No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

If you haven’t already contributed to an IRA (Individual Retirement Account), there’s still time to do so. Many people don’t know that the 2018 contribution deadline is actually the 15th of April. However, if you do decide to contribute, you must designate the year you are contributing for. Your tax preparer should be able to help you fill out the necessary forms.

For 2018, the maximum amount you can contribute is $5500 or $6500 if you’re over the age of 50. This applies to both traditional and Roth IRAs. If you’re unsure whether to contribute or not, remember:

If you have yet to set up an IRA for 2018, you can still do that. The deadline to establish an IRA is April 15th as well. In other words, if you want to take advantage of the benefits an IRA has to offer, there’s still time to do so, either by contributing to an existing account or by establishing a new one.

If you have any questions about IRAs—whether it’s the right decision for you, how your IRA should be managed, or anything else—please give us a call at 301-294-7500. We would be happy to speak with you.

From someone who is considered one of the greatest investors of all time

During the past century, many of the world’s leading economists have studied the science – or art – of investing. A large number of investing systems, models, and theories have been created, most of them requiring a PhD to understand. But when it comes to learning how to invest, sometimes it’s best to turn to the people who actually do it for a living.

Case in point, take Peter Lynch.

From 1977 through 1990, Lynch ran one of the most successful mutual funds ever, posting an average annual return of 29%. Over his career, Lynch espoused many investing principles, but there are seven in particular that I think all investors should keep in mind.1 So without further ado, here are:

Peter Lynch’s 7 Rules of Investing

1. KNOW WHAT YOU OWN. Invest in companies, industries, and funds you understand well. What do they do? Who uses their goods or services? Is it a company you would want to do business with yourself?

2. PREDICTION IS FUTILE. No one can predict where the markets will go or what the economy will do, so don’t even try. Instead, focus on what you can control, like the types of companies or funds you invest in, how much you save, etc.

3. BEFORE YOU BUY, BE ABLE TO EXPLAIN. Before investing, can you explain to a family member what you’re buying and why? Can you describe how that company or fund works? If not, take your time and do more research.

4. AVOID LONG SHOTS. Investing isn’t gambling, either. While we have no control over the markets, we do have control over how much risk we take on. Your portfolio isn’t the place for speculation or bets. For that, head to Vegas.

5. BUY GOOD COMPANIES. Invest in companies that have proven management, a strong business model, and that sell things people actually use. Otherwise, you’re investing in companies you guess might prove popular…and that’s just another form of gambling.

6. LEARN FROM YOUR MISTAKES. Even the greatest investors sometimes get things wrong. When that happens, accept it humbly and try to determine how you can improve.

7. TAKE YOUR TIME. Investing isn’t a race. You have plenty of time to do your research and find outstanding companies to invest in. Follow the tortoise’s example, not the hare’s.

Ultimately, all investing comes with risk, and there is no strategy or rule that guarantees success. But there are solid “rules of thumb” you can follow to make smart, simple investment decisions. And best of all, you don’t need a PhD to understand them!

1 “The Greatest Investors: Peter Lynch” https://www.investopedia.com/university/greatest/peterlynch.asp

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Tax season is the time between January 1 and April 15. It is when most people prepare and file their taxes. This year’s tax season is special. It has been just a little over a year since the Tax Cuts and Jobs Act went into effect. It is the largest overhaul of the tax code since 1986 and the still-relatively-new law could have a major impact on your taxes, including your refund. Just for that reason, I thought it would be good to review what the law changed, as well as what you can do to minimize headaches as you file your taxes ahead of the April 15 deadline.

Quick disclaimer: The tax law is a politically charged subject, but you will not find any politics here. While some experts may argue whether the tax law has been good or bad for the country, this letter is only about how the law may affect you. So, without further do, let’s discuss:

Major Changes to Remember as You File

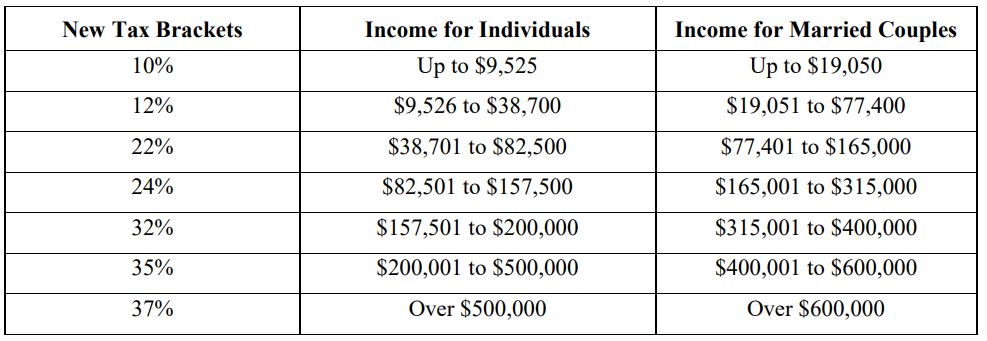

The most obvious major change to remember is that most tax rates have been reduced. That means there’s a good chance you paid less in taxes over the past year. Here’s how the various tax brackets look now: 1

If you receive a paycheck every month, you should pay special attention to your federal income tax withholding this year. This is the amount of federal income tax withheld from your paycheck. Because of the new tax brackets, most people started seeing withholding changes around February or March of last year. And while it’s likely that less of your paycheck went to federal income taxes, you should still scrutinize your withholding carefully to make sure it’s correct. The last thing you want is to find that not enough tax was withheld by your employer! That could require you to pay a penalty when you file your return.

According to the IRS1, people who meet any of the following criteria should be especially careful when checking their withholding:

• Belong to a two-income family.

• Work two more jobs, or only work for part of the year.

• Have children and claim credits such as the Child Tax Credit.

• Have older dependents, including children age 17 or older.

• Claimed itemized deductions on their prior year’s tax returns.

• Earn high incomes and have more complex tax returns.

• Received large tax refunds or had large tax bills for the prior year.

Ensuring the accuracy of your withholding is always important, of course, but because of all the changes to the tax code, it’s more critical than ever that you be thorough! Speaking of changes, let’s now turn to:

Changes to Deductions

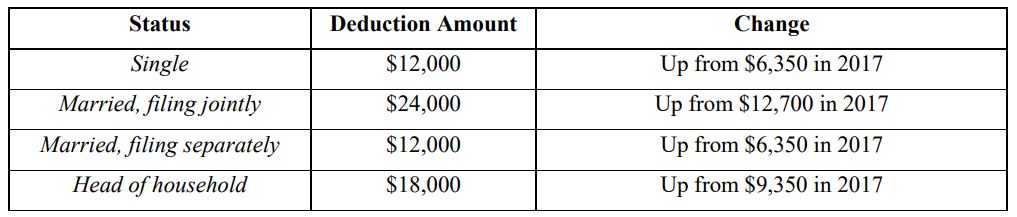

There are two basic kinds of deductions – standard and itemized. As the IRS puts it, “The standard deduction is a dollar amount that reduces the amount of income on which you are taxed and varies according to your filing status.” 1 The new tax law nearly doubled standard deductions. Here’s what the new standard deduction looks like:1

But all this comes with a catch: You can’t take the standard deduction if you also itemize deductions. And for married couples filing separately, both spouses must take the same type of deduction. So if one spouse chooses to itemize, the other spouse must as well. So, here’s what you need to determine: Will you enjoy a larger tax cut by taking the standard deduction, or itemized?

For most people, the standard deduction is probably the way to go. But if you still choose to take itemized deductions, there are changes to those you need to be aware of as well. For instance:

Medical expenses: For your 2018 taxes, you can deduct out-of-pocket medical and dental expenses that exceed 7.5% of your “adjusted gross income”. (This is your total gross income minus specific deductions.) This is down from the previous 10%, although the level returns to normal next year.1

State and local taxes: One of the biggest changes to itemized deductions is that you can now deduct no more than $10,000 of any combination of state and local income taxes, sales taxes, and property taxes. For people living in high-tax states, this is perhaps the single biggest reason why it now makes more sense to take the standard deduction. 1

Mortgage interest: If you took out a mortgage or home equity loan before December 15, 2017, you can deduct up to $1,000,000 in interest. However, the new tax law caps the deduction at $750,000 for loans taken out after that date. 1

Charitable contributions: The limit on charitable contributions in cash is now 60% of your adjusted gross income, up from 50% before the new tax law. That means you may be able to deduct more of any charitable cash contributions you made in 2018. 1

Changes to Child Tax Credits and the AMT

Due to the new law, more families with children under 17 now qualify for a larger child tax credit. For your 2018 return, the maximum credit is now $2,000 per child for individuals earning up to $200,000 and married couples earning up to $400,000, so long as they file jointly. 1

Another major change to this tax season is that fewer people now pay the Alternative Minimum Tax, or AMT. Long considered one of the most complex aspects of the tax code, the AMT was originally designed to prevent using a dizzying array of credits, deductions, and loopholes to avoid taxes altogether. Over the decades, however, the AMT began hitting those who were already paying a host of other taxes.

Calculating what amount people actually pay is a complex process, and that has not changed. What has changed, however, is the threshold at which people are exempt from paying the AMT. For individuals, the exemption level has increased to $70,300, up from $54,300. For married couples who file jointly, the exemption has risen to $109,400, up from $84,500. 1

A few more things to be aware of this tax season

It’s impossible to cover all the ways the new tax law will affect your filing this year. But there are a few more things to be aware of.

Tax Refunds

First, your tax refund could be smaller than in years past. As of this writing, the IRS has reported the average refund to be 8.4% less than last year.2

This shouldn’t come as a surprise. Since many people received a tax cut in 2018, refunds will also go down. That’s especially true for people who previously used itemized deductions on their property and local income taxes. The changes in federal tax withholding also play a major role. It’s possible, too, that many people will end owing money to the government this year.

For that reason, taxpayers should hold off on planning any major purchases until they know exactly what their refund will be.

The IRS is playing catch-up

As you probably know, Washington was paralyzed by the longest government shutdown in history earlier this year. During the shutdown, the IRS operated with only 12% of its staff.3 That means the IRS has a lot to catch up on, including answering questions, preparing reports, processing returns, and distributing refunds. And because the tax code is so different now, you may need to wait longer than normal to get your questions answered or get your refund.

Ways to de-stress your tax filing

Preparing your taxes is never fun, but there are ways to minimize stress. For example:

1. Work with a qualified professional. While there is software aplenty to help you file, nothing beats working with an experienced Certified Public Accountant. I would be happy to put you in touch with a good one if you need assistance with this.

2. File electronically. If you’re doing it on your own, it’s better – and faster – to file electronically than on paper. You can learn more at www.irs.gov/filing/free-file-do-yourfederal-taxes-for-free.

3. Do a “paycheck checkup.” This is a resource the IRS provides to determine if you need to adjust your withholding or make additional tax payments. Visit www.irs.gov/paycheck-checkup to learn more.

4. Start now. If you’ve already finished your tax return, great! But if not, don’t delay. Start gathering documents, writing down questions, and examining your options. The easiest way to ensure tax-related headaches – and make mistakes on your return – is to wait until the last minute.

I hope you found this letter helpful. Of course, if you have any questions, please don’t hesitate to contact us! Finally, remember that we at Research Financial Strategies are here to help you work toward your financial goals. Please let us know if there’s ever anything we can do.

1 “Tax Reform: Basics for Individuals and Families,” Internal Revenue Service, https://www.irs.gov/pub/irs-pdf/p5307.pdf%20

2 “Filing Season Statistics for Week Ending February 1, 2019.” Internal Revenue Service, https://www.irs.gov/newsroom/filing-season-statistics-for-week-ending-february-1-2019

3 “Federal shutdown means tax refunds may be delayed,” CNBC, https://www.cnbc.com/2019/01/04/what-the-federal-shutdown-could-mean-for-tax-season.html

As you probably know, there has been a lot of market volatility in recent months. Being a financial advisor, I get asked a lot of questions, even from people who aren’t my clients! Some ask if it’s a good time to invest in the markets, or if they should be sticking their money under a mattress. Others ask me about what the future holds for the economy. But the most common question I get is this:

“What,” they say, “is the number one financial tip you can give me?”

Here’s my answer:

You’re probably wondering what I mean. It’s simple. When is the worst time to buy a home security system? After a break-in. When’s the worst time to check your tire pressure? After you’ve already had a blowout. When’s the worst time to put your seatbelt on?

You get the idea.

It’s a fundamental fact of life, and it extends to your finances, too. I can’t say for sure when the next bear market will come – and the recent volatility is not necessarily an indication that a bear is just around the corner. What I can say, however, is that a bear market is inevitable, because the markets can take hits just like everything else.

Whether the next bear market comes this year or next, there’s only one thing to do about it, and that’s to have a plan. But a plan is nearly useless after the fact.

We’ve known this lesson since we were kids. Aesop, that ancient master of common sense, says it better than I can in his story, “The Caged Bird and the Bat.”

A singing bird was confined in a cage which hung outside a window and had a way of singing at night when all other birds were asleep. One night, a bat came and clung to the bars of the cage. The bat asked the bird why she was silent by day and sang only at night.

“I have a very good reason for doing so,” said the bird. “It was once when I was singing in the daytime that a fowler was attracted by my voice. He set his nets for me and caught me. Since then, I have never sung except by night.” The bat replied, “It is no use your doing that now when you are a prisoner. If only you had done so before you were caught, you might still have been free.”

As your financial advisor, one of my most important responsibilities is to help you do now what people in the future will wish they had done earlier. That includes preparing for more market volatility.

By reviewing your portfolio, your goals, your current vulnerability to risk, and your overall finances, we can do what needs to be done now rather than waiting until it’s too late. We can plan for the future before the future becomes the present. We can take precautions before the next market crisis. Please fill the questionnaire out and return it to me as soon as possible. By doing this, we can determine:

• Whether it’s time to focus on preserving your money over growing your money.

• Whether you currently own investments not under my management that are unsuitable for your financial goals – especially with more volatility knocking on the door.

• How the recent volatility may be affecting you and what we can do about it.

Market volatility is on the rise. By taking suitable precautions with your money, you’ll find that it’s always there to support you.

Because, after all… Precautions are useless after a crisis.

As always, thank you for your business! We look forward to hearing from you soon.

Me and You. True Love. Be Mine.

People have been giving candy hearts with little messages on them for Valentine’s Day for over 100 years. But most likely not this year. A new company purchased the rights to the sweets but announced they would not have enough time to make them for this Valentine’s Day.1

For the first time in over a century, everyone will have to celebrate Valentine’s without the day’s most popular candy.2

A crisis? Not really. When I saw the news circulating on the internet, it got me pondering about something called The Five Love Languages. You see, there’s a theory that every person expresses and experiences love in different “languages”. To put it simply, each of us has our own preferred way of receiving love from others.

For example, some people feel the most loved when they hear words of gratitude and affirmation.

You inspire me.

I love you.

Thank you.

Others feel the most loved when they receive acts of service.

Breakfast in bed.

Folding the laundry.

Watching the kids so he/she can sleep in.

Some feel most loved when they receive gifts.

That new book they’ve been wanting to read.

Flowers.

Their favorite chocolate.

Others simply want to spend quality time with their spouse or partner.

Conversation.

Date night!

A weekend away at a B&B.

For the rest, there’s no stronger sign of love than physical touch.

A passionate kiss.

A long hug.

A tender massage.

First proposed in 1995 by author Gary Chapman, the theory has inspired many people to practice expressing love for their partner in the way that means the most to them. But here’s the amazing thing. Whichever love language you or your significant other prefers, they all have something in common: They are all so easy to speak!

That’s the thing about true love: It doesn’t take much to express it!

How difficult is it to tell someone you love them every day?

How much time does it take to do the dishes?

How much effort does it require to spend an intimate evening with the person who means more to you than anyone else?

The answer: Not difficult/Not much time/Not much effort at all.

Most of the time, we make a big deal about the pageantry and traditions of Valentine’s Day, when really, the day is simply an opportunity. An opportunity to do something, give something, or say something in a way that means the most to the person who matters the most.

And that’s why Valentine’s Day doesn’t need candy hearts. Because, in the end: Candy hearts take months to make, but connecting hearts takes only seconds or minutes.

On behalf of everyone at Research Financial Strategies, I wish you and yours a lovely Valentine’s Day!

1 “America’s favorite Valentine’s Day candy is unavailable this year,” CNBC, January 23, 2019. https://www.cnbc.com/2019/01/23/americas-favorite-valentines-day-candy-is-unavailable-this-year.html

2 “Most Popular Valentine’s Candy by State,” CandyStore.com, January 17, 2019. https://www.candystore.com/blog/holidays/valentines-candy-popular-states/

3 “The Five Love Languages,” Wikipedia, https://en.wikipedia.org/wiki/The_Five_Love_Languages

It was a rough fourth quarter of 2018 for the markets. It seems like week after week, the major indexes – like the Dow and S&P 500 – get hammered by volatility. These days, just about every news website you can find is packed with breathless headlines about plummeting stocks, photos of nervous-looking traders, government shutdowns and editorials about a possible bear market sometime in 2019.

Frankly, it’s true. One major index was brushing up against a bear already, and it’s possible volatility will continue for the foreseeable future. But does that mean we should panic?

Nope.

Okay, take another deep breath. Market volatility is unpleasant, and here at Research Financial Strategies, we certainly take it seriously. But panic? Never. Let’s break this down objectively by discussing:

Five Things to Know about Market Volatility

1. The definition of a bear market.

A bear market is defined as a 20%-or-greater decline from a recent peak. As of this writing, the Nasdaq, an index largely comprised of technology stocks, is flirting with bear market territory.1 The other two main indexes, the Dow and the S&P, are still some distance away. Instead, the Dow and the S&P are hovering around what’s known as a market correction, which is a 10%-or-greater drop from a recent peak. Whether that correction will eventually turn into a bear is impossible to say, but regardless, here’s what investors need to remember:

2. Corrections – and even bear markets – are a normal part of investing.

On average, a market correction occurs about every 1-2 years. In fact, both the Dow and the S&P 500 endured brief corrections earlier this year before soaring to new heights. Bear markets are less common, but far from rare. Between 1900 and 2015, the markets encountered 32 bears – roughly one every 3.5 years.2

Pleasant? No. Normal? Absolutely.

In a sense, a market correction is like the common cold. Annoying – but you tend to get one every year, and it hardly stops you from living your life. A bear market is more like influenza. It makes the average investor feel miserable, and you certainly should treat it seriously. But for most people, it’s nothing to panic about. You get some rest, follow your doctor’s orders, and wait to get better.

Right now, the markets have a cold. Do colds sometimes turn into the flu? Sure, and it’s possible the current correction will develop into a bear. But it’s not unusual and it’s nothing to freak out about.

3. Panic only makes things worse.

Imagine you got sick and then didn’t get better as quickly as you wanted. Would you start panicking? No. You would probably go see a doctor, but you wouldn’t resort to extreme measures like using leeches or asking for an operation.

Unfortunately, investors aren’t always so rational. The fact is, many investors do panic during corrections and bear markets, especially if they last for a long time. They sell all their investments without forethought, or move everything over into bonds, or any of a hundred other things. It’s reckless – and recklessness has destroyed more wealth than any bear market.

History shows that it takes around four months for the markets to recover from a correction, and twentytwo months from a bear.3 Some are shorter, some are longer, but regardless of the duration, our own emotions are the bigger problem.

When we get sick, we understand that it might take a while before we feel entirely normal. It’s a healthy acceptance of reality – and it’s a key part of getting better.

As investors, we need to bring the same acceptance to the markets.

4. The best way to combat panic is to increase our own knowledge.

When you’re sick, you go to the doctor and ask questions. Or you research your symptoms online, hoping to find answers there. Maybe you fire up an old episode of The Magic School Bus. Either way, you seek to understand exactly what’s going on in your body – and what your body’s doing to fight the infection. And if you’ve ever known anyone with a chronic illness, you’ve probably heard them say that simply understanding what was going on made them feel much, much better.

Let’s do that right now by looking at what’s causing this current market malaise. In this case, there are four main factors:

Interest rates. The Federal Reserve raised the country’s key interest rate on Wednesday, December 19.4 This was expected. Part of the Fed’s mandate is to raise interest rates when the economy is strong – as it currently is – because a strong economy mixed with low rates often leads to inflation. However, the markets don’t always appreciate higher interest rates, because it makes borrowing more expensive. This, in turn, reduces spending and can slow economic growth. Which leads me to the next factor.

The economy may be slowing down anyway. Make no mistake, the economy is currently strong – but there are signs that it might be weakening a little. Corporate earnings are slowing, many corporations are deeply in debt, oil prices have fallen dramatically, and the housing market is coughing, too. Some analysts even believe the U.S. is due for a recession in 2020 or 2021. This has many calling for the Fed to cut back on raising interest rates, and the Fed itself predicted it would only do it twice in 2019. 4

Another possible reason for a slowing economy is the third factor, which is:

The trade war. Trade tensions with China continue, and while new tariffs are on hold for now, there’s no immediate end in sight. It’s not hard to understand why the markets worry about this so much. Tariffs – essentially a tax on imported goods and services – often hurt businesses. That’s because higher tariffs often lead to higher prices, which in turn lead to higher expenses. For example, if companies must pay more for the raw materials they need, that can significantly eat into their own profits. This, in turn, can lead to shipping delays, supply chain problems, higher prices for consumers, a resulting loss of business, you name it. All these issues, of course, are then reflected in the stock prices of the various companies affected.

Investor psychology. We already talked about the dangers of panicking. With any market correction, fear is always a factor. In this case, pundits have been proclaiming for months that the bull market may be ending, and that a bear isn’t so far away. This often becomes a self-fulfilling prophecy, because bearphobic investors will soon see bear tracks everywhere they look. This fear leads to panic, panic leads to sell-offs, and sell-offs lead to corrections.

So, what can we do with this information? We can use it to understand there are reasons for the current market volatility, just as there are reasons we get sick. Neither, however, spells certain disaster or the end of the world.

5. Accepting market volatility as normal doesn’t mean we don’t have a plan for dealing with it.

The final thing you should know about bear markets is also the most important.

Here at Research Financial Strategies, we believe strongly in the use of technical analysis. That means we decide when to buy and when to sell based on supply and demand, not storylines in the media or emotion. We have long been prepared to “go on defense” when necessary, and we understand that protecting your money is just as important as growing it.

Using technical analysis, we look at market trends. Is the market trending up or down? What about different sectors of the market? What about your individual investments? As you know, we have rules in place specific to you that determine at what point in a trend we decide to buy, and at what point we decide to sell. For example, if an investment trends down below a certain price, we follow the rules and sell. Period. If an investment trends up above a certain price, we buy. This allows us to make investment decisions based on what makes sense for you rather than just following the herd. And the best part about this kind of approach? It works whether we’re in a bull market or a bear! Other investment philosophies, like buy-and-hold, can’t say the same.

It’s cold-and-flu season here in the United States…and apparently in the markets as well. That’s why you should focus on living and let us do the worrying. We’ll continue to monitor the markets and the economy. We’ll continue researching your investments to make sure they continue to make long-term sense for your goals. We’ll continue focusing on keeping your finances healthy. As always, contact us if you have questions or concerns. Our team stands ready, our door is open, and so is our inbox! In the meantime, have a great 2019!