Special Edition from Jack – the 45 DAY REPORT!

Friends and Clients,

Hard to believe, isn’t it?

The first quarter is half over. The year is 45 days old. It’s 1/8th over with!

The stock market bull rally continues, and hopes for President Biden and his COVID stimulus package are high. Looks as if it’ll pass. The president is also promising an infrastructure bill, which will create jobs and fuel several sectors that we are thinking about adding to our aggressive growth model: the industrials, building materials, trains, planes, cement, steel, tractors, heavy machinery, etc.

If the infrastructure bill passes, we’re looking at two ETFs. Click here for details on the holdings in XLI and XLB. Lots of infrastructure companies.

Interest rates continue to remain very low, and residential real-estate sales, as well as new construction, remain high. One of my close friends and clients, a broker in Ocean City, Maryland, said that while he was in church on Sunday, from 9:00 to 10:30 AM, he missed 17 calls from buyers wanting to see properties. I hear similar stories all day long from my network.

Here’s How We’re Doing

Our 45-day returns look like this:

Our Growth Model

· The AG model is + 9.15% so far in 2021.

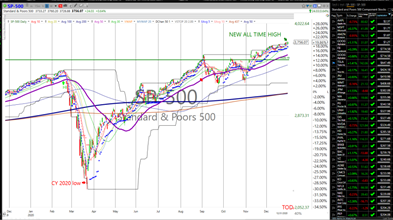

· The S&P 500 equity benchmark is +4.5972%.

· So our performance is almost exactly twice the performance of the S&P.

Our Bond Model

· The bond model (“fixed income”) is + 5.16% YTD.

· AGG, the Barclays fixed income benchmark is negative 1.362%.

· So we’re miles ahead of the benchmark.

Both models are on track to match or beat our record setting returns of 2020!

Defense When Necessary

As always, I am prepared to take decisive and speedy defensive action if market conditions turn against us. We will not let your wealth suffer in a market plunge.

Thank you … for your trust and confidence.

Sincerely,

Jack

Call me on my cell 240 401 2355

Please share my number with family, friends, clients, and colleagues.

Most Popular Financial Stories

Don’t forget about your 2020 IRA contributions!

There’s still time to contribute to your IRA!If you haven’t already contributed to an IRA (Individual Retirement Account), there’s still time to do so. Many...

Valentine’s Day Message

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio > December 9, 2020 Our Mission Is To Create And Preserve...

SPECIAL EDITION MARKET UPDATE

How Long Can This Last?Performance NumbersOur aggressive growth model is once again outpacing the S&P 500 Index. We’re up 8.48% year-to-date, while the...

When the Year Is New

Time to Take Stock Bye-bye 2020. For everything not financial, we don’t hate to see you go. Pandemics. Riots. Elections. Safe Distancing. Masks. Lockdowns. The parade of...

Special Edition – Year End Tax Matters

Making a List and Checking It TwiceAs one of the strangest years ever thankfully draws to a close, it behooves us to take stock and see our situation as it now...

DOW 30K: Yellin’ for Yellen

The market likes President-Elect Joe Biden’s selection of Janet Yellen to serve as Treasury Secretary. Many Wall Streeters feared that Biden would appoint...