Veterans Day 2022

Join us in honoring Veterans Day and recognizing the deeply appreciated service of the U.S. military.

Join us in honoring Veterans Day and recognizing the deeply appreciated service of the U.S. military.

This is the most important article you will read this year. It is the details behind what we wrote about in Tuesday’s email. China wants Taiwan. Not to “reunite with the motherland”, and all the other BS reasons they dream up. There is one reason, and only one. China wants the TSCM foundry.

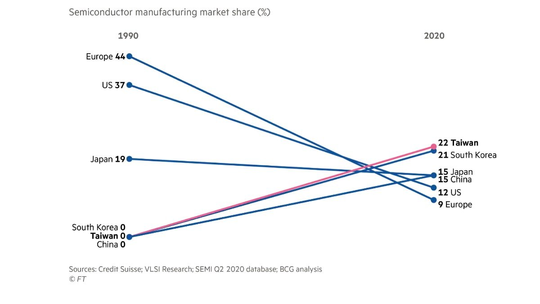

The chart below is very scary. Look at the comparison between semiconductor production by country from 1990 to 2020. 43% comes from Taiwan and South Korea. These chips are used in the production for everything from computers, cell phones, defense weaponry to cars. Wouldn’t be a problem except that China wants to invade Taiwan, and North Korea uses South Korea as a test site for nukes!!

Also, in the detail you will read the other scary stat: TSCM is responsible for 20% of all worldwide production and 92% of the advanced chips. I just don’t understand why the White House, the defense intelligence agencies, and the S&P 500 companies don’t have a high level working relationship to forecast these highly important manufacturing glitches that put the national defense and security of Americans first. Obviously, China does! You don’t need furniture from Vietnam. But life as you know it is OVER WITHOUT SEMICONDUCTOR CHIPS!

Yesterday the RFS investment committee made the tough decision to sell your “short” positions, SQQQ and SPXS. So far it is working. You’re probably wondering what has changed and why? The S&P 500 index, our main benchmark, has put up 6 green bars out of 9 in the last 9 days. Last Thursday we officially recorded a “crossover”. You likely remember what a crossover is from our prior emails; nonetheless, it is when one moving average “MA” crosses above or below another MA. The 5 day MA crossed back over the 10 day MA, which is historically a positive “buy” signal. Not a guarantee, but historically very accurate. Simply put, the average of the last 5 days is now higher than the average of the last 10.

The “whys” are not easy. I do not want to be accused of making a political statement, just reporting what is in all the news, including the Washington Post,

Wall Street Journal , and the NY Times. Investors appear to be regaining confidence in the markets as we approach the mid-term elections, which is 2 weeks from today. Putting aside a huge political or economic event, it appears the GOP will take control of both Houses of Congress. President Biden’s approval rating is at an all time low, and he recently suggested he may not run for a 2nd term. Investors and consumers alike are not happy with inflation, interest rates, food, and fuel prices. As you scan and/or read the articles below, the residential real estate market is in a total collapse, as well as new home construction. The 30 year mortgage rate just hit 7%, more than doubling the cost of a mortgage, which was 2.5%, 20% down, last October. Further interest rate increases are potentially in the near future as the Federal Reserve tries to try to help quell inflation which will take another bite out of your budget. Further, most consumers cannot afford new or used car loans, and the auto industry is still suffering from two years of chip shortages. In addition, Goldman Sachs reported yesterday that auto/truck loans are at a higher default rate than they were in July of 2009. One of the articles below reports that real estate agents are leaving the business at a higher rate than in 2008.

The political environment is not great either. President Xi of China just won reelection to a third term and consolidated his top 25 team with all staunch loyalists. He even dismissed, or “retired”, his immediate predecessor. Further, for the 1st time since 1947 there are no women on the top 25 team. All of this is directly from the New York Times.

Xi continues to have his eyes on Taiwan, where the big prize is the worlds largest semi-conductor foundry, TSMC. The NYT further wrote that if Xi invades Taiwan and captures the foundry we will have a worldwide economic collapse. A very good friend and client told me to buy and read, “The Avoidable War”, by Ken Rudd. He is the former Foreign Secretary and Prime Minister of Australia. Very scary stuff, as he knows what he is talking about.

And of course, Russia continues to wreak havoc in the Ukraine, and reducing many parts of the European economy to a standstill.

The realities of climate change aren’t helping either. As in a historic drought has sent the Mississippi River level to record lows, plus the water level in Europe is so low that barges and tourist ships cannot pass from Budapest to Amsterdam. Winter is coming and natural gas shortages could leave millions of Europeans without heating fuel.

That is all for now. We will continue to keep you posted. As always, please call me or write me back, and thanks to the many already doing that.

Praying for a peaceful and prosperous end to this madness.

Home prices cooled at a record pace

https://www.cnbc.com/2022/10/25/home-prices-cooled-at-a-record-pace-in-august-sp-case-shiller-says.html?__source=androidappshare

50% of voters expect the economy will get worse in 2023, new NBC News poll says

https://www.cnbc.com/video/2022/10/24/50-percent-of-voters-expect-the-economy-will-get-worse-in-2023.html?__source=androidappshare

The fate of the world economy may depend on what happens to a company most Americans have never heard of

https://www.businessinsider.com/tsmc-us-china-tensions-may-dictate-fate-of-global-economy-2022-10?nr_email_referer=1&utm_source=Sailthru&utm_medium=email&utm_content=10_things_tech&utm_campaign=Post%20Blast%20sai:%20

A “Record” Number Of Real Estate Agents Will Quit Due To Economy, Realtor Predicts

https://quoththeraven.substack.com/p/a-record-number-of-real-estate-agents?utm_source=substack&utm_medium=email

Southwest Florida real estate expert gives outlook on market

https://www.winknews.com/2022/10/17/southwest-florida-real-estate-expert-gives-outlook-on-market/

Home asking prices tumble at record pace as mortgage rates surge: data

https://nypost.com/2022/10/17/home-asking-prices-tumble-at-record-pace-as-mortgage-rates-surge/

QQQ: U.S. ETF market contracts by $1.1T since it peaked back in March

https://seekingalpha.com/news/3892588-us-etf-market-has-shrunk-by-11t-since-it-peaked-back-in-march?mailingid=29423248&messageid=2900&serial=29423248.15777&utm_campaign=rta-stock-news&utm_content=link-3&utm_medium=email&utm_source=seeking_alpha&utm_term=29423248.15777

Mortgage demand drops to a 25-year low, as interest rates climb

https://www.cnbc.com/2022/10/19/mortgage-demand-drops-to-a-25-year-low-as-interest-rates-climb.html?__source=newsletter%7Cmorningsquawk

Recession-proof Microsoft lays off nearly 1,000 employees across the company – Fortune

https://fortune.com/2022/10/18/recession-microsoft-software-tech-layoffs-staff-employees/

The market’s having a trying month. Fortunately, we are attuned to the economic reports that are coming out daily and will safeguard your portfolios by adjusting to the news.

Jerome Powell, Chairman of the Federal Reserve, repeatedly has confirmed the intention to continue to raise interest rates in order to stem rampant inflation now running at close to 8%. The Fed seeks to achieve a target 2% inflation rate. Economist Steve Hanke, Senior Fellow at the Cato Institute and longtime professor at Johns Hopkins University, warned this week that we should expect a “whopper of a recession” in 2023. He bases his prediction on “unprecedented growth” in the money supply since the Pandemic.[1]

The Dow Jones, Standard & Poors 500, and NASDAQ indices all are down 3.5 – 4.5% this month, affecting all market sectors except energy, which has risen at the same time that prices at the pump have been on a steady decline.

On the other side of the coin is the news that the money supply has, in fact, leveled off since February. Volatility in the market has begun to trend downward, non-farm unemployment is just 3.5%,[2] and corporate profits have been fairly solid in the U.S. as well as in Europe. Although the market has been negative all week, the downward movement appears to be moderating today.

So what does this mean to you, the investor? Today there are many market sectors that appear to be attractively priced. As we believe that the risk of missing the upside recovery may be greater than the risk of missing the bottom of the market, we will continue to look for opportunities to place your funds where you can derive the greatest benefit. The bottom line is we have a plan and will continue to monitor and adjust your portfolios to navigate the difficult market we are now experiencing.

Motley Fool wrapped up Foolfest, its annual investment conference, yesterday, emphasizing optimistic views on a number of individual stocks. We also see some room for guarded optimism and continue to advocate that one should engage primarily in index and ETF investing. We will track the trends and invest your funds accordingly – on both the long and short sides of the Market. But we will continue to let the experts pick the individual securities that populate these funds.

As I write this at 3:00 p.m., the RFS Growth Model is ahead of the S&P 500 Index by greater than 7% for August. Our triple short ETF positions comprise 45% of the Model and have significantly enhanced our performance. This is why you rely upon RFS. We thank you for your continued confidence and support.

[1] CNBC Interview, August 29, 2022

[2] United States Bureau of Labor Statistics news release August 5, 2022

It Was the Best of Times ….

On Friday the 26th, we locked in a big win.

Nine days earlier, on Wednesday the 17th, as a protective shield, we purchased a large position in SQQQ, a triple short.

We sold that position on Friday, earning an 11% profit on a 40% size (we invested 40% of each account in SQQQ).

Our AG model, aggressive growth, for the month of August, is beating the S&P 500 by an outstanding +300 basis points. The S&P is down 1.59%. That is an RFS win of +4.59% (one basis point is 0.01 %).

It Was the Worst of Times ….

I have no idea what the Fed and the White House are doing.

All I can tell you is investors and institutions don’t like it. I believe more pain lies ahead, and the current bear market could rival the period from October 2007 to March 2009―a nightmarish bear market of -57% on the S&P 500. I am far from alone in having that opinion, and lots of bad news out there supports that view.

Much of the bad news I’ve covered in recent emails. Unfortunately, there’s more.

Water Water Nowhere and Not a Drop ….

Bloomberg reported on a world-wide fresh water shortage with over 20 pics of rivers and lakes bone dry. The pics are staggering! (You can get an intro subscription to Bloomberg for $1.99/month here.) In one case, the Rhine and the Danube, where they try to connect to the Main going over Switzerland, the rivers no longer connect. Water levels are so low that all boats, barges, and cruise ships cannot pass. I have been there, and have seen it. It briefly happened in July, 2015. This is much worse. This is crippling transportation of oil, food, grains, etc., and causing the cancellation of thousands of cruise ship reservations.

The “leisure” sector stock market index, which includes all the publicly traded cruise lines, is -31% YTD. Europe is in an economic free fall. Bloomberg also went on to say that thousands will suffer from hunger this winter, mostly eastern Europe, and millions in the UK are facing heating energy price increases of over 300%.[1]

Here in the U.S., we are having the same problem with the Colorado and Rio Grande rivers, creating massive shortages of fresh water delivery to Los Angeles and all of southern California and east to Arizona and beyond.

Impact on People

The saddest news of all is that domestic violence, drug abuse, and suicides are all on the rise in the U.S. Along with abortions, this portends a huge, long-term demographic problem for the U.S.―fewer babies, fewer employees, fewer tax payers, fewer consumers.

Lastly, Bloomberg included numerous reports of higher delinquency levels of mortgages and auto/truck loans. They sit at their highest marks since the March 2009 Great Recession.

All of this comes from Bloomberg, so you might want to consider a subscription for $1.99/month (here).

Maybe someone can explain the game plan of the Fed and the White House.

I cannot.

I do know that everything can get a lot worse before it gets better.

Prepare to see another position in SQQQ soon.

If you have any questions, comments, or suggestions, please call us at 301-294-7500. We are always happy to answer any questions you have.

Inflation is proving to be far more tenacious than financial markets had hoped.

The idea that inflation peaked in March was put to rest last week when the Consumer Price Index (CPI) showed that inflation accelerated in May. Overall, prices were up 8.6 percent last month, an increase from April’s 8.3 percent. It was the highest inflation reading we’ve seen since December 1981.

The most significant price increases were in energy (+34.6%) and food (+10.1%). That’s unfortunate because the War in Ukraine has a significant influence on food and energy prices right now, and no one knows how long it will last. In April, the World Bank’s Commodity Markets Outlook reported:

“The war in Ukraine has been a major shock to global commodity markets. The supply of several commodities has been disrupted, leading to sharply higher prices, particularly for energy (natural gas, coal, crude oil), fertilizers, and some grains (wheat, barley, and corn).”

With inflation rising, the Federal Reserve will continue to aggressively raise the federal funds rate. There is a 50-50 chance the Fed will raise rates by 0.75 percent in July (rather than 0.50 percent), and some economists say there could be a 0.75% hike this week when the Fed meets, reported Scott Lanman and Kristin Aquino of Bloomberg.

Mortgage rates jumped sharply this week, as fears of a potentially more aggressive rate hike from the federal reserve upset markets.

The average rate on a 30-year fixed mortgage rose 10 basis points to 6.28% Tuesday. That followed a 33 basis point jump Monday. The rate was 5.55% one week ago.

Rising rates have caused a sharp turnaround in the housing market. Mortgage demand has plummeted. Home sales have fallen for six straight months, according to the National Association of Realtors. Rising rates have so far done little to chill the red-hot home prices fueled by historically strong, pandemic-driven demand and record low supply.

The inflation news unsettled already volatile stock and bond markets. Major U.S. stock indices declined last week as investors reassessed the potential impact of higher interest rates and inflation on company earnings and share prices, reported Randall W. Forsyth of Barron’s. The Treasury yield curve flattened a bit as the yield on two-year Treasuries rose to a multi-year high, reported Jacob Sonenshine and Jack Denton of Barron’s. The benchmark 10-year Treasury Note finished the week yielding more than 3 percent.

There was a hint of good news in the report. The core CPI, which excludes food and energy prices because they are volatile and can distort pricing trends, is trending lower. It dropped from 6.5 percent in March to 6.2 percent in April and 6.0 percent in May.

The Federal Reserve’s favored inflation gauge is the Personal Consumption Price (PCE) Index, which will be released on June 30.

COPING WITH A BEAR MARKET IS NOT EASY.

A bear market occurs when stocks have declined in value by about 20 percent or more. Investing during a bear market can be a lot like playing baseball for a team that’s in a slump. Your teammates are worried, hecklers distract the players’ attention, and the team’s record of wins and losses moves in the wrong direction. You might find yourself beginning to question whether playing baseball is right for you.

Here are some interesting statistics for coping with bear markets:

Remember, downturns don’t last forever.

The Standard & poor’s 500 Index has experienced 8 bear markets over the last 50 years and recovered from all of them, reported Thomas Franck of CNBC. Here’s a rundown of the duration and returns of bear and bull markets since 1973.

Year Bear market Total return Bull market Total return

1973 21 months -48 percent 74 months +126 percent

1980 20 months -27 percent 60 months +229 percent

1987 3 months -34 percent 31 months + 65 percent

1990 3 months -20 percent 113 months +417 percent

2000 31 months -49 percent 60 months +102 percent

2007 17 months -57 percent 131 months +401 percent

2020 1.5 months -34 percent 21 months +114%

2022 5 months to date -22 percent TBD TBD

As you can see from the chart, bull markets tend to last far longer and generate moves of far greater magnitude than bear markets. Time after time, bear markets have proven to be good buying opportunities for long-term investors.

The current market conditions, as further compounded by the Russia/Ukraine war, as well as interest rates and inflation skyrocketing, have produced an environment unseen since ‘73/’74. All the benchmarks for stocks and bonds are double digit negative. The only asset class producing YTD positive gains is commodities: energy, food and grains, and metals. I DO NOT SEE one good reason for the overall markets to not continue to fall further. We will most likely be adding a SPXS and SQQQ positions (benefiting as the markets go down) to our investment models.

A recap of 2022 YTD symbols:

The Good, The Bad, The Ugly

S&P 500 -21.63%

DIA -16.29%

QQQ, TECHNOLOGY -30.58%

COMPQX -30.79%

IJH, MID CAP 400 -19.75%

IJR, SMALL CAP 600 -18.67%

IWM, RUSSELL 2000 -23.86%

RSP, EQUAL WEIGHT SPY -17.67%

RPG, SPY GROWTH -30.47%

RPV, SPY VALUE -4.84%

SPHB, SPY HI BETA -24.85%

AGG, THE AGGREGATE BOND INDEX -13.69%

GLD, GOLD –1.33%

SLV, SILVER -9.81%

What is working:

UNG, natural gas +96.64%

UGA, gasoline +81.47%

USO, oil +63.08%

XME, metals and mining +6.41%

WEAT, wheat +45.74%

CORN, corn +32.36%

CANE, sugar +2.39%

JJA, agriculture +25.55%

JJE, energy +94.01%

JJG, grains +31.67%

JJN, nickel +21.89%

SPXS, 3 X short SPY +72.65%

SQQQ, 3 X short QQQ +114.38%

Talk with us.

During market downturns, investors often panic. That causes some to want to sell investments and incur losses that may be difficult to recover. If you’re tempted to sell, give us a call. We’ll discuss your concerns, review your portfolio and help you decide on a course of action.

Weekly Focus – Think About It

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.”

—Peter Lynch, former portfolio manager

Sources:

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.bls.gov/news.release/archives/cpi_05112022.htm

https://openknowledge.worldbank.org/bitstream/handle/10986/37223/CMO-April-2022.pdf [Page 4]

https://www.bloomberg.com/news/articles/2022-06-10/barclays-sees-75-basis-point-fed-hike-next-week-on-price-surge (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-13-22_Bloomberg_Barclays%2c%20Traders%20Set%20Sights%20on%20Fed%20Rate%20Hike_4.pdf)

https://www.barrons.com/articles/inflation-is-hot-and-stocks-are-cold-now-the-fed-needs-to-rethink-its-rosy-projections-51654908515 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-13-22_Barrons_Inflation%20is%20Hot%20and%20Stocks%20Are%20Cold_5.pdf)

https://www.barrons.com/articles/stock-market-today-51654850113?mod=hpsubnav

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202206

https://www.frbsf.org/education/publications/doctor-econ/2004/october/core-inflation-headline/

https://www.bls.gov/news.release/archives/cpi_04122022.htm

https://www.cnbc.com/2020/03/14/a-look-at-bear-and-bull-markets-through-history.html

https://www.investopedia.com/financial-edge/0511/the-top-17-investing-quotes-of-all-time.aspx

TC2000

https://www.mortgagenewsdaily.com/

https://www.cnbc.com/2022/06/08/mortgage-demand-falls-to-the-lowest-level-in-22-years.html