://www.goodreads.com/quotes/tag/linguistics