Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year....

Market Commentary December 27, 2022

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

What a year!

In some ways, it feels as though we lived through several years in 2022. The onslaught of events included, “The first major European war since the 1990s, unprecedented sanctions, energy-price mayhem, bail-outs, global interest rates rising at their fastest pace in four decades, a faltering Chinese economy, an overheating American one, housing markets looking peaky across the rich world, [and] a crypto blow-up for the ages…,” reported Hamish Birrell in The Economist’s Money Talks newsletter.

The impact of these events was felt around the world. Global inflation averaged 10 percent, and global stock markets were down about 20 percent through November, reported The Economist. Yet, some countries showed remarkable economic resilience, performing far better than average. The Economist surveyed economic and financial data from 34 wealthy countries. The data included gross domestic product or GDP (which is the value of all goods and services produced in a nation), inflation, breadth of inflation, stock market performance and government debt.

Many of the top performers were in the Mediterranean. They tended to have better-than-average stock market performance, declining debt-to-GDP ratios*, strong economic growth, and/or below average inflation. The top 10 included:

- Greece

- Portugal

- Ireland

- Israel

- Spain

- Mexico

- Canada

- Japan

- France

- Italy

The United States ranked 20th, although its position may have skewed low. The author opined, “America’s GDP numbers are misleadingly weak: in recent quarters official statisticians have struggled to account for the impact of enormous stimulus packages.”

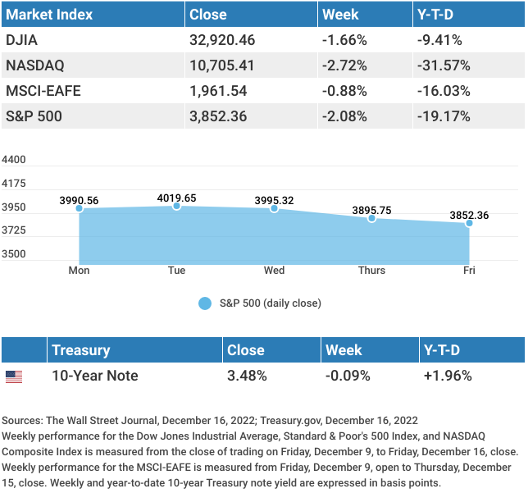

Last week, major U.S. stock indices delivered mixed results as economic data, created uncertainty reported Nicholas Jasinski of Barron’s. Positive earnings news and strong labor market data were countered by cooling inflation and slower consumer spending. The Standard & Poor’s 500 Index and the Nasdaq Composite moved lower, and the Dow Jones Industrial Average rose. Treasury bond yields generally moved higher.

OUT WITH THE OLD. IN WITH THE NEW. Every new year brings new ways of doing things. Here are some of the trends and ideas that may shape 2023 (or not).

Challenging your taste buds. “Flavors that violate [consumers’] expectations are sure to be a hit…unexpected and unique flavor combinations will be in demand going into 2023.” Spoiler alert. If you want to be surprised by 2023’s new flavors stop reading here. If you want to warn your tongue what may be coming, prepare for dragon fruit and Vietnamese-Cajun.

Traveling for inner growth. One of the top travel trends in 2023 will be transformation retreats, according to Sarah Allard of Condé Nast Traveler. “…2023 will be the year we travel for personal betterment. Whether you are seeking to overcome grief, identify your life’s mission, or discover what your body is physically capable of, there will be a transformation retreat that caters to it.” Another anticipated trend is “set-jetting,” visiting countries where your favorite movies and television shows are filmed.

Dowsing for fresh water. 2023 may be the year that water-strapped cities and regions begin harvesting water vapor. That’s the suggestion offered by scientists at the University of Illinois at Urbana-Champaign who have been researching sources of fresh water. “A new study suggests an investment in new infrastructure capable of harvesting oceanic water vapor as a solution to limited supplies of fresh water in various locations around the world,” reported Science Daily.

And now for something completely different. If you’re bored with your current exercise routine, you might consider the Ministry of Silly Walks workout. A tongue-in-cheek study published in the British Medical Journal found that inefficient walking (of the type seen in Monty Python’s Ministry of Silly Walks skit) burns lots of calories. “Adults could achieve 75 minutes of vigorous intensity physical activity per week by walking inefficiently for about 11 min/day. Had an initiative to promote inefficient movement been adopted in the early 1970s, we might now be living among a healthier society.”

We hope you have a safe and happy New Year celebration.

Weekly Focus – Think About It

“Write it on your heart that every day is the best day in the year.”

—Ralph Waldo Emerson, philosopher

Most Popular Financial Stories

Stock Pullbacks Are Helpful, Not Hurtful

Market Outlook by Jack Reutemann

All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over?...

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our...

Happy New Year!

Sending you warm thoughts and best wishes for a wonderful new year. May the days ahead be filled with joy, laughter, and prosperity for you and those you hold most dear.

Happy Thanksgiving

Thanksgiving will be here soon. The holiday always gives us a chance to appreciate what we have – friendships, relationships, and a sense of togetherness. These gifts are...

IRS Releases 2025 Tax Brackets

The Internal Revenue Service released the updated income tax brackets, standard deduction, and retirement contribution limits for the 2025 tax year. While these changes...

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

Sources:

https://www.economist.com/newsletters [Money Talks newsletter] (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/12-27-22_The%20Economist_We%20Look%20at%20the%20Bright%20Side%20of%202022_1.pdf)

https://www.economist.com/finance-and-economics/2022/12/18/2022s-unlikely-economic-winners (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/12-27-22_The%20Economist_2022s%20Unlikely%20Economic%20Winners_2.pdf)

https://www.barrons.com/articles/stocks-limp-toward-2023-as-the-data-show-few-signs-of-a-clear-direction-51671841571?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/12-27-22_Barrons_Stocks%20Limp%20Toward%202023_3.pdf)

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202212

https://corporatefinanceinstitute.com/resources/economics/debt-to-gdp-ratio/

https://elibrary.worldbank.org/doi/abs/10.1596/1813-9450-5391

https://www.foodbusinessnews.net/articles/22886-flavors-to-watch-in-2023

https://www.cntraveler.com/story/17-travel-trends-youll-see-in-2023

https://www.sciencedaily.com/releases/2022/12/221206083115.htm

https://www.bmj.com/content/379/bmj-2022-072833

https://www.brainyquote.com/topics/new-years-quotes