2018: The Year in Review

Every January, it’s customary to look back at the year that was. What were the highlights? What were the “lowlights”? What were the events we’ll always remember? Most importantly, what did we learn?

Before we get into that, though, let’s take a brief jaunt back to the 1800s.

The famous 19th century composer, Robert Schumann, used to moonlight as a music critic when he wasn’t writing his own work. What’s notable about his reviews is that instead of writing from his perspective, he often wrote from the perspective of two imaginary characters, Florestan and Eusebius. Florestan represented Schumann’s passionate, witty side; Eusebius, his thoughtful and introspective side. These two characters would debate a piece of music, each bringing a different perspective to the table because their personalities were so different. Was a composition ardent and exciting – or merely flashy and melodramatic? Sincere and thought-provoking, or dull and trite? Both characters had their own opinions, proving that two people can experience the same thing very differently depending on their personality – or in the case of Schumann, that one person can.

Why am I telling you all this? Because when you look back on the year that was, it’s possible to draw very different conclusions. If you were to Google “2018 year in review in the markets”, you’d find wildly varying opinions from analysts, pundits, bankers, economists, and others. They’re all reviewing the same year – but their interpretations tend to be very different.

So, with that in mind, let’s review the year the way Schumann would. I present to you two characters: Volatilis and Tranquillitas, the Latin words for volatile and calm.

The Markets

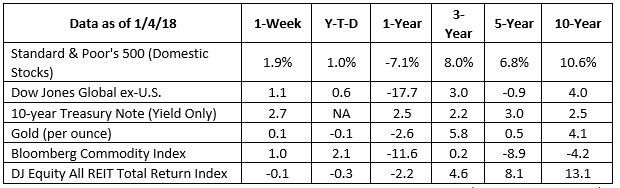

Volatilis: “Look, it was a volatile year. The Dow, S&P 500, and Nasdaq all ended the year lower than they started – the first time that’s happened since 2008.1 The S&P and Nasdaq are in or near bear market territory, and the Dow had its worst December since the Great Depression.”2

Tranquillitas: “Oh, come now, the year wasn’t so bad as all that. In fact, the markets spent most of 2018 climbing rather than falling. The Dow soared to never-before-seen heights, and at one point, the Nasdaq was up 17.5% for the year!1 A few down months can’t erase all the good that came before.”

Volatilis: “Quite the contrary. When it comes to the markets, losses can quite literally wipe out gains! In fact, since October, the markets have lost all they gained and more. And even earlier in the year, we still saw dramatic peaks and valleys. The markets shot out of the gate in January after the new tax law went into effect, but then quickly plunged in February. The same pattern occurred in March and April. We’ve already covered what happened in summer and autumn – a tremendous rise, followed by a tremendous fall. My dear Tranquillitas, don’t you know that’s what volatility means?”

The Economy

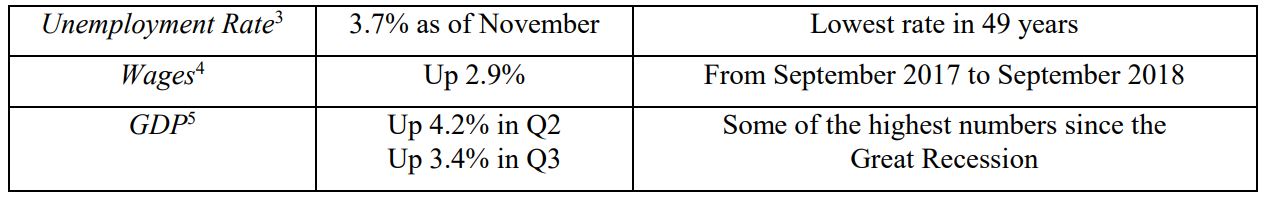

Tranquillitas: “But the markets are not the same as the economy, and the economy soared in 2018. Observe these numbers:

“Those numbers paint a picture of a strong economy – and it’s a beautiful picture, indeed!”

Volatilis: “A lovely chart, but it doesn’t tell the whole story – which is that the economy is likely slowing down. The economic expansion has been driven for years by historically low interest rates – rates the Federal Reserve continues to raise. This, in turn, has affected the housing market and the stock market. Oil prices have plummeted, too, which is good for consumers at the gas pump, but bad for the energy industry. Meanwhile, many of the world’s largest economies are also slowing down, especially in China and Europe. In this ever-more connected global economy we all participate in, that spells trouble. “I don’t need to tell you that if these trends continue, 2019 could be more volatile still.”

The Future

Tranquillitas: “Slowing is not the same as stopping. Interest rates are rising but are still relatively low. Corporate profits remain steady, consumer spending is thriving, as is the labor market. These are all indicators of a healthy economy in 2019, even if it’s not quite producing at the same pace it was before.”

Volatilis: “I see your indicators and raise a few of my own. There’s a ceasefire in the trade war with China, but it could pick up again at any time. The federal government is experiencing another shutdown. Furthermore, a large portion of the economy’s growth over the last decade has been prompted by fiscal stimulus from the government – stimulus that will be harder and harder to provide as the nation’s deficit climbs and climbs.6 Take away that prop, and what happens to growth? “The fact is, investors often tend to be both irrational and impatient – a volatile combination. While the economy may be technically strong, trends are what anxious investors pay attention to. And if the economy looks like it’s trending down, it’s quite possible the markets will follow.”

Tranquillitas: “Yes, Volatilis, but have you considered –”

***

Okay, you get it. In many of Schumann’s reviews, it was at this point that a third character would appear: Master Raro, a teacher who through pure logic and reason would serve as a final arbiter over Florestan’s and Eusebius’ debates. I’ll try to do the same – though I certainly don’t claim to be more capable of “pure logic” than other people!

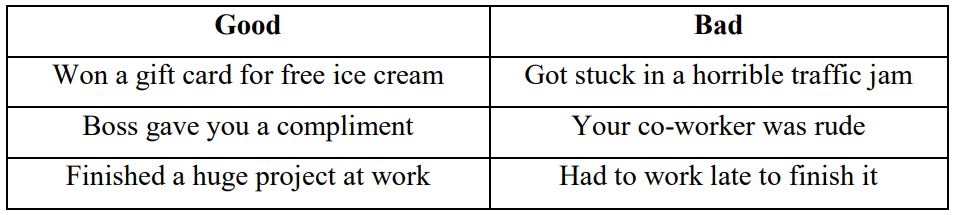

If you look at all the points and counterpoints made above, though, the logical conclusion is that 2018 was neither a “good” year or a “bad” year. It was…a year! The markets were volatile, but the economy was strong. Similarly, there are indicators of economic strength for 2019, as well as signs that market volatility may continue. Both our fictional characters, Volatilis and Tranquillitus, made good points based on actual facts. But their interpretations of those facts were very different – and that says more about them than anything else. Here’s why that’s important. When we form an opinion about something, it’s often colored by which facts we value more than others. For example, think about when someone asks, “How was your day?” Most days are usually a mixture of good and bad things, aren’t they?

This is a trivial example, but the point is, whether you saw your day as good or bad would depend largely on which events mattered more to you. If you’re someone who thrives off praise and accomplishment, it was probably a great day! If you’re someone who is extremely schedule-oriented, the fact you got stuck in traffic and worked extra late would probably make it a bad day – or at least, not one you’d remember with any fondness. Either way, the facts didn’t change – only your interpretation of them.

Similarly, what we expect of 2019 largely depends on which facts we value more than others. As investors, it’s critical that we remind ourselves about this tendency. Whenever we select an investment, formulate a plan, or make a decision, it’s useful to ask ourselves, “Which facts are causing me to think this way? Which facts am I overemphasizing more than others?” By doing this, we can avoid both undue optimism and overt pessimism – becoming more balanced, less emotional investors in the process!

Whatever 2019 has in store, rest assured there will be both obstacles to avoid and opportunities to seize. But whatever happens, we here at Research Financial Strategies will continue analyzing all the facts and data to help you make smart, unbiased, unemotional financial decisions – music to any investor’s ears. As always, please let me know if there is anything I can do for you in 2019.

Happy New Year!

1 “Investors Find Few Places to Hide,” The Wall Street Journal, December 18, 2018. https://www.wsj.com/articles/market-slidefoils-investors-11545154550?mod=ig_2018yearinreview

2 “Dow closes lower, ending a volatile week on Wall Street,” CNBC, December 27, 2018. https://www.cnbc.com/2018/12/28/usstocks-and-futures-dow-sp-and-nasdaq-on-roller-coaster-week.html

3 “Let the Good Times…Stay a Little Longer?” The Wall Street Journal, December 16, 2018. https://www.wsj.com/articles/letthe-good-times-stay-a-little-longer-11544993632?mod=ig_2018yearinreview

4 “U.S. workers see fastest wage growth in a decade,” The Washington Post, October 31, 2018. https://www.washingtonpost.com/business/economy/us-workers-see-fastest-wage-increase-in-a-decade/2018/10/31/3c2e7894- dc85-11e8-85df-7a6b4d25cfbb_story.html

5 “U.S. Economy at a Glance,” Bureau of Economic Analysis, September 19, 2018. https://www.bea.gov/news/glance

6 “U.S. deficits and the debt in 5 charts,” Politifact, November 2, 2018. https://www.politifact.com/truth-ometer/article/2018/nov/02/five-charts-about-debt/