October is coming to an end, and that means Halloween will be here before you know it. Are you ready for the holiday? If you have kids or grandchildren, no doubt they are!...

Pinching Pennies, Pensions, and 401k’s

Tough Times

When times get rough, the natural human urge becomes one of extreme frugality. Certainly those who survived the Great Depression developed various habits prompting others to view them as “penny pinchers.”

Well, today, those sitting atop the financial infrastructure―companies, governments, and other organizations that sponsor ginormous pension funds and 401k plans―have begun to feel the pinch―perhaps not the pinch of pennies but certainly the pinch of nerves.

40% Are “Nervous”?

Pension and 401k plans are underperforming. When massive amounts of money are set aside to fund the retirement of employees, the sponsors of those plans set their sights on a certain rate of return. The planners know how many years the average pension recipients have before they slip off the raft and can thus figure out how much the average plan participant needs to live a decent life. A certain rate of return―together with Social Security and personal investments―will produce that level of income.

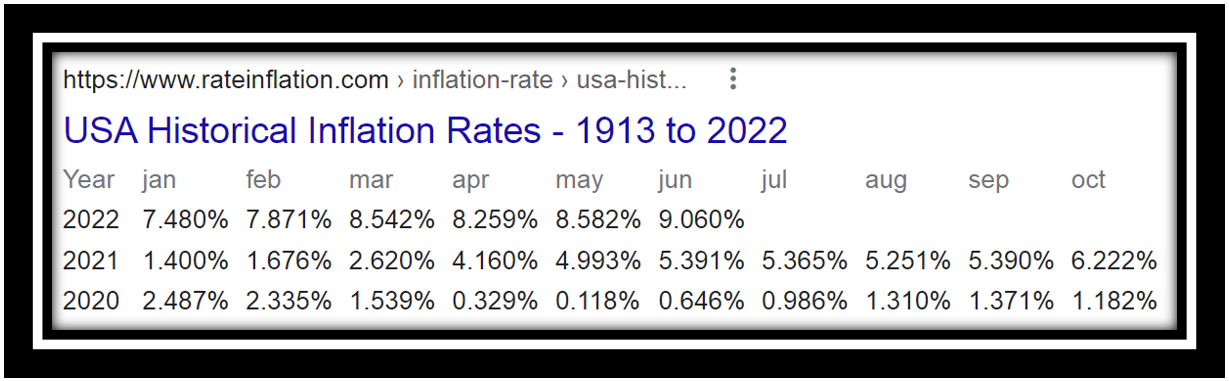

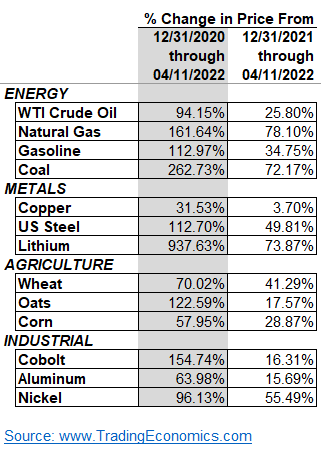

But what happens when the rate of return fails to materialize? The S&P 500 Index was created in 1957. For 64 years―until Dec. 31, 2021―the S&P returned an average of 10.67%.[1] But so far this year, the S&P is down -2.82% in price. When .77% in dividends are added in, the net return this year is negative -12.05%.[2]

To find out how plan sponsors were coping, Cogent Syndicated, a division of Escalent, “conducted an online survey of a representative cross section of 1,267 401(k) plan sponsors from February 11 to March 8, 2022. Survey participants were required to have shared or sole responsibility for plan design, administration or selection and evaluation of plan providers, or for evaluating and/or selecting investment managers/investment options for 401(k) plans.”[3]

40%? Yes, Almost

The war in Ukraine and market volatility have frightened nearly 40% of those surveyed. According to the survey, “nearly four in ten (37%) plan sponsors expect domestic marketplace conditions to worsen, up from 20% in 2021.”[4]

Nearly 60% Fear Underperformance

The fear factor increases when plan sponsors were asked about the ability of their 401k’s or pensions to meet performance targets. “Concern about underperformance of plan investment options continues to grow with 57% of plan sponsors concerned in 2022, increasing by 6% since 2021.”[5]

What to Do?

Perhaps the 401k or pension just cannot meet initial targets. After all, the plan cannot create returns out of thin air. It becomes perfectly plain that plan recipients will have to reduce their expectations and take affirmative steps to make ends meet. Recipients just might have to learn those money-saving steps that served our forbears so well in the 1930s. Even pinching pennies comes to mind.

An Escalent executive describes the problem and some steps plan sponsors might take:

“Creating a retirement plan that is attractive to employees is even more difficult in the current volatile economic and talent environment,” said Sonia Davis, senior product director at Escalent. “In order to combat participant fears, our research supports that plan sponsors need to encourage employees to keep a long game strategy, avoid drastic withdrawals that will hinder future retirement readiness and think beyond saving by seeking help with their decumulation phase.”[6]

Though we’re not precisely certain, we imagine that “thinking beyond saving by seeking help with the decumulation phase” means “retired participants can’t spend money that’s not there so they must learn how not to spend or how to spend less than they planned or hoped for in their golden years.”

Educating Recipients

Many participants in 401k’s and pension plans have never experienced a downturn like the one currently hitting investors. One observer stresses the importance of education:

“Employee education that emphasizes the importance of long-term investment strategy and dollar cost averaging is more crucial as many new employees in the workforce have never experienced a prolonged market downturn,” said Rikin Patel of Kingswood U.S. Enterprise.[7]

Younger plan participants can view downturns as terrific buying opportunities and with dollar cost averaging can obtain lower average costs of certain investments. But older participants surely view a severe downturn as a direct threat to their security, and, as a result, must adopt more defensive strategies to preserve capital.

Please Call Us

If you have any questions, comments, or suggestions, please call us at 301-294-7500. We are always happy to answer any questions you have.

[1] https://www.investopedia.com/

[2] https://www.slickcharts.com/

[3] https://escalent.co/news/

[4] https://escalent.co/news/

[5] https://escalent.co/news/

[6] https://escalent.co/news/

[7] https://www.investmentnews.