Special Edition from Jack – the 45 DAY REPORT! Friends and Clients, Hard to believe, isn’t it? The first quarter is half over. The year is 45 days old. It’s 1/8th over...

Friends and Clients, I’ll be brief. All is well with our managed accounts

Friends and Clients,

I’ll be brief. All is well with our managed accounts. Through July 15, the RFS pure aggressive growth model is up 15.98% for the year, while the S&P 500 index is down 0.13%. Essentially, we are beating the index by 16%. We hope you are pleased with that performance. As always, keep in mind that if you are invested in one of our models that blends with fixed income, your results will differ.

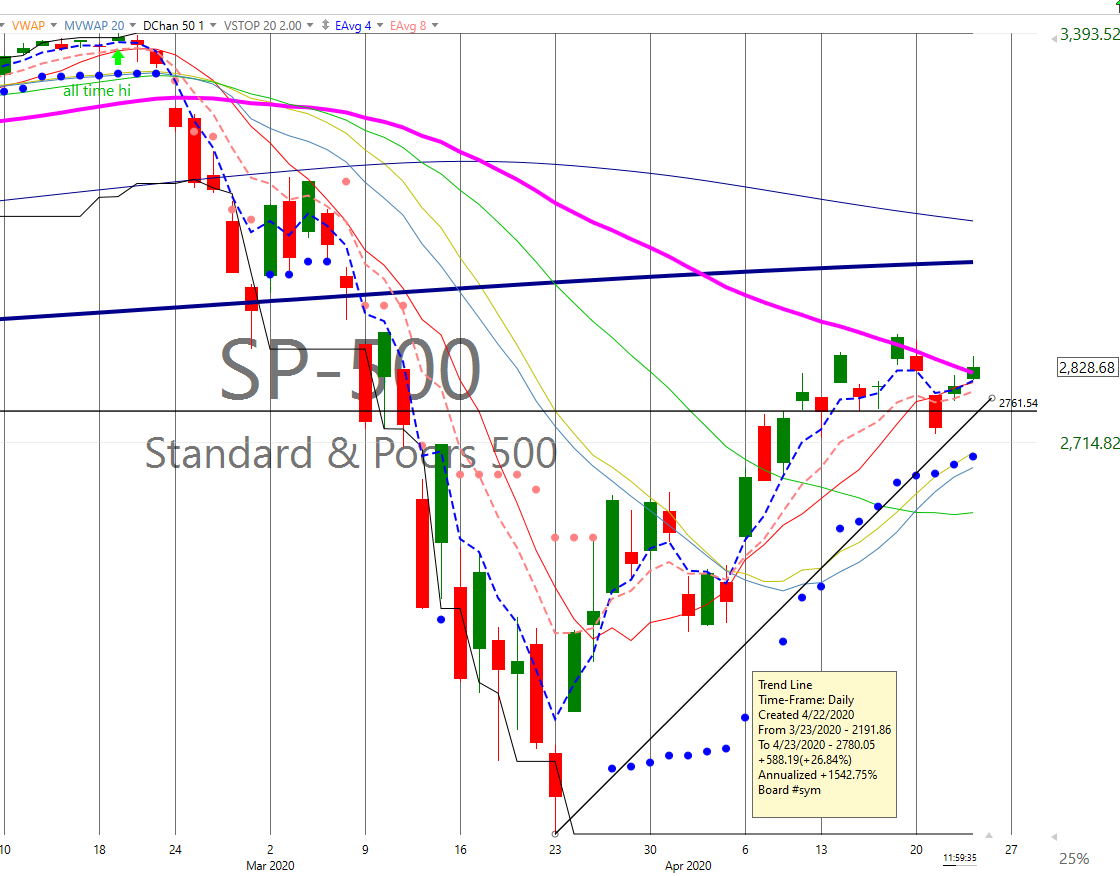

I have been getting a lot of phone calls and emails asking, “Jack, are we going to have another market crash? Should we just get out now?” I don’t think so. Not yet, anyway. We could have another 10 to 30% market sell-off between now and the election, and we are prepared for that. We take offensive positions when our indicators point in that direction. And when they point down, we don’t hesitate to play defense. In fact, our defensive strategy includes some offense because we take on short positions that profit handsomely in down markets. You all know firsthand what we did in March, when we established SPXS positions that produced positive gains as the market crashed.

The recent market rebound has been directly tied to improving economic numbers, and the perception that the CV-19 crisis is getting better. Unfortunately, the Johns Hopkins statistics (available for free everyday in the New York Times) do show a spike in Corona cases in the U.S. and throughout the world. Just yesterday, for example, new Corona cases in the U.S. totaled 77,217. Further spikes could negatively impact the market. We watch these stats daily.

I am “optimistically cautious,” and on full alert at the same time. The current political and racial discourse is destroying our country and our families, and we are in the middle of a very nasty Presidential election cycle. But at the end of the day, there is more good news than bad. Otherwise, the markets wouldn’t be going up.

As you have all heard me say on many occasions, “The only truth is supply and demand. Everything else is someone’s opinion.” There are well over 100 news commentators a day on all the major channels, all with an opinion. They don’t matter. Rule # 1 in technical analysis: the only truth is the “price.”

Here’s my personal opinion: I hope the market does crash. We will make a fortune with our defensive shorting strategy, and a lot of ignorant investors will finally get the message, one more time: “buy and hold” is an academic, institutionalized falsehood, fabricated and promoted by the . . . for want of a better term, I’ll make one up …. “broker-dealer/mutual fund industrial complex.”

We’ve got your back. The RFS Team is doing, and will continue to do, a great job protecting your money.

Like most of you, I am working from home. Awfully quiet around here. Don’t hesitate to give me a call on my cell phone at 240-401-2355.

And, if you’re so inclined, you can always add funds to those we manage.

With kind regards,

Jack

John F. Reutemann, Jr., CLU, CFP®

Founder and CEO

Financial and Wealth Advisor

2273 Research Blvd., Suite 101

Rockville, MD 20850-3264

Phone: 301-294-7500

Fax: 301-294-7504

john.reutemann@rfsadvisors.com

www.rfsadvisors.com

Check out our latest Weekly Market Recap

Investment advice offered through Research Financial Strategies, a registered investment advisor. Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, headquartered at 18 Corporate Woods Blvd., Albany, NY 12211. Purshe Kaplan Sterling Investments and Research Financial Strategies are not affiliated companies.

Trading instructions sent via email, fax or voicemail will not be honored. There is no assurance that these messages can be retrieved on a timely basis, nor is there any sure method of confirming the customer’s identity.

The information contained in this message is being transmitted to and is intended for the use of only individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution or copying of this message is strictly prohibited. If you have received this message in error, please immediately delete.

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

Most Popular Financial Stories

Special Edition from Jack – the 45 DAY REPORT!

Valentine’s Day Message

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio > December 9, 2020 Our Mission Is To Create And Preserve...

SPECIAL EDITION MARKET UPDATE

How Long Can This Last?Performance NumbersOur aggressive growth model is once again outpacing the S&P 500 Index. We’re up 8.48% year-to-date, while the...

When the Year Is New

Time to Take Stock Bye-bye 2020. For everything not financial, we don’t hate to see you go. Pandemics. Riots. Elections. Safe Distancing. Masks. Lockdowns. The parade of...

Special Edition – Year End Tax Matters

Making a List and Checking It TwiceAs one of the strangest years ever thankfully draws to a close, it behooves us to take stock and see our situation as it now...

DOW 30K: Yellin’ for Yellen

The market likes President-Elect Joe Biden’s selection of Janet Yellen to serve as Treasury Secretary. Many Wall Streeters feared that Biden would appoint...