Trade War

The long-running Trade War with China blew up in a big way last month – and then expanded into a twofront war with our neighbors to the south.

Early in May, President Trump placed a new 25% tariff on all Chinese imports that had been previously been spared.1 Soon after, China responded with more tariffs of their own. Then, just as the smoke started to clear from that announcement, the White House announced a new set of tariffs – this time on Mexico.

Why does this matter to the markets? In the short term, it all goes back to uncertainty. Remember, a tariff is essentially a tax on imported goods. With over $50 billion a month moving back and forth across the border every month, higher prices on Mexican products could potentially have a major impact on the economy.2 After all, American businesses rely heavily on everything from Mexican cars to Mexican cables; from food to appliances. Tariffs could lead to longer and more costly supply chains, which in turn can eat into corporate profits.

When that happens, the markets hurt.

On the other hand, recent history suggests the markets can be remarkably resilient to the Trade War’s effects. Often, when new tariffs are announced, the markets will dip and then rise again. Furthermore, the news broke out on Friday, June 7, that the tariffs on Mexico will not come to pass – at least for the time being.3 That’s why the only thing we can be certain of is, well, uncertainty.

The Economy

After roughly a decade of growth, signs of a slowing economy continue to stack up.

Economists use various indicators to forecast where the economy will go. One indicator is the job market. While the nation’s unemployment rate remains historically low at 3.6%, fewer and fewer new jobs are being added. In May for example, the economy added only 75,000 new jobs, which seems like a lot but was far less than the 180,000 most experts predicted.4

Another indicator is the yield on U.S. Treasury bonds. To put it simply, the yield is the return you get on a bond. Bond yields will fall when bond prices – the amount you pay when you purchase a bond – go up. Bonds are often perceived by investors as being less risky than stocks, so during times of uncertainty, more and more investors will pile into bonds, driving up the price and driving down the yield.

Got all that? If not, that’s okay, because here’s what really matters. When the yield on short-term Treasury bonds rises higher than the yield on long-term bonds, economists tend to sit up and push their glasses further up their noses. That’s because this “inverted yield curve”, as it’s often known, is rare, and sometimes signals an impending recession.

An inverted yield curve is happening now.5

I could go on for pages and pages on how bonds and the overall economy intersect, but time is precious, and you shouldn’t have to spend yours reading about things like inverted yield curves. (That’s what you pay me for!) The point is, there are a number of indicators suggesting that the economy is weakening. On the other hand, optimists can point to other, equally compelling data – like the unemployment rate, the country’s GDP, and high consumer confidence reports – that says the economy is doing just fine.

So, how do we know what’s going to happen?

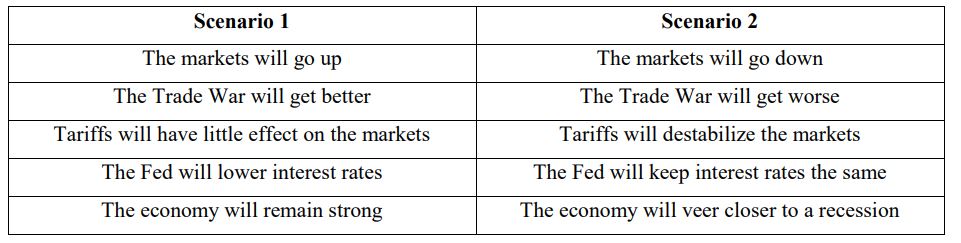

We don’t. Nobody does. Experts can make educated guesses. Analysts can make data-driven predictions. Some of those will undoubtedly come true. Most will be wrong. Nobody has a crystal ball. The greatest financial advisor in the world can’t tell you what will happen in the markets tomorrow, let alone next month or next quarter.

In the world of finance, uncertainty rules. Sometimes its influence is greater or lesser, but it’s always there.

But that doesn’t mean we can’t do anything about it.

I said at the beginning of this letter that I would tell you what my team and I are doing. I can sum it up in two words: Risk Management.

Risk management is the process of identifying, analyzing, accepting, and then working to mitigate the risks that come with uncertainty. It’s one of the most important things I do for clients like you!

Standard disclaimer: All investing involves some risk. It’s impossible to get rid of it entirely –nor would we want to! (It’s a truism that no risk means no reward.) But we can take steps to manage your risk, and that’s what my team and I do every day.

It’s true, I can’t tell you exactly what the markets will do. So, here’s what I can do instead:

Use rules-based investing and a sell-side discipline

These are just fancy terms for something very simple. While many investors practice something called “buy-and-hold”, where they pick some investments and then hold onto them no matter what, we put rules in place that determine when to sell an investment if it falls below a certain price, or is likely to. While we can’t control whether an investment will grow or not, we can take steps to protect you from losing your principal. The ancient Greek physician, Hippocrates, had a maxim: “First, do no harm.” I take a similar view. While we want to help you grow your money, we’re dead set on protecting your money.

Monitor trends by tracking supply and demand

Risk management is sort of like buying strawberries. When you go to the store, you might ask yourself, “Is it worth it to buy strawberries today?” The answer would depend on lots of things. Are strawberries in season? Are they more or less expensive than usual? Do they look ripe?

That’s how you determine whether buying strawberries is worth the risk or not.

We do the same thing with the investments in your portfolio. We look at whether there’s more supply or more demand for an investment – more buyers or more sellers – to determine whether that investment is trending up or down. We look at how strong or weak an investment is relative to other investments that are similar to it. We look at how close it is to the buy/sell price we’ve already established. (That’s rulesbased investing.)

That’s how we determine whether the investments in your portfolio are worth the risk or not.

Here’s why I’m telling you all this. While we can’t know for certain how the Trade War will affect the markets, or whether the economy will veer into a recession, that doesn’t mean we’re sitting idle. I want you to know that my team and I are working constantly to analyze how these stories could affect your hard-earned money. We’re always working to manage the risk in your portfolio. To keep you on track to your financial goals. Sometimes, we try to speed up the journey. Sometimes, we may slow down, or move off the road entirely. But we always try to keep you pointed in the right direction.

If you ever have any questions or concerns, please contact us. In the meantime, I hope you enjoy a wonderful summer!