Market Commentary – November 5, 2018

Stocks recovered some ground last week and then stumbled over unemployment.

Major U.S. stock indices faltered Friday after the Bureau of Labor Statistics (BLS) reported on a popular ‘lagging’ economic indicator – unemployment. (Remember, lagging indicators describe what has happened in the past.) The BLS reported:1, 2, 3

“The unemployment rate remained at 3.7 percent in October, and the number of unemployed persons was little changed at 6.1 million. Over the year, the unemployment rate and the number of unemployed persons declined by 0.4 percentage point and 449,000, respectively.”

Reuters reported the number of Americans receiving unemployment benefits was at the lowest level in 45 years. That’s good news, but it’s old news. Again, unemployment is a lagging indicator and the report reflected what happened in October.4

The stock market, on the other hand, is a ‘leading’ economic indicator. It moves in response to investors’ expectations for the future – and recent gyrations suggest investors aren’t certain what to think. Barron’s Daren Fonda wrote, “The market’s 6.9 percent slide in October and the stock averages’ wild swings are testing everyone’s mettle.”2, 5

Economists are uncertain about what’s to come, too. Kevin L. Kliesen, in an Economic Synopses on the St. Louis Federal Reserve website, wrote, “Historically, a trough in the unemployment rate also tends to be a reliable predictor of a business recession…an economic analyst is nonetheless never sure that a trough has occurred. Indeed, the unemployment rate can move up and down over the expansion.”6

There is one thing many analysts think is likely. They expect the Federal Reserve to increase the Fed funds rate so the U.S. economy does not overheat. Paul Kiernan at The Wall Street Journal reported, “Robust hiring and wage gains last month leave the Federal Reserve all but certain to raise interest rates in December and on course to continue gradually lifting them next year.”7

Higher interest rates are expected to keep inflation in check by slowing economic growth.8

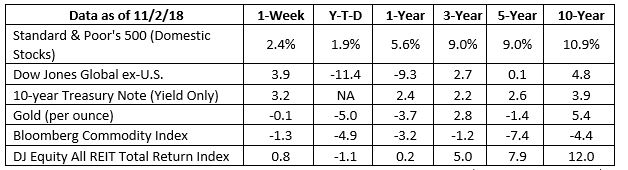

Despite Friday’s stumble, major U.S. stock indices finished the week higher.1

Here’s an unexpected retirement saving trick. If you’re concerned your adult children are not saving enough for retirement, send them a photo of themselves that’s altered so they appear to be older, perhaps age 60 or 70. (You can do this for yourself, too.)9

One reason Americans don’t begin saving early enough, or save as much as they should for retirement, is ‘present bias.’ When asked to choose between two possible rewards, research shows that people tend to choose the one that will be received sooner.10

For instance, imagine you have chocolate and fruit salad. Which will you choose to eat today and which will you choose to eat next week? Researchers found that 83 percent of people chose chocolate today and fruit salad next week.11

Try this one.

You can watch one movie today and another movie tomorrow. Your choices include ‘Anchorman,’ ‘Clear and Present Danger,’ ‘The Piano,’ and ‘Schindler’s List.’ What movie will you watch today? Which will you watch tomorrow?

Researchers found a higher percentage of participants chose to watch lighter films on the day they were asked and more intellectually taxing films later.12

When presented with the choice to vacation today or save for retirement, it’s little surprise many people choose the former. The rewards associated with retirement are often far into the future. As a result, until a person is within a decade or so of retirement, it’s easy to rationalize spending on other things and not setting aside money for the future.12

There is a way to overcome present bias. When people ‘get to know’ their older selves by spending time looking at altered photos, they tend to save more for the future.9

Weekly Focus – Think About It

“If we now care little about ourselves in the further future, our future selves are like future generations. We can affect them for the worse, and, because they do not now exist, they cannot defend themselves. Like future generations, future selves have no vote, so their interests need to be specially protected. Reconsider a boy who starts to smoke, knowing and hardly caring that this may cause him to suffer greatly fifty years later. This boy does not identify with his future self.”

–Derek Parfit, British philosopher13

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

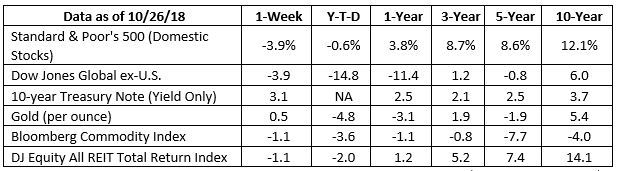

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indices referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* You cannot invest directly in an index.

* Stock investing involves risk including loss of principal.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

1 https://www.barrons.com/articles/stock-rally-fizzles-in-wake-of-strong-payrolls-report-1541201581?mod=hp_DAY_8

2 https://www.investopedia.com/ask/answers/what-are-leading-lagging-and-coincident-indicators/

3 https://www.bls.gov/news.release/empsit.nr0.htm

4 https://www.reuters.com/article/us-usa-economy-unemployment/u-s-labor-market-tightening-manufacturing-slowing-idUSKCN1N64XA

5 https://www.barrons.com/articles/stock-market-fear-1541091809?mod=hp_LEAD_3

6 https://research.stlouisfed.org/publications/economic-synopses/2018/06/01/recession-signals-the-yield-curve-vs-unemployment-rate-troughs

7 https://www.wsj.com/articles/fed-will-likely-raise-rates-after-strong-jobs-report-1541176431

8 https://www.reuters.com/article/us-usa-economy/u-s-job-growth-soars-annual-wage-gain-largest-since-2009-idUSKCN1N70AJ

9 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3949005/

10 https://www.behavioraleconomics.com/resources/mini-encyclopedia-of-be/present-bias/

11 https://canvas.harvard.edu/files/2761311/download?download_frd=1 (Pages 10, 14-16; Course taught by Brigitte C. Madrian, https://scholar.harvard.edu/bmadrian/classes/api-304-behavioral-economics-and-public-policy)

12 https://pdfs.semanticscholar.org/2b03/cdc6119a5578cd284d8fe9de99e1f169a8fb.pdf (Pages 262-263, 265)

13 https://books.google.com/books?id=ulhHdvbDRUkC&pg=PA319&lpg=PA319&dq=If+we+now+care+little+about+ourselves+in+the+further+future,+our+future+selves+are+like+future+generations.+We+can+affect+them+for+the+worse,+and,+because+they+do+not+now+exist,+they+cannot+defend+themselves.+Like+future+generations,+future+selves+have+no+vote,+so+their+interests+need+to+be+specially+protected.&source=bl&ots=lVFartNzpF&sig=LgqLWOkCgwMIpj5ixgDFIqNMJuw&hl=en&sa=X&ved=2ahUKEwil5t3plbbeAhVRmeAKHbX1AhYQ6AEwAHoECAAQAQ#v=onepage&q=319&f=false (pages 319-320)