All, Over the past two weeks, I have spoken with several clients about the current investment climate. I wanted to share our discussions with everybody. Is the Party Over?...

Market Commentary – November 18, 2019

The longest bull market in history showed no signs of slowing last week.

U.S. stock markets climbed higher for the sixth week straight – the longest rally in U.S. markets in two years – and the Dow Jones Industrial Average surpassed 28,000 for the very first time, reported Bloomberg.

The Economist reported, “It has been a year of mood swings in financial markets. In the spring and summer, anxious investors piled into the safety of government bonds, driving yields down sharply. Yields have recovered in recent weeks…Equity prices in America have reached a new peak. But what is more striking is the performance of cyclical stocks relative to defensive ones. Within America’s market the prices of industrial stocks, which do well in business-cycle upswings, have risen relative to the prices of utility stocks, a safer bet in hard times.”

Last week, Federal Reserve Chair Jerome Powell confirmed the United States appears to be in good economic shape. The U.S. economic outlook remains favorable despite weakening business investment, which has slowed because of sluggish global growth and uncertainty surrounding trade. The unemployment rate remains low and more people are returning to the workforce, which is a positive development. Overall, Powell and his colleagues believe economic expansion is likely to continue.

A similar phenomenon has occurred in European markets.

Randall Forsyth of Barron’s cited a source who stated, “…the global economic backdrop has, for the first time in 18 months, begun to improve.” Forsyth went on to explain, “It’s not just because of prospects of a trade deal. Recession risks have, well, receded. Growth may slow to a 1 percent annual rate in the current quarter, but odds of falling into an outright recession have slid.”

Whenever investors are happy and markets are moving higher, contrarians begin to ask questions. For example, a leading contrarian indicator is the Investors Intelligence Sentiment Survey. The survey queries investors and investment professionals about whether they are feeling bullish or bearish. When the ratio of bulls to bears is above 1.0, the market may be overly bullish. When it is less than 1.0, it may be too bearish.

Yardeni Research reported the ratio stood at 3.22 last week; 57 percent bulls and 18 percent bears

In case you missed it, the winner was #435.

For the last five years, Katmai National Park and Preserve in Western Alaska has hosted ‘Fat Bear Week’ to celebrate bears as they prepare for hibernation. The participants are coastal brown bears who live along Alaska’s Brooks River.

The event helps people better understand hibernation. You may not have realized it, but bears spend the summer fattening up because they lose about one-third of their body weight during the winter. It’s an interesting scientific phenomenon. The Katmai National Park Service website explained:

“Hibernation is a state of dormancy that allows animals to avoid periods of famine. It takes many forms in mammals but is particularly remarkable in bears…After a summer and fall spent gorging on food, a bear’s physiology and metabolism shifts in rather incredible ways to help them survive several months without food or water.”

In Katmai, conservancy media rangers select twelve participants from among the park’s 2,000 bears and post before-and-after photos on social media to showcase the effects of summer feasting. People near and far can participate by watching bear cams. There is even an ursine madness bracket where voters choose the fat bear that wins each pairing, and the crowd favorite moves on to the next match-up.

This year, the Fat Bear Week champion was number 435, a.k.a. Holly. The Katmai announcement touting 435’s win stated, “All hail Holly whose healthy heft will help her hibernate until the spring. Long live the Queen of Corpulence!”

Weekly Focus – Think About It

“If we had no winter, the spring would not be so pleasant: if we did not sometimes taste of adversity, prosperity would not be so welcome.”

–Anne Bradstreet, Poet

Best regards,

John F. Reutemann, Jr., CLU, CFP®

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Investment advice offered through Research Financial Strategies, a registered investment advisor.

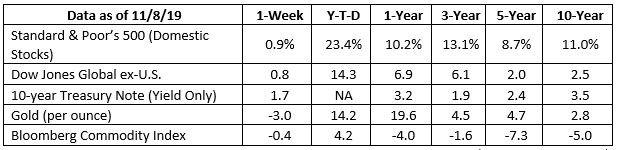

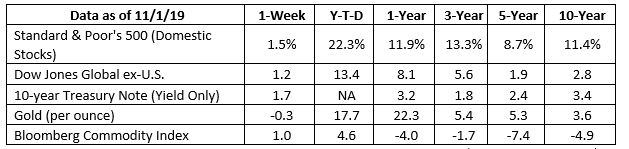

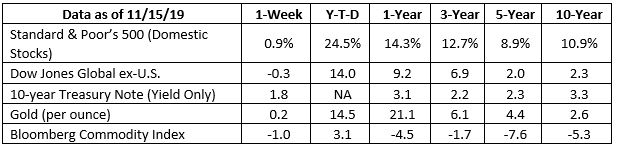

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Most Popular Financial Stories

Market Outlook by Jack Reutemann

Market Update – January 2025

Happy New Year! The past 75 days have been quite eventful. Several clients have inquired about our investment approach for accounts not held at Schwab. To clarify, our...

Happy New Year!

Sending you warm thoughts and best wishes for a wonderful new year. May the days ahead be filled with joy, laughter, and prosperity for you and those you hold most dear.

Happy Thanksgiving

Thanksgiving will be here soon. The holiday always gives us a chance to appreciate what we have – friendships, relationships, and a sense of togetherness. These gifts are...

IRS Releases 2025 Tax Brackets

The Internal Revenue Service released the updated income tax brackets, standard deduction, and retirement contribution limits for the 2025 tax year. While these changes...

Happy Halloween!

October is coming to an end, and that means Halloween will be here before you know it. Are you ready for the holiday? If you have kids or grandchildren, no doubt they are!...

* This newsletter and commentary expressed should not be construed as investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

* To unsubscribe from the Weekly Market Commentary please reply to this e-mail with “Unsubscribe” in the subject.

Sources:

https://www.bloomberg.com/news/articles/2019-11-15/stocks-breeze-to-records-as-trade-hopes-cover-up-economic-gloom?srnd=markets-vp

https://www.economist.com/finance-and-economics/2019/11/14/the-improved-mood-in-financial-markets (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-18-19_TheEconomist-The_Improved_Mood_in_Financial_Markets-Footnote_2.pdf)

https://www.federalreserve.gov/newsevents/testimony/powell20191113a.htm

https://www.barrons.com/articles/next-stop-dow-30-000-it-could-happen-51573871667?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-18-19_Barrons-Next_Stop-Dow_30000-It_Could_Happen-Footnote_4.pdf)

https://investinganswers.com/dictionary/b/bullbear-ratio

https://www.yardeni.com/pub/stmktbullbear.pdf (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/11-18-19_Yardeni-Stock_Market_Indicators-Bull_Bear_Ratios-Footnote_6.pdf)

https://www.npr.org/2019/10/06/767384374/its-fat-bear-week-in-alaska-s-katmai-national-park-time-to-fill-out-your-bracket

https://www.npr.org/2019/10/09/768475870/stuffed-with-sockeye-salmon-holly-wins-fat-bear-week-heavyweight-title

https://www.nps.gov/katm/blogs/bear-hibernation.htm

https://www.goodreads.com/quotes/tag/winter