It may sound strange to hear a financial advisor say this but achieving the things you care about most requires more than just money. There are certain habits...

Weekly Market Insights: Boost Early In Week Keeps Markets Ahead

A powerful two-day stock rebound cemented a positive week for investors as a new trading month began.

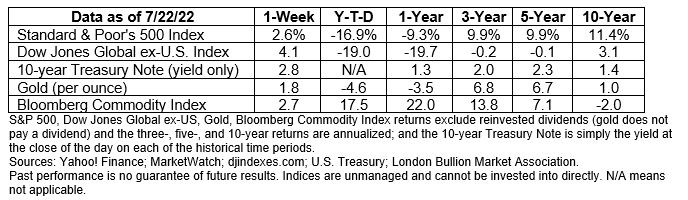

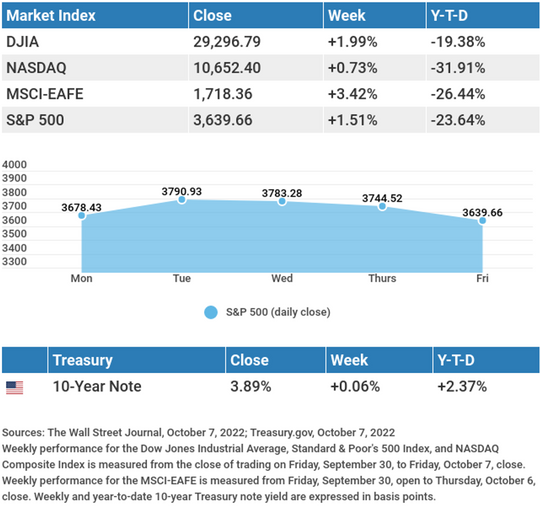

The Dow Jones Industrial Average rose 1.99%, while the Standard & Poor’s 500 added 1.51%. The Nasdaq Composite index increased 0.73% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 3.42%.1,2,3

Stocks Start StronglyStocks opened the week posting their best two-day rally since March 2020, as the U.K. prime minister’s decision to reverse a tax cut proposal that had upended financial markets the previous week lifted investors.4 Falling yields further lifted investor enthusiasm, as did new economic data indicating a cooling economy. Losses in the last two days erased much of the gains as concerns about higher rates and recession once again moved front and center. The selling pressure was due to a stream of hawkish comments by Fed officials and labor market data that suggested the Fed would likely stick with its rate-hike plans. A Mixed Labor PictureEmployment-related reports offered conflicting signals on the state of the labor market. In a sign of cooling, the number of open jobs in August fell 10%, while a subsequent report from Automated Data Processing (ADP) showed continued labor market strength. ADP reported private employers added a higher-than-anticipated 208,000 jobs in September, and annual wages rose 7.8% from a year ago.5,6 Jobless claims rose to 219,000, up from the previous week’s 190,000 and in line with 2019’s average. September’s employment report showed that employers added 263,000 jobs–slightly lower than expectations. The combination of new hiring and lower labor force participation led to a drop in the unemployment rate to 3.5%.7,8 This Week: Key Economic DataWednesday: Producer Price Index (PPI). Federal Open Market Committee (FOMC) Meeting Minutes. Thursday: Consumer Price Index (CPI). Jobless Claims. Friday: Retail Sales. Source: Econoday, October 7, 2022 This Week: Companies Reporting EarningsWednesday: Delta Air Lines, Inc. (DAL), PepsiCo, Inc. (PEP). Thursday: Wells Fargo & Company (WFC), Walgreens Boots Alliance, Inc. (WBA), BlackRock, Inc. (BLK). Friday: JPMorgan Chase & Co. (JPM), UnitedHealth Group, Inc. (UNH), Citigroup, Inc. (C), Morgan Stanley (MS), The PNC Financial Services Group, Inc. (PNC), U.S. Bancorp (USB). Source: Zacks, October 7, 2022 |

“All of us have to learn how to invent our lives, make them up, imagine them. We need to be taught these skills; we need guides to show us how. If we don’t, our lives get made up for us by other people.”

– Ursula K. Le Guin

Essential Tax Reminders For People Selling A Home

If you’re selling your home, you may be able to exclude all or part of any gain from the sale when filing your tax return. To see if you are eligible for this benefit, you have to consider:

- The home’s ownership and use: Over five years, ending on the date of the sale, the homeowner must have owned the house and lived in it as their main home for at least two years.

- Any gains: Taxpayers who sell their primary home and gain from the sale may be able to exclude up to $250,000 of that gain from their income. The exclusion increases to $500,000 for a married couple filing jointly.

- Mortgage debt: Generally, if your mortgage debt was forgiven or canceled, such as in the case of a foreclosure, you have to report this forgiven debt as income on your tax return.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov9

What Is Percussive Therapy?

If you’ve ever had a hard workout or gone on a long hike, you know how tight your muscles can get. There are many ways to help alleviate this soreness, from foam rolling to stretching. Percussive therapy is another option to help soothe sore muscles.

Percussive therapy uses a massage gun that rapidly strikes the sore muscle with varying pressure. Percussive therapy devices include names like Theragun, Hypervolt, and a handful of others.

This therapy aims to increase blood flow to the sore muscles to speed up recovery and limit soreness. It is the same idea as deep tissue massages; you glide a percussive massage gun device over sore muscles. Different guns come with various attachments and levels of pressure.

Tip adapted from Greatist10

A man leaves home and makes three left turns. He comes home again and sees two masked men waiting for him, but he jogs straight toward them with a smile as others cheer. Why is this man so unafraid?

Last week’s riddle: Seven people stand in a square room which measures 30′ x 30′. Each one can see the entire room and everyone in it without making any physical movement (aside from eye movement). Where inside this room can you place an apple so that all but one person can see it? Answer: Place the apple atop one person’s head.

Crater Lake, Crater Lake National Park, Oregon.

Footnotes And Sources

2. The Wall Street Journal, October 7, 2022 3. The Wall Street Journal, October 7, 2022 4. CNBC, October 3, 2022 5. The Wall Street Journal, October 4, 2022 6. CNBC, October 5, 2022 7. The Wall Street Journal, October 6, 2022 8. CNBC, October 7, 2022 9. IRS.gov, May 19, 2022 10. Greatist.com, May 26, 2022 |

|

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general. U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility. |