Do me a favor: print the chart in this email and pin it to your wall. I want you to have a constant reminder that stock prices see pullbacks several times during the year....

Q1 2022 Update

Ehhh, What’s up Doc?

Just two years ago, media had zero coverage of inflation as a topic of interest. Now, multiple stories appear every day about how inflation is affecting the global economy, consumers, and business.

In many ways, the economy is like a three-legged stool. For a strong economy we rely on strength in three sectors, consumer discretionary, financials and technology. Inflation is affecting all three of these sectors.

Consumer Price Inflation was reported last week at 8.5%1 with many forecasters expecting that it is the peak. Then the Producer Price Index reported inflation at 11.2%. Those higher prices that manufacturers are paying have not, yet, been passed on to retail outlets. The CPI, even if it peaks at 8.5% isn’t going to ease quickly.

Whether at the gas station, grocery store or general shopping, higher prices have caught our attention. Household and business budgets are being reprioritized by reducing discretionary expenses which will eventually impact the economy.

Housing is a major cause of inflation2 as the country deals with a limited number of houses for sale and a growing demand due to Millennial household formation. Housing data is added to the CPI on a lag. Rising home sales will be adding to the inflation data well into next year even if sales begin to slow.

Except for Baby Boomers, most investors have never seen inflation at today’s levels. Even most Boomers weren’t big investors in the ’70s when inflation was even higher than today. Gasoline rationing and grocery shortages were not supposed to happen in America.

In 1979, Fed Chairman Paul Volker changed monetary policy3 and aggressively raised interest rates to 13%. Home mortgage rates rose to as much as 21%! The economy responded to expensive money and prices began to fall. The rate hike was hard and much like giving a child cod liver oil. It was unpleasant but “what the doctor ordered.” Collective thinking by the public and all levels of government changed from this experience.

Forty years of declining interest rates4 benefited job creation, wages, purchasing power and the country’s standard of living. The stock and bond markets began long-term appreciation trends. “Buy the dip” and “the market always goes up” became common beliefs.

Today’s Fed Chairman, Jerome Powell, has a task similar, but different, than the Fed confronted in the ‘70s. In the post-Covid economy business conditions are much different than at the beginning of our technology explosion.

Raising rates aggressively could cause a recession5 boosting unemployment and aggravating existing shortages. Higher interest rates would push 30-year mortgage rates above the current 5% slowing home sales. Lower home sales results in lower employment and broadly impacting related industries.

A broad base of stocks has been declining for several years6, but the falling prices have been masked by Wall Street propping up favored technology and growth stocks. Now, with the Fed announcing higher interest rates those same favorite stocks that dominate major indexes are being repriced to lower levels.

For investors whose major experience in the markets has been post-2008, it is time to examine basic assumptions. Interest rates are rising which means the safe haven of bond investing is gone7.

Bonds benefit from falling interest rates and lose value with rising rates. Bond values and interest rates are connected to each other as on a teeter-totter. The majority of investors have significant bond allocations as the primary means of protecting their portfolios. It is essential to reconsider this assumption. As of mid-April, Barclay’s Aggregate Bond Index (AGG) is negative 9.11% year-to-date. That isn’t the safety asset that investors expect.

Investor’s favorite FANG stocks (Facebook, Amazon, Apple, Netflix, and Google) are negative 18.66%. The NASDAQ is negative 14.63% while the S&P is negative 7.71% at this writing. This year is different than we are used to. It is changing and as the Federal Reserve attempts to conquer the inflation it created, more changes in the markets lie ahead.

Higher interest rates make rising dividends more valuable8 in the near term than investing in a company with an unproven product or concept. That includes many growth and technology firms.

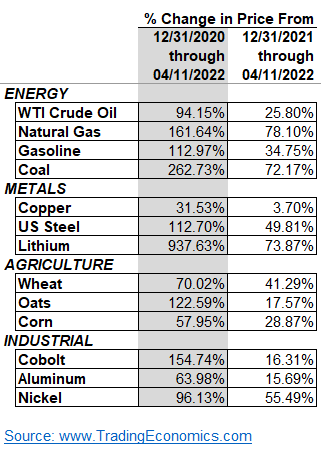

Shortages have revived a focus in commodities9 which most portfolios have ignored for a few decades. New industry leadership will surface from recent knee-jerk volatility. We will adapt.

Questions? Call us. We are here for you! 301-294-7500

1 https://www.nytimes.com/live/2022/04/12/business/cpi-inflation-report

3 https://www.thebalance.com/who-is-paul-volcker-3306157

4 https://www.ocregister.com/2021/10/19/40-years-of-falling-interest-rates-who-got-rich/

5 https://www.bankrate.com/banking/federal-reserve/will-the-fed-cause-a-recession/

6 https://www.cnbc.com/2022/02/16/stock-market-futures-open-to-close-news.html

7 https://am.jpmorgan.com/br/en/asset-management/adv/insights/ltcma/rethinking-safe-haven-assets/

9 https://www.bnnbloomberg.ca/commodities-soar-as-anxiety-over-supply-shortages-increases-1.1732299