All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over?...

Weekly Market Commentary 7/26/2021

How Are Your Investments Doing Lately? Receive A Free, No-Obligation 2nd Opinion On Your Investment Portfolio >

Shortest ever.

Last week, the National Bureau of Economic Research (NBER) finally announced the official dates for the recession that occurred in 2020. Economic activity peaked in February 2020 and bottomed in April 2020. That makes the pandemic recession the shortest in American history.

According to the NBER, “The recent downturn had different characteristics and dynamics than prior recessions. Nonetheless, the committee concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warranted the designation of this episode as a recession, even though the downturn was briefer than earlier contractions.”

Since then, the United States’ economy has accelerated like a sports car on the German Autobahn, leading the developed world in the race toward economic recovery. A gradual slowdown was inevitable. However, three obstacles in the road may result in a sharp deceleration, reported The Economist.

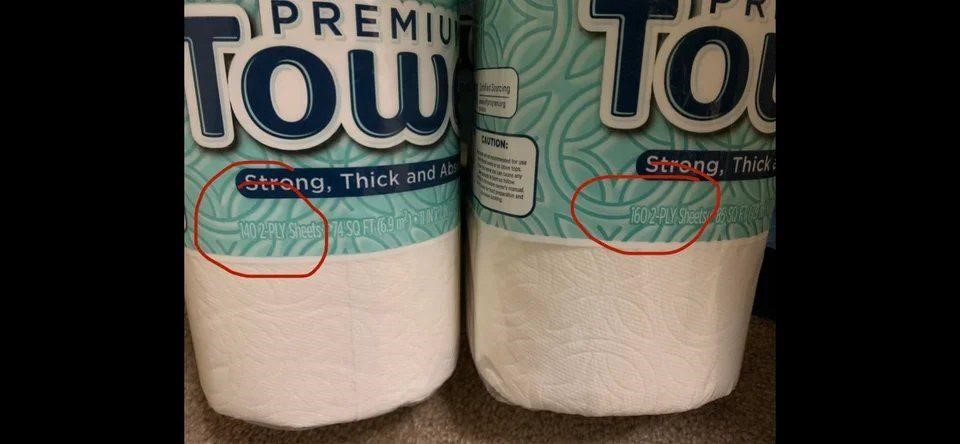

#1. Inflation. A shortage of goods triggered inflation. Consumers have noted some price hikes, although others are less clear obvious. Makers of cereal, snacks, candy, and other products, are offering unchanged packages, priced as usual, that hold smaller quantities of product, reported Axios. The technique is known as shrinkflation.

#2. The end of pandemic policies. Enhanced unemployment benefits end in September, and the national moratorium on evictions ends in late July. The latter was the first of its kind and no one is certain how unwinding it will affect the economy, reported The Economist. Almost 36 percent of adults living in households that are behind on rent or mortgage payments, according to the latest Household Pulse Survey. We could see a housing boom and a housing crisis simultaneously.

#3. Spread of the Delta variant. The average number of coronavirus cases is up more than 180 percent over the last two weeks. “In the near term, the economic impact of the new wave of the pandemic in the U.S. could hinge on whether governments ratchet up restrictions intended to curb the virus’ spread.” reported Josh Nathan-Kazis of Barron’s.

While risks to economic growth persist, the earnings of publicly traded companies are strong. So far, 24 percent of the companies in the Standard & Poor’s (S&P) 500 Index have reported second quarter earnings. Year-to-year blended earnings growth has been stellar, in part, because of how bad things were during the second quarter of last year, reported John Butters of FactSet.

Net profit margins, which could have been trimmed by inflation, are currently 12.4 percent. That’s the second highest level since FactSet began tracking data in 2008. Analysts anticipate profit margins will average 12 percent through the end of 2021.

HOW MUCH ARE OLYMPIC MEDALS WORTH? The Tokyo Organizing Committee of the Olympic and Paralympic Games took a new approach to producing medals. “Approximately 5,000 medals have been produced from small electronic devices that were contributed by people all over Japan…From the procurement of the metals to the development of the medal design, the entire country of Japan was involved in the production of the medals for the Tokyo 2020 Games – a project that was only possible with the participation of people across the nation.”

The current medal format – awarding gold, silver and bronze medals to the top finishers in each event – was introduced during the 1904 Olympics. For a few years, around that time, the medals were made of gold, silver and bronze, but that’s no longer the case. The medals awarded at the Tokyo Games are composed of a variety of metals.

· Olympic gold. The gold medal contains 550 grams of silver ($490) covered in 6 grams of gold plating ($380). That puts its monetary value at about $870.

· Olympic silver. The silver medal is made of pure silver. At the 2020 Olympics, the medal weighs in at about 550 grams, and its value is about $490.

· Olympic bronze. The bronze medal is comprised of 450 grams – almost a pound – of red brass. Red brass is 95 percent copper and 3 percent zinc, and is valued at about $2.40 a pound. The medal’s monetary value is about $2.40.

Of course, the real answer to the question about the value of Olympic medals is that they are priceless. The achievement they represent – becoming one of the world’s best athletes in a sport – has a value that cannot be measured in dollars and cents.

Weekly Focus – Think About It

“Never underestimate the power of dreams and the influence of the human spirit. We are all the same in this notion: The potential for greatness lives within each of us.”

– Wilma Rudolph, Four-time Olympic medalist

Most Popular Financial Stories

Market Outlook by Jack Reutemann

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our...

Happy New Year!

Sending you warm thoughts and best wishes for a wonderful new year. May the days ahead be filled with joy, laughter, and prosperity for you and those you hold most dear.

Happy Thanksgiving

Thanksgiving will be here soon. The holiday always gives us a chance to appreciate what we have – friendships, relationships, and a sense of togetherness. These gifts are...

IRS Releases 2025 Tax Brackets

The Internal Revenue Service released the updated income tax brackets, standard deduction, and retirement contribution limits for the 2025 tax year. While these changes...

Happy Halloween!

October is coming to an end, and that means Halloween will be here before you know it. Are you ready for the holiday? If you have kids or grandchildren, no doubt they are!...

Investment advice offered through Research Financial Strategies, a registered investment advisor.

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

Sources:

https://www.nber.org/news/business-cycle-dating-committee-announcement-july-19-2021

https://www.economist.com/leaders/2021/07/24/does-america-face-a-growth-slowdown (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/07-26-21_Economist_Does%20America%20Face%20a%20Slowdown%20in%20Economic%20Growth_2.pdf)

https://www.axios.com/shrinkflation-inflation-cheerios-78a856e1-342f-404f-8d09-ad0da57a299e.html

https://www.economist.com/united-states/2021/07/24/as-moratoriums-lift-will-america-face-a-wave-of-foreclosures-and-evictions (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/07-26-21_Economist_As%20Moratoriums%20Lift_4.pdf)

https://www.census.gov/data-tools/demo/hhp/#/?measures=EVICTFOR&periodSelector=33

https://www.barrons.com/articles/delta-variant-covid-19-economy-51627066659 (or go to https://www.barrons.com/articles/delta-variant-covid-19-economy-51627066659)

https://www.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_072321.pdf

https://www.barrons.com/articles/dow-jones-industrial-average-record-covid-19-51627088150?refsec=the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/07-26-21_Barrons_The%20Dow%20Just%20Hit%2035000_8.pdf)

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

https://olympics.com/tokyo-2020/en/games/olympics-medals/

https://olympics.com/en/olympic-games/olympic-medals

https://olympics.com/tokyo-2020/en/games/olympics-medals-design/

https://www.bloomberg.com/markets/commodities/futures/metals

https://www.fullcirclerecyclingri.com/current-prices

https://olympic-speakers.com/news/10-inspirational-quotes/