The Big Guys Move In

On September 13, 2022, the biggest of the big guys on Wall Street came out with a rather earth-shaking announcement. None other than Fidelity, Citadel Securities, and Charles Schwab have launched a new cryptocurrency exchange. In the words of the press release:

“A consortium of leading broker-dealers, global market makers and venture capital firms today announced the launch of EDX Markets (EDXM), a first-of-its-kind exchange that will address latent demand for digital asset trading by enabling safe and compliant trading of digital assets through trusted intermediaries. The new exchange will combine proven technology provided by MEMX with best practices from traditional financial markets and tighter spreads enabled by greater liquidity, to support secure, fast and efficient cryptocurrency trading for U.S. retail and institutional investors.”[i]

Jamil Nazarali, the new CEO of EDX Markets and former global head of business development at Citadel Securities, had this to say (and I’m fairly certain he meant virtual and not virtuous, although it might have been Freudian slip):

“We look forward to welcoming additional participants to the exchange, which will drive ongoing trading in this important asset class while creating a virtuous cycle of continually enhanced liquidity and efficiency supported by MEMX’s cutting-edge technology.”[ii]

The Upshot of All This?

A massive amount of sideline money is about to be invited into the world of Bitcoin and other cryptocurrency.

In my view, the results will be catastrophic, for according to many respected voices in the world of finance, there just isn’t any there there.

Just What the Heck Is Bitcoin Anyway?

It’s really an ingenious system. In 2009, an anonymous person or persons named Satoshi Nakamoto wrote a White Paper explaining a new, complex form of digital currency. In the White Paper, you’ll find some relaxing reading that looks like this;

“∑ k=0 ∞ k e − k! ⋅{ q/ p z−k if k≤z 1 if kz} Rearranging to avoid summing the infinite tail of the distribution… 1−∑ k=0 z k e − k! 1−q/ p z−k”

Read the entire White Paper here. It’s only 9 pages.

Now this complex system would have to be supported on powerful computers. They cost money. Why would anyone donate computer power to this system? Because Nakamoto created a computer network that would produce “coins” that owners of the computers would automatically receive if they added “blocks” to the blockchain that is Bitcoin. Yes, Bitcoin is one large and growing blockchain that generates coins with each additional block created.

What’s a “block”? Well, it’s a unit of data. In the Bitcoin blockchain, a block can contain only 1 MB of data, which is enough to store 2,000 transactions.[iii] Actually, after an upgrade to the Bitcoin protocol called “Segregated Witness” the size of the blocks is larger, for they are now measured in block weight and not block size.

These blocks “are linked using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. A blockchain is a decentralized, distributed and public digital ledger that is used to record transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the consensus of the network.”[iv]

And what’s a “cryptographic hash”? Way above my paygrade, but I can show you one. Try this on for size:

38FC4D3E1531D7661A4E32F4B6AE9EF9238DA753F485F17401140B2504A6012B

So when a miner crunches millions of calculations involving transaction hashes and Lord know what else to prove that the data in a block is verified and can’t be changed, the blockchain grows by one block, the miner gets 6 or so Bitcoins, and the process continues―in feverish computers across the globe.

Nakamoto knew that for computer owners to agree to offer their computer power to hold up this potentially enormous computer network, they’d have to be paid. And the coins they would receive for “mining” had to have value. How would they be valuable? If masses of people would buy the coins by moving real money into the pockets of those who would sell them Bitcoins, then the coins would have value.

And that’s what happened. In a very big way. In the early years, you could buy Bitcoin for pennies. In fact, on May 22, 2010, “Laszlo Hanyecz made the first recorded purchase of a physical good using Bitcoin. He spent 10,000 Bitcoin to purchase two Papa John’s pizzas …. Since Papa John’s didn’t accept Bitcoin as payment, he posted a 10,000 Bitcoin offer on Bitcointalk.org and Jeremy Sturdivant, a 19-year old then, took the offer, … bought the two pizzas, and delivered.”[v]

The pizzas cost Jeremy $41. So $41 divided by 10,000 yields an 2010 price of Bitcoin at $.0041 or four tenths of one penny. And how on earth would Laszlo Hanyecz “send” 10,000 Bitcoins to Jeremy? They aren’t, after all, physical coins. They are nothing more than computer code.

Today, if you want to send someone some Bitcoin, you just ask them for their “receive” address. Do you have to send an entire Bitcoin, which is worth around $19,000? No, Bitcoin can be divided into 8 decimal places. In fact, the smallest Bitcoin unit is .00000001 and it’s call “one Satoshi,” named after the anonymous founder.

To receive Bitcoin today, you’d just provide your Bitcoin “address.” Here’s one. It’s real and the owner would love for you to send Bitcoin to it:

3P2awwGe7kpEQgyAiw6vupHJ9vKvtJRJqb

So today, there are hundreds of thousands of computers holding up this vast computer network. They “mine” Bitcoin, which they either keep (hoping for a higher price) or sell (to cover their expenses). Who buys these Bitcoins? Millions of people around the world.

How Many People Own Bitcoin?

People buy cryptocurrency by setting up an account with an exchange―like the new exchange coming from Fidelity, Citadel, and Schwab. As of July 2022, more than 83 million people had created accounts on Blockchain.com. Coinbase, one of the most popular exchanges, has 98 million users. Crypto.com has 50 million customers. The Binance exchange has over 25 million customers. Those are the major exchanges with 256 million customers.

Now, all those people don’t own Bitcoin. They own other cryptocurrencies. Which ones? Who knows. Motley Fool estimates the total at 12,000:

“There are now more than 12,000 cryptocurrencies, and what’s truly astonishing is the growth rate. The number of cryptocurrencies more than doubled from 2021 to 2022. At the end of 2021, the market was adding about 1,000 new cryptocurrencies every month.

“This isn’t entirely good news. Many new cryptocurrencies have little purpose other than making money for their developers, which means investors need to be selective. Only a small portion of cryptocurrencies are worth learning about and potentially buying.”[vi]

With all these computers holding up thousands of crypto coins, they share one thing in common. Their lifeblood is electricity.

Strike One Against Bitcoin: Electricity Consumption

In Bitcoin’s early years, miners used general-purpose graphics processing units (GPUs) and field-programmable gate arrays (FPGAs). But in 2012, the first application-specific integrated circuits (ASICs) came on the scene. In the words of Cambridge Bitcoin Electricity Consumption Index:

“ASICs are specialised hardware specifically optimised for Bitcoin mining that are orders of magnitude more efficient than previous devices used for mining. As a result, it did not take long for ASICs to dominate and eventually displace GPU and FPGA mining.”[vii]

Today, mining Bitcoins eats up an incredible amount of electricity. According to the New York Times:

“The process of creating Bitcoin to spend or trade consumes around 91 terawatt-hours of electricity annually, more than is used by Finland, a nation of about 5.5 million.”[viii]

According to recent studies, the increased energy consumption attributable to Bitcoin mining threatens “the ability of governments across the globe to reduce our dependence on climate-warming fossil fuels. If we do not take action to limit this growing industry now, we will not meet the goals set forth by the Paris Agreement and the Intergovernmental Panel on Climate Change to limit warning to 2°C.”[ix]

Earthjustice and the Sierra Club wrote a new guidebook that “comprehensively document[s] the explosive growth of cryptocurrency mining in the United States and examine[s] how this industry is impacting utilities, energy systems, emissions, communities and ratepayers.”[x]

Bitcoin Goes BOOM!

The Guidebook is entitled; The Energy Bomb: How Proof-of-Work Cryptocurrency Mining Worsens the Climate Crisis and Harms Communities Now. In the Guide, you’ll find vast amounts of information, not just about Bitcoin and air pollution but also about … noise pollution. Consider these local concerns:

“Neighbors have reported [various horror stories].

“At a mining facility in Limestone, Tennessee, residents have described the noise as ‘like a jet engine idling on a nearby tarmac.’ A commissioner who voted to approve the operation told a reporter that he has ‘never regretted a vote like this one. I sure wish I could take it back.’

“In Cherokee County, North Carolina, residents offer that the noise is ‘like living on top of Niagara Falls’ and ‘like sitting on the tarmac with a jet engine in front of you. But the jet never leaves. The jet never takes off…. It’s just constant annoyance.’”[xi]

Strike Two: Computers Are Thrown Away

As new computers become faster and more efficient, Bitcoin miners must buy new equipment. Their ASICs are primarily designed for Bitcoin mining, so when better equipment becomes available, they just junk existing systems. There’s a name for that: e-waste. And the amount of waste is significant. Again, the Times:

“Bitcoin mining means more than just emissions. Hardware piles up, too. Everyone wants the newest, fastest machinery, which causes high turnover and a new e‑waste problem. Alex de Vries, a Paris-based economist, estimates that every year and a half or so, the computational power of mining hardware doubles, making older machines obsolete. According to his calculations, at the start of 2021, Bitcoin alone was generating more e-waste than many midsize countries.

“‘Bitcoin miners are completely ignoring this issue, because they don’t have a solution,’ said Mr. de Vries, who runs Digiconomist, a site that tracks the sustainability of cryptocurrencies. ‘These machines are just dumped.’”[xii]

Strike Three: Just What Exactly Do You Own?

Jamie Dimon, the CEO of JP MorganChase, has his opinion of Bitcoin. He doesn’t hold back.

“Jamie Dimon didn’t mince words when a US lawmaker mentioned the executive’s history of criticizing cryptocurrencies.

‘‘I’m a major skeptic on crypto tokens, which you call currency, like Bitcoin,’ the JPMorgan Chase & Co. chief executive officer said in congressional testimony Wednesday. ‘They are decentralized Ponzi schemes.’”[xiii]

If you own a share of stock, you own part of a company. That company earns money. That company might own real estate. It might have valuable patents and trademarks. It might have a boatload of cash in its coffers. You own part of that.

Now you don’t have to own 1 Bitcoin to own cryptocurrency. You can buy $100 or even $1.00 worth of Bitcoin (the coin is divisible to 8 decimals).

So if you own $100 of Bitcoin, you own …. What? You own the ability to sell it or to send it to someone else. If you sell it, you hope the price has risen. So why is it worth anything?

“‘The reason why it’s worth money is simply that we, as people, decided it has value—same as gold,’ says Anton Mozgovoy, co-founder & CEO of digital financial service company Holyheld.”[xiv]

But it differs from gold. You can hold gold in your hand. But you can only “hold” Bitcoin in a crypto wallet or in a crypto exchange account … like the ones that Fidelity, Schwab, and Citadel are about to loose on the world.

When that exchange goes live, it will make the purchase of Bitcoin and other cryptocurrencies a great deal easier. And that will attract potentially millions of new people betting their hard-earned savings on what the esteemed Mr. Dimon calls a “Ponzi Scheme.”

The volatility of Bitcoin is notorious. It reached its all-time high (ATH) of $69,045 on Nov. 10, 2021. It’s price on Sept. 24, 2022, was $19,091. Those who buy today hope it reaches the ATH once again. Those who bought 1 Bitcoin at the ATH are nursing a $49,954 loss. That’s a 72% loss, leaving you with just 28% of what you started with. To recover all you lost, it will need to increase 257% to get back to its ATH. Not an easy task.

So Mr. Dimon has his opinion.

I have mine.

Bitcoin and all its relatives are going to end up as the world’s largest financial fraud. I am disappointed that Schwab has agreed to be part of this scheme. The reasons for the massive popularity of Bitcoin are several:

Ignorant Investors

Ill-informed speculators, especially those under 45, are rolling the dice, and don’t have a clue what it really is. It’s worse than betting at the Las Vegas Blackjack Tables.

Criminal Use

There is no doubt that Bitcoin has been used by criminals around the world to move money. There’s also no doubt that hundreds of millions of dollars have been stolen through various cryptocurrency frauds. Even though governments are having some success in tracking down crypto criminals,[xv] the fact remains; you can move millions of dollars anonymously with Bitcoin.

Market Manipulation

Watch out for the Whales.

The what?

The Whales.

In the world of Bitcoin, a Whale is a person, group of people, or organization that owns more than 1,000 Bitcoins (around $19 million at today’s prices). Whales have a huge amount of power over the crypto market. On April 2, 2019, for example, a single order for 20,000 Bitcoins was executed on three exchanges. The price jumped from $4,200 to $5,000 in just two hours. This single purchase triggered a change in sentiment. Bitcoin’s price increased 240% by the end of June.[xvi]

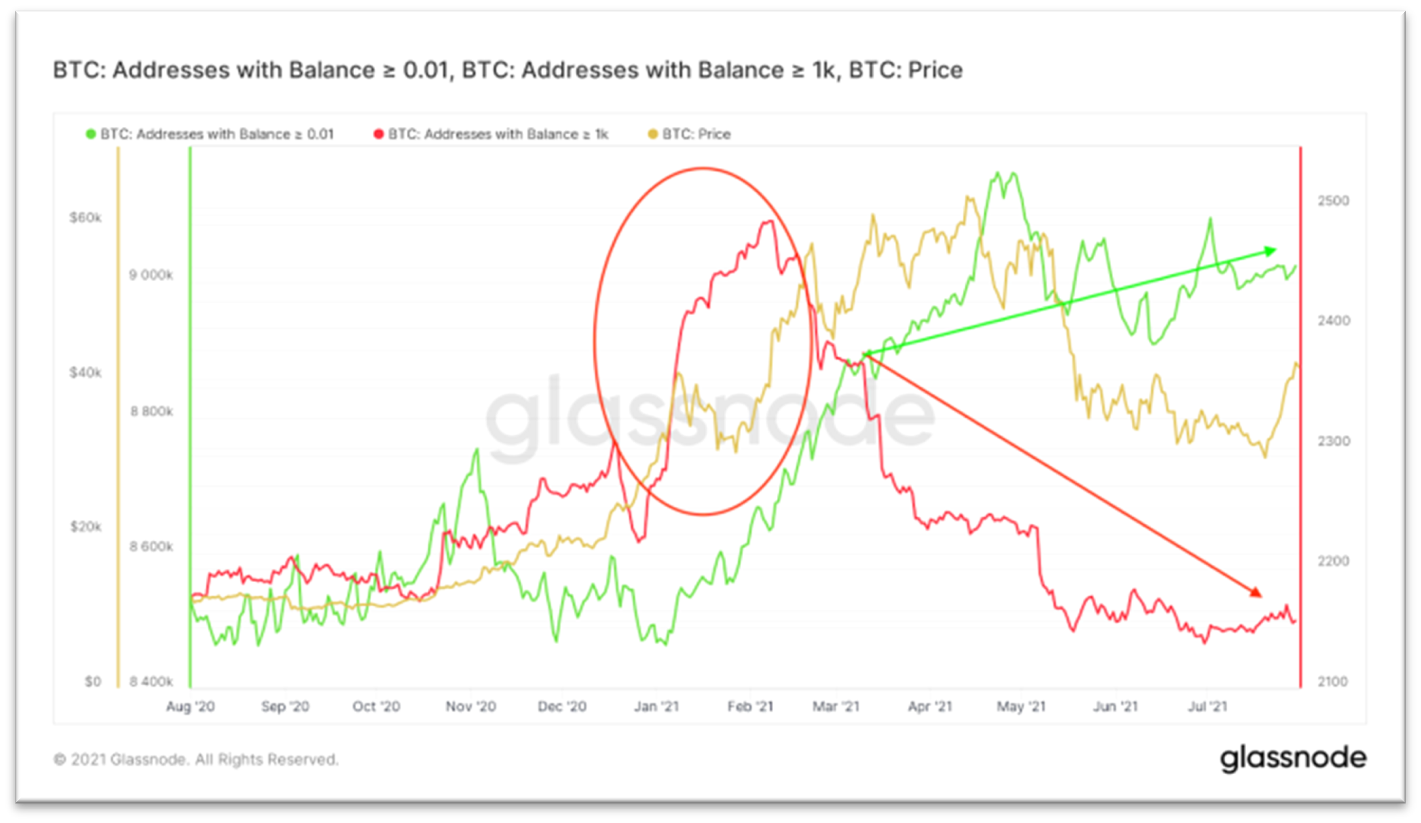

An even more telling Whale activity occurred in the spring of 2021. The chart below, from glassnode,[xvii] shows what happened. The red line shows the number of addresses holding 1,000 or more Bitcoins (Whales). The green line shows the number of addresses holding 0.01 or more Bitcoins (retail traders, that is, Krill). The gold line shows Bitcoin’s price. As you can see, in the middle of February Whales began selling their Bitcoins to those with small accounts as the price continued to rise. Then, the bottom fell out. Whales made millions. The little guys lost.